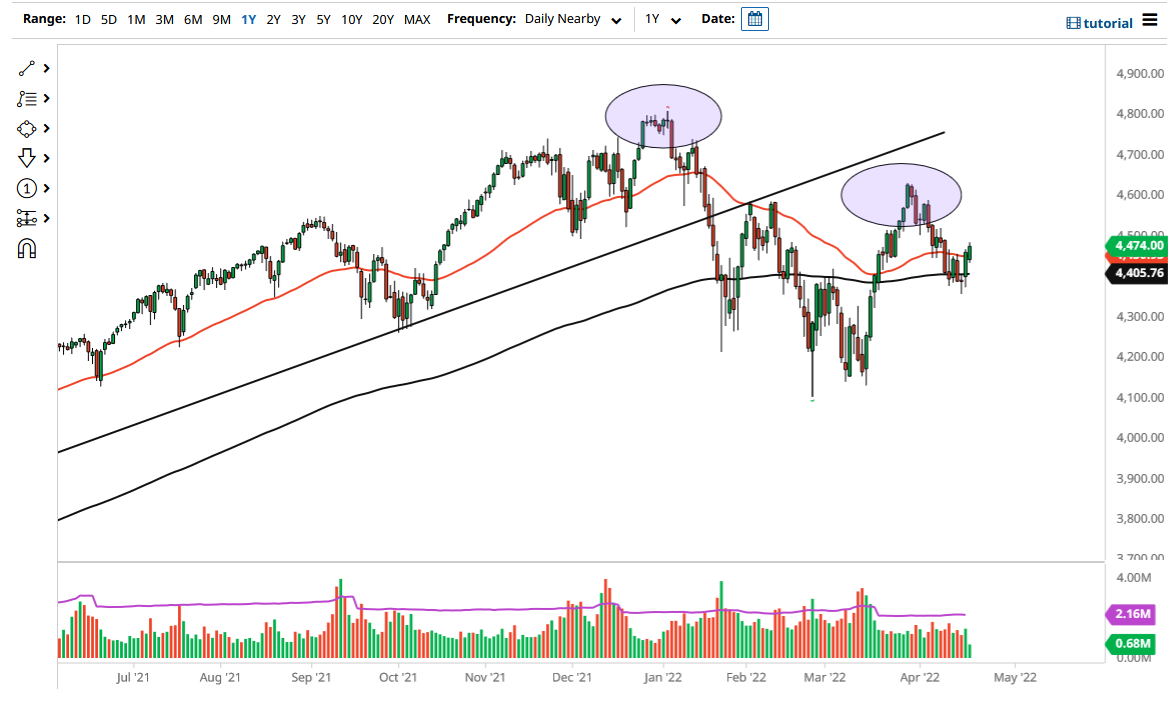

The S&P 500 has rallied a bit during the trading session on Wednesday as we have broken above the 50 Day EMA. This is an area that suggests a little bit of noise, and therefore think the market is likely to see a struggle to go higher, and it is worth noting that the market has pulled back a bit from the highs during the trading session. While I do not necessarily think that the market is going to fall apart, it certainly looks as if we are going to struggle to go higher.

It is worth noting that the 4500 level is just above, and it would cause a certain amount of psychological resistance, so it makes sense that we struggled a bit. At this point, if we break down below the bottom of the candlestick, then we are more likely than not could go looking to reach the 200 Day EMA underneath. The 4400 level is a large, round, psychologically significant figure as well, so therefore if we break down below there then we have to take a serious look at the Monday candlestick.

The Monday candlestick is a hammer, so as long as we stay above there, there is still a possibility that buyers will jump in. However, if we were to break down below the hammer, then it opens up selling pressure, perhaps a move down to the 4300 level, and then even the 4100 level after that.

Keep in mind that inflation is a major influence on the market right now, and of course what the Federal Reserve will do to fight it. Because of this, traders will be paying close attention to the bond market, which of course has been working against the value stocks. After all, bonds are offering a real rate of return now, which is something that the market is not used to. Because of this, I would anticipate a lot of back and forth and noisy behavior, so obviously you are going to need to keep your position size reasonable. Pay close attention to the overall risk sentiment of market participants, because that will obviously have a major influence on what happens next in this market. In general, we are trying to decide whether this has been a short-term pullback, or if it is the beginning of something rather negative.