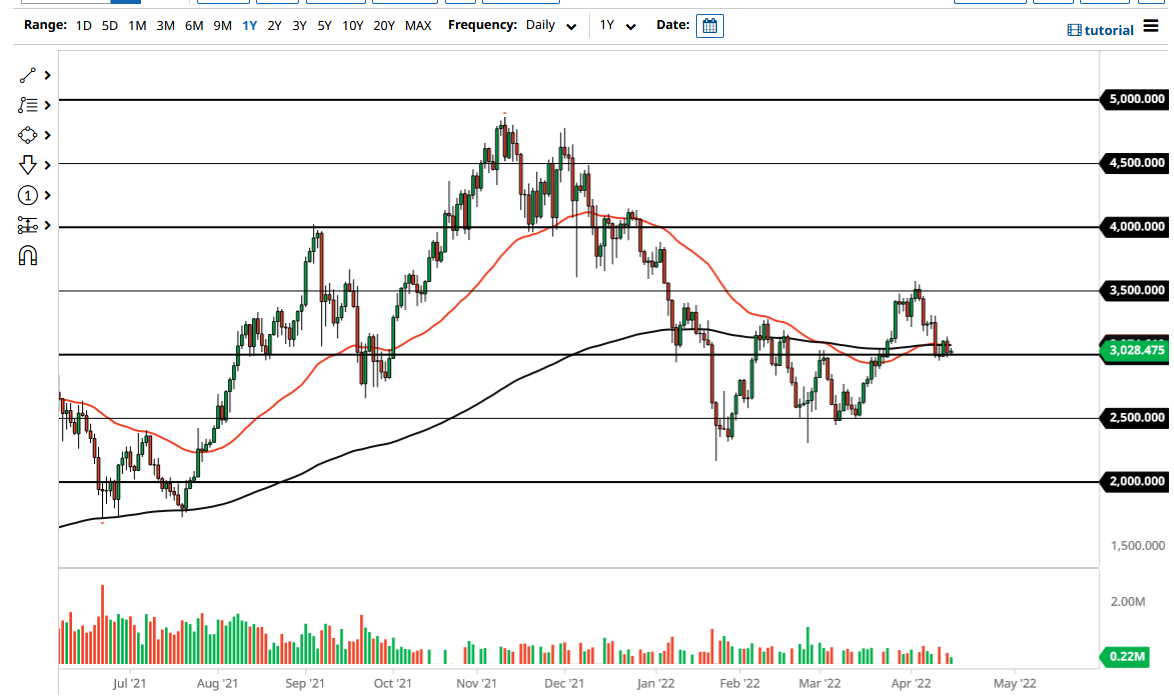

Ethereum markets were very quiet on Friday, which is not a huge surprise considering that it was a holiday. With good Friday coming and going, a lot of traders would not have been that interested. The $3000 level is a large, round, psychologically significant figure that would attract a lot of attention, not to mention the fact that we have the 50-day EMA and the 200-day EMA just above.

If we were to break down below the $2900 level, then it is possible that we could break down rather significantly. After that, we could go looking towards the $2750 level, maybe even the $2500 level. The $2500 level is an area that has seen plenty of support previously, so I think it will be a place where we have a lot of buyers in that general vicinity. If we were to break down below the $2500 level, then it is possible that we could go to the $2000 level given enough time.

If for some reason we were to break down below the $2000 level, it would open up the possibility of a “crypto winter”, as it would be a major breach of support. Furthermore, you should keep in mind that it was just announced that the June merge seems to be pushed back indefinitely, as Ethereum continues to drag its feet moving forward. This is not a good look, and one has to wonder how long it will be before people start to lose faith? I do not necessarily think that will end up being the longer-term trajectory of Ethereum, because I do think that the Ethereum project is going to fail, just that it is taking longer than anticipated. I still have a lot of faith in Ethereum longer term, but right now it still looks as if the project is going to stall a bit, and that is certainly not a good look considering that Bitcoin is struggling to rally as well. With this, I think you have plenty of time to build a position in Ethereum, and you will probably get an opportunity to buy it at lower levels. Ultimately, if we were to turn around and break above the highs of the candlestick earlier this week, then we could open up a move to the $3500 level, possibly even the $4000 given enough time.