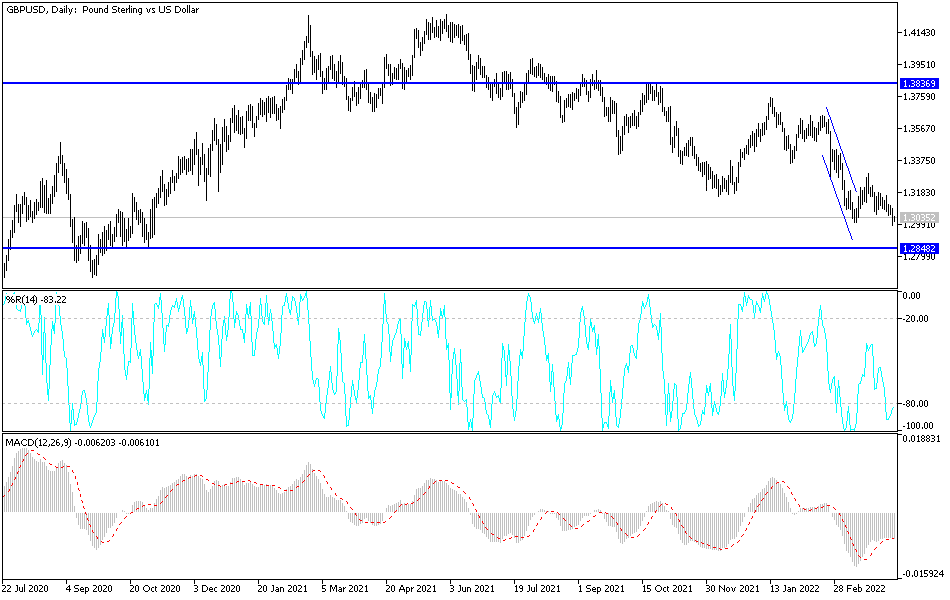

At the end of last week's trading, the GBP/USD exchange rate approached its lowest levels in 2022 as US government bond yields rose further and the dollar's strength expanded. This is making the pound weak in the context of recent uncertainty over the Bank of England (BoE) interest rate outlook. The GBP/USD pair fell to the support level 1.2982, breaching the psychological support 1.30, and settled around the 1.3035 level. Sterling fell broadly on Friday but incurred one of its biggest losses against the US dollar, which broadly consolidated amid heavy losses for government bond markets around the world and pushed GBP/USD below the 200-week moving average ahead of the holiday. weekend.

Government yields rose sharply as bond prices themselves fell amid a rout in the US market, which deepened after the release of Wednesday's Federal Reserve meeting minutes and subsequent notes from FOMC members. “The long-term weakness is driven by the movement in real yields which in itself is a function of the Fed's move towards QT,” says Biban Ray, FX analyst at CIBC Capital Markets. The US dollar benefits as a result.”

The price of the US dollar has risen further since the Fed took its first step to start withdrawing the interest rate cuts and other stimulus announced at the start of the coronavirus crisis, and its subsequent contacts were the main driver. The Fed's communications continued to indicate that it could surprise the hawkish side of the outlook even as market pricing implies a confident bet by investors that it is already on its way to one of the sharpest price increases in decades.

Last week's minutes from last month's meeting revealed the extent to which the Fed is likely to reduce its presence in the US government bond market in an effort to shrink a balance sheet that has ballooned by more than $2 trillion to nearly $9 trillion as a result. The meeting record suggests that asset holdings could shrink by $95 billion a month starting in May, which is nearly as fast as $120 billion a month at which the balance sheet has grown and means it is likely to fall by about $1.7 trillion by the middle of next year.

The speed and confidence with which the Fed is approaching the pending period of monetary tightening contrasts with the Bank of England (BoE) where the Monetary Policy Committee, after three bank rate increases since December, said risks to the outlook are now more balanced.

According to the technical analysis of the pair: As mentioned before, the breach of the 1.3000 psychological support for the price of the GBP/USD currency pair will remain important for the bears to control the direction of the currency pair and warn of a deeper downward move. As investors are currently balancing the future of central banks' monetary policy, which will be in favor of the strength of the US dollar. The closest targets for the bears are currently 1.2955 and 1.2800, respectively.

On the upside, the currency pair's turn to bullishness will depend strongly on the breach of the resistance 1.3335, according to the performance on the daily chart. Today, the sterling pairs will be affected by the announcement of the growth rate of the British economy, as well as the announcement of the rate of industrial and industrial production in the country.