Within narrow ranges, the price of gold is still moving since the start of trading this week between the support level of $1915 and the resistance level of $1945. It settled around the level of $1927 at the time of writing the analysis. Stability returns to the gold market, as investors balance between the future of tightening the Fed’s policy, which leads the general trend of global central banks in tightening, and between the continuation of global geopolitical tensions, which support the demand for buying gold as a safe haven. The US dollar stabilized and Treasury yields rose after Federal Reserve Governor Lael Brainard, who is awaiting Senate confirmation to serve as Vice Chairman of the Federal Reserve, described the task of reducing inflation pressures as “of paramount importance” and indicated a strong approach to shrinking the Fed’s balance sheet.

The United States said it would impose "significant and immediate economic costs on the Putin regime for its atrocities in Ukraine, including Bucha". The sanctions include freezing the US assets of Putin's daughters and cutting them off from the US financial system. Washington also said it would apply "total ban" sanctions against Sberbank and Alfa Bank, Russia's largest public and private financial institutions.

For its part, the European Commission has already proposed new sanctions, including a ban on imports of Russian coal, raising concerns about a new challenge to global supplies.

Stocks fell and bond yields rose on Wall Street on Wednesday after details from the Federal Reserve's meeting last month showed that the US central bank intends to be assertive in its efforts to combat inflation. Meeting minutes show that policymakers agreed to begin reducing the Fed's stockpile of Treasuries and mortgage-backed securities by about $95 billion per month, starting in May. As a result, the S&P 500 fell 1%, and the Dow Jones Industrial Average fell 0.4%. Tech companies suffered some of the biggest losses, sending the Nasdaq down 2.2%. The yield on the 10-year Treasury rose to 2.61%.

The minutes of the meeting three weeks ago reveal that federal policymakers generally agreed to start reducing the US central bank's stockpile of Treasury securities and mortgage-backed securities by about $95 billion per month, starting in May. This is more than some investors expected and almost double the pace the last time the Fed trimmed its balance sheet. At the meeting, the Fed raised its benchmark short-term interest rate by a quarter of a percentage point, its first increase in three years. The minutes showed that many Fed officials wanted to raise interest rates by a larger margin last month, and still see "one or more" of these huge increases likely to come at future meetings.

Overall, investors are focused heavily on Fed policy as the central bank moves to reverse low interest rates and the exceptional support it began providing the economy two years ago when the pandemic pushed the economy into recession. The Fed's proposed timetable to allow billions of bonds and mortgage-backed securities off its balance sheet was hinted at Tuesday in comments by Fed Governor Lael Brainard, who said the process could begin as soon as May and continue at a rapid pace.

A rapid reduction in the Federal Reserve's balance sheet will help raise long-term interest rates, but it also contributes to higher borrowing costs for consumers and businesses. Traders are now pricing in a roughly 77% probability that the Fed will raise its key interest rate by half a percentage point at its next meeting in May. That's double the usual amount and something the Fed hasn't done since 2000.

US inflation has reached its highest level in four decades and threatens to derail economic growth. Rising prices on everything from food to clothing have raised fears that consumers will eventually cut back on spending. Russia's invasion of Ukraine added to those fears, sending energy and commodity prices, including wheat, higher.

US Treasury Secretary Janet Yellen warned a House of Representatives committee on Wednesday that the conflict would have "enormous economic ramifications in Ukraine and beyond."

The conflict in Ukraine has continued to create financial pressures against Russia. The White House said Western governments would ban new investors in Russia after evidence that its soldiers deliberately killed civilians in Ukraine. The US Treasury said that the government of Russian President Vladimir Putin will be prevented from repaying dollar debts from US financial institutions, which could increase the risk of default. They have resisted calls to boycott Russian gas, Putin's largest source of exports, due to the potential impact on their economies.

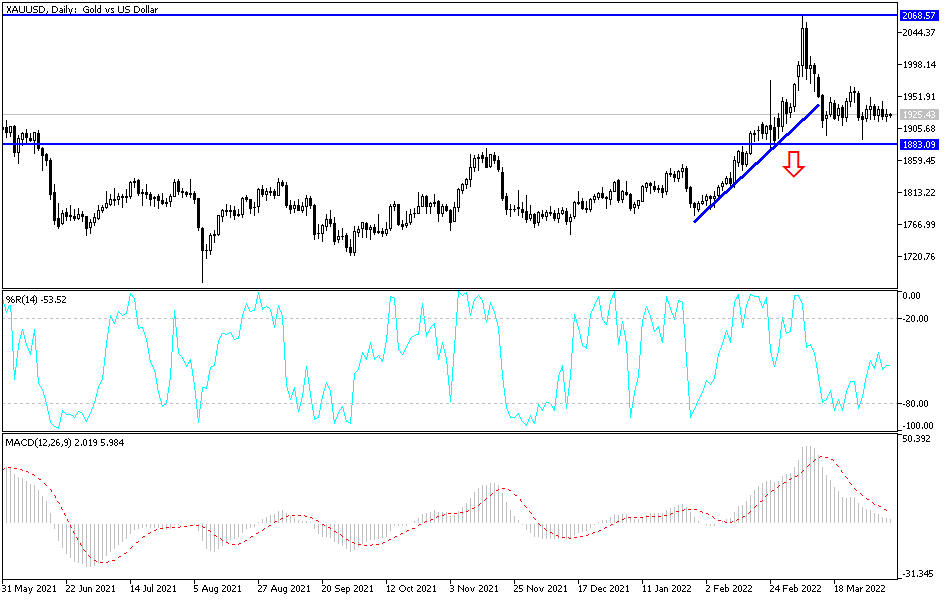

Despite the strength of the US dollar, the gold market still maintains the bullish trend, as I mentioned before, global geopolitical tensions and the return of anxiety over the Corona epidemic will remain supportive factors for the gold market. According to the performance on the daily chart, stability will remain around and above the resistance at $1900, supporting the bulls' continuous control of the trend. The closest resistance levels are $1945 and $1970, and the last level is crucial for the price to reach the historical psychological peak of $2000 again.

On the downside, I still see the psychological support of $1880.