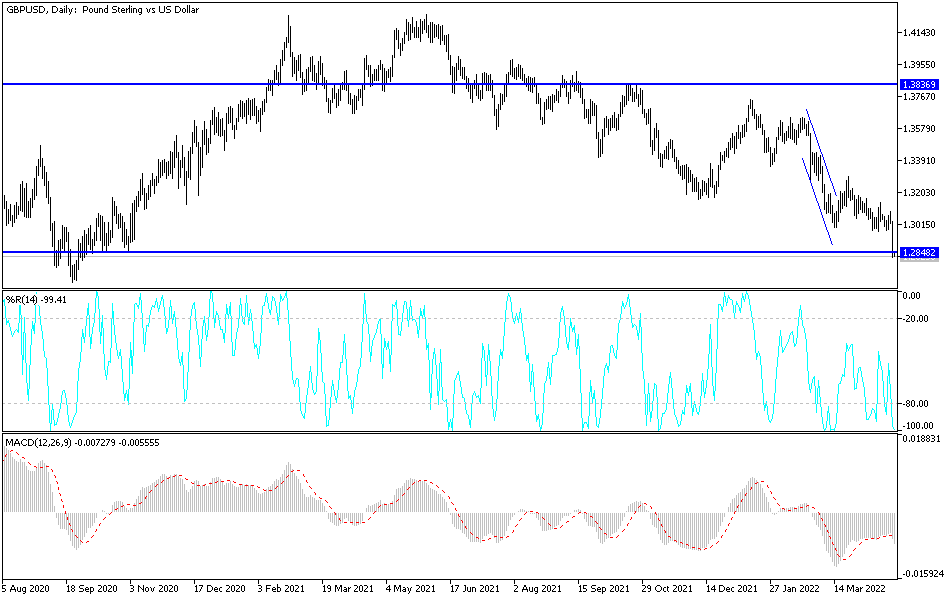

Last Friday’s session was harsh for the price performance of the GBP/USD currency pair, as the currency pair fell from the resistance level 1.3034 to the 1.2823 support level. This is its lowest since September 2020, losing more than 200 points in one trading session. The decline came after UK economic data forced financial markets to reconsider the outlook for the Bank of England. The British pound was the biggest long-term loser on Friday after data from the Office for National Statistics (ONS) revealed a sharp decline in the volume and value of UK retail sales for the past month in a strong indication that lower household income is now hampering total income.

UK retail sales fell -1.4%, much more than economists had expected, making it their biggest drop in one month for nearly a year. This is a result that came as a huge blow to the recently pumped pound on the back of very ambitious market expectations for an interest rate from the Bank of England. Commenting on this, Bethany Beckett, an economist at Capital Economics, said: “The significant drop in retail sales in March marks the second consecutive month of decline and adds to the evidence that real wage pressures are hurting consumer spending.”

"With CPI inflation already at a 30-year high and set to continue rising, there is a real risk of a direct decline in consumer spending in the coming quarters," Beckett also said in a review of the data.

Stephen Gallo, FX Analyst at BMO Capital Markets says, “The position of the 2-year GBP/USD swap spread for cable suggests that the drop in spot is a bit exaggerated (in the near term), but we believe the trend in sterling based on fundamentals is the right direction.” "We prefer the sell side of the GBPUSD, especially on rallies above 1.30," he added.

The pound rose in the previous session after financial markets concluded, perhaps incorrectly, that Bank of England policymaker Catherine Mann was suggesting in a speech on Thursday that she might vote for a massive 0.5% increase that would raise the bank rate from 0.75%. to 1.25% in May. MPC member Mann cited "extremely strong sales and price expectations" from large companies participating in the Bank of England surveys and the possibility of higher payrolls for the workforce to anticipate the continuing risks of a prolonged period of above-target inflation on Thursday.

According to the performance of the forex market, warns Kit Juckes, FX analyst at Societe Generale, “It now appears that 1.30 GBP/USD has broken decisively and a realistic 1.25 target. GBP/USD is likely to match any decline in EUR/USD that comes as a result of concerns about gas supplies to Europe and the state of war in Ukraine.”

“Monetary policy needs to keep inflation expectations steady; By doing this now, further tightening will be needed later, when demand is still weak,” he said. Mann suggested that if these sales and price expectations actually come true and “if the impact on aggregate demand of the energy price shock is more modest than currently expected”, the BoE is likely to raise interest rates sharply in the coming months.

However, the retail spending data for March may have ruled that out.

Friday's IHS Market survey of large service-oriented firms also pointed to growing headwinds in the UK's largest economic sector. “This really reiterates what we said in the February monetary policy report and the March MPC meeting minutes, you know, we are now walking a very fine line between addressing Inflation and the production effects of the real income shock and risks that may lead to a “recession”.

The pound-dollar exchange rate reached its lowest level since September 2020 in the wake of Friday's data and was quickly approaching a key level of technical support on the charts. Robert Wood, UK economist at BofA Global Research, says: “We estimate consumer confidence to have a 35% chance of a recession. However, company surveys are stronger.”

The strong dollar added to the pound's losses after Federal Reserve Chairman Jerome Powell said at the last meeting of the International Monetary Fund and the World Bank Group last Thursday that a higher-than-usual rate hike is now on the table in the US next month.

While financial markets were already pricing in a 0.50% rise in the fed funds rate, from 0.5% to 1%, the dollar was still broadly ahead overnight and into the last session of the week's trading.

According to the technical analysis of the currency pair: In the near term and according to the performance of the hourly chart, it appears that the GBP/USD currency pair is trading within the formation of a sharp descending channel. This indicates a strong short-term bearish momentum in the market sentiment. Therefore, the bulls - are targeting potential recovery profits at around 1.2863 or higher at 1.2908.