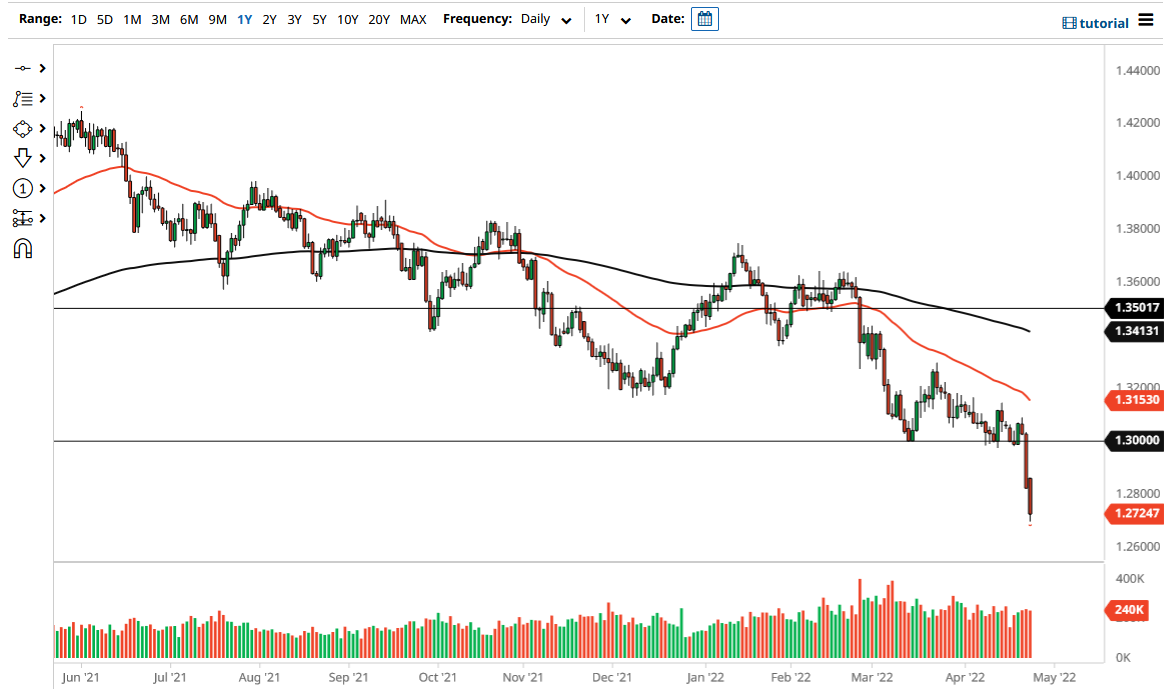

The British pound fell on Monday to break down below the 1.28 handle. This is an area that previously had been supportive, so it is interesting to see that we simply sliced through it. The first hint was that we closed at the very bottom of the range for the Friday session, and we continue to see a lot of “risk-off” attitude out there.

As long as we are in a rather negative frame of mind, it does make a lot of sense that the US dollar will continue to strengthen. Furthermore, “real rates” in the bond market continue to favor the United States, so I think we will continue to see the US dollar rally. By breaking down the way we have, it looks as if we are going to continue to see negative pressure, but I would not be surprised at all to see a little bit of a bounce. The bounce is a selling opportunity unless something fundamentally changes. At this point, the fundamentals continue to line up in favor of the greenback, not only against the British pound but against most currencies around the world.

The 1.30 level is a large, round, psychologically significant figure, as it has also offered significant support previously. Now that we have clearly broken through that area, any move toward the 1.30 level should have a major detrimental effect on any type of rally. Beyond that, the 50-day EMA is at the 1.3150 area and drifting lower. That should offer a certain amount of negative pressure, so I also believe that is an area where we would see sellers. It is also worth noting that we had formed a descending triangle previously, and just broke down below it. Now that we have essentially fulfilled the “measured move” of the descending triangle, a bounce would make quite a bit of sense.

When I look at the longer-term chart, I believe that the British pound is going to go looking to reach the 1.25 handle. That is a large, round, psychologically significant figure that a lot of people will be paying close attention to, so I also think that could offer a bit of support. As far as buying is concerned, at the very least we need to recover the 1.30 handle. Even then, I will have to reassess the fundamental situation.