The Euro has fallen again during the trading session on Monday to kick off the week on the back foot yet again. The market is likely to continue going lower, perhaps reaching toward the 1.0850 level underneath. This is where we had bounced from previously, so it does suggest that there would be a certain amount of support in that general vicinity.

If we were to break down below the 1.0850 level, then it is possible that we could go looking below to reach the 1.05 level over the longer term. I do see a lot of noise in that area underneath, so even though if we did break down to reach that area, it does seem a bit of a stretch to think that we simply slice through it. There is no real reason to think that the Euro is going to strengthen from a longer-term standpoint, mainly due to the fact that Germany is almost certainly going to enter a recession with the problems involving energy at the moment, and the economic figures to begin with.

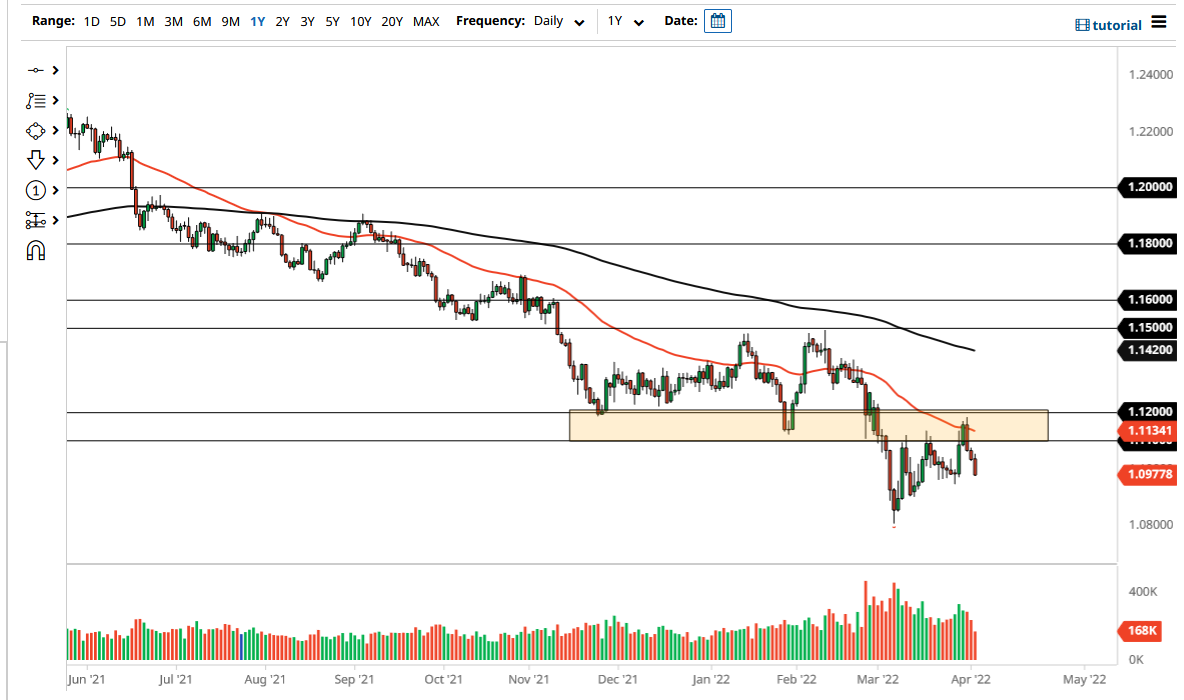

The interest rate differential continues to see the US dollar as the stronger currency, and therefore it is likely that we continue to see sellers come in every time we rally, at least on the first signs of exhaustion. I see the 50 Day EMA above and offering significant resistance, but beyond that, I see the area between the 1.11 level and the 1.12 level as being a “zone of resistance.” It would obviously take a lot of momentum to break out of that area, so if we did clear the 1.12 level, I would have to stand up and take notice.

As things stand right now, it simply looks as if this is a “fade the rallies” type of situation, which has the market focusing on short-term charts, taking advantage of “cheap US dollars” every time it can. The trend has been very strong for a while now, even though the last week or two has been more consolidation than anything else ultimately, this is a market that I think it is difficult to imagine going higher very easily unless of course there is a major change coming out of the Federal Reserve, which still looks much more hawkish than the ECB.