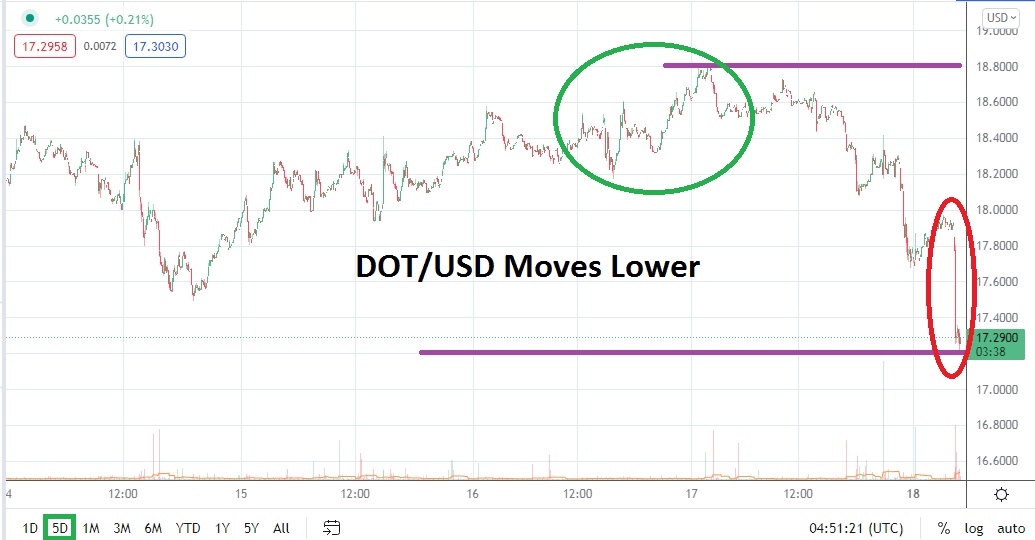

DOT/USD is trading above the 17.2000 mark in early trading this morning, but it started the day slightly below the 18.0000 level. The sudden burst of selling lower in Polkadot mirrors the price action being seen in the broad cryptocurrency market, which continues to see negative sentiment strengthen. The question now is if the selling being seen in DOT/USD and other cryptos will spark a reversal higher, or if there is more downside to come.

The last time DOT/USD sincerely traded below the 17.0000 mark was on the 13th of March. It was also this date which was reflected in the broad cryptocurrency market too, when a sudden shift in sentiment began to be demonstrated and a bullish trend was displayed which brought positive price action into the marketplace. A high of nearly 23.8500 was seen on the 2nd of April for DOT/USD, but since then bearish selling has been exhibited.

While optimistic bulls certainly still exist, sellers are once again being heard in DOT/USD and the lower price levels being demonstrated cannot be easily ignored. One year ago today, DOT/USD was near the 38.0000 price. A record high of nearly 55.0000 was seen in early November 2021. The long bearish move seen since then looked like it may have been ready to be swept to the side in early April of this month, but the sudden price momentum lower which has mounted recently appears to be ready to produce more fireworks lower.

Support levels near 17.0000 need to be monitored in DOT/USD. While a spike lower this morning was fast, a drop below 17 USD for Polkadot could spur on additional nervous sentiment. On the 7th of March DOT/USD was trading a hair above the 16.0000 juncture. And as an additional scary thought, on the 24th of February DOT/USD was trading slightly above the 14.0000 ratio. While optimists may believe DOT/USDS will produce a turnaround soon and prove buyers correct, fighting against the short term bearish trend may prove to be dangerous.

The broad cryptocurrency market appears to be fragile early this morning. Polkadot and many of the other major digital assets did seeing selling pressure build this weekend, and as today has begun DOT/USD has seen another wave downward adding to poor sentiment.

Traders should be prepared for volatility in the near term, the cryptocurrency markets appear ready to put on a speculative violent show. Sellers of DOT/USD may be making the correct wager. Cautious traders may want to wait for slight moves higher to ignite their selling positions while looking for lower price action to be delivered again.

Polkadot Short-Term Outlook

Current Resistance: 17.8100

Current Support: 17.0500

High Target: 18.8900

Low Target: 15.9800