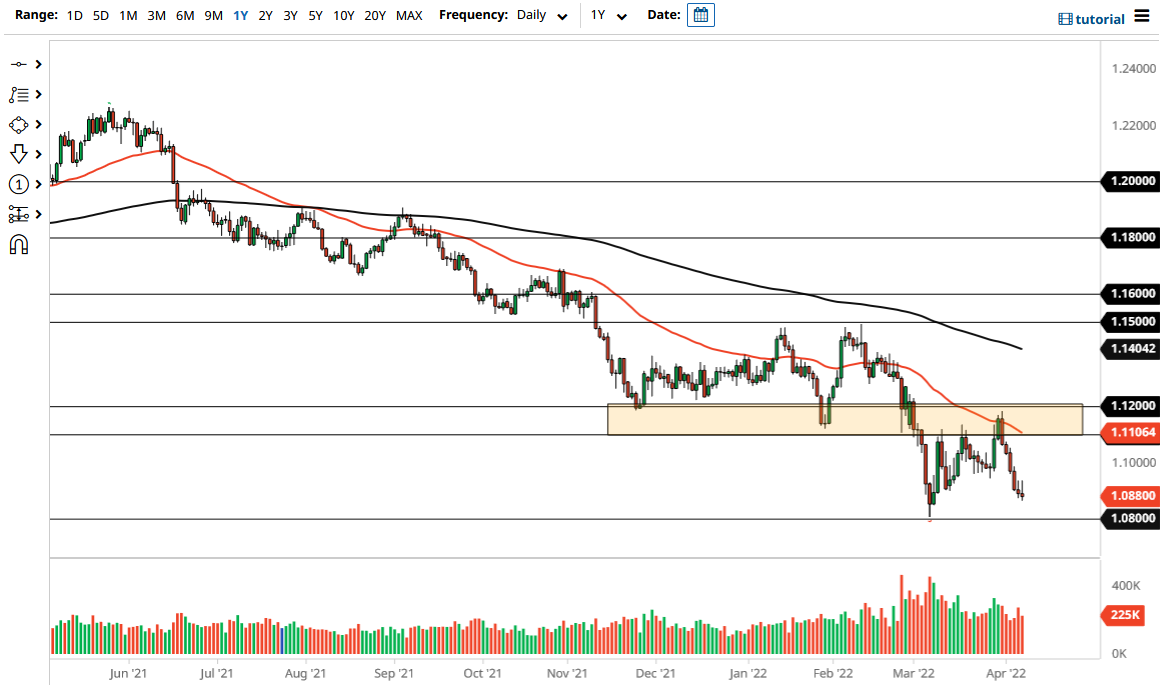

The Euro has rallied a bit during the trading session on Thursday but gave back the gains to form an inverted hammer. While this market continues to drop, the reality is that the strength of the candlesticks continues to shrink as well. This suggests that perhaps we could see this market try to make a turnaround rather soon, but we need to pay close attention to the 1.08 level as it is a major floor in the market.

The 1.08 level caused the most recent bounce, so it does make a certain amount of sense that there will probably be support there again. Breaking below that level would attract a lot of attention, and perhaps even more selling but it is worth noting that it is at the top of a major consolidation area on longer-term charts. The market breaking below the 1.08 level would more likely than not offer choppy downward action. I do not think that it will be easy to bust through all of that noise underneath.

On the upside, if we were to break above the highs of both Wednesday and Thursday, that would be the violation of a couple of inverted hammers, and that would of course be a very bullish sign. In that scenario, the market would initially target the 1.10 level, and then perhaps the 1.11 level after that. The 50 Day EMA is sitting at the 1.11 level as well, so that adds even more credence to the idea of resistance. In fact, that is the beginning of a “zone of resistance” that extends to the 1.12 level. In general, this is a market that needs to break through all of that in order to go higher for the longer term.

As things stand right now, I believe this is a market that is going to be easier to short than to go long in, perhaps using rallies to find a bit of value in the US dollar, as the market continues to favor the greenback. Furthermore, the interest rate differential continues to favor the United States, and I think that will be a major driver here. This is a market that has been in a downtrend for ages, and even if it were to change directions for the longer term, we have a lot of work to do before you can be a buyer.