The Australian dollar was sold off quite drastically on Monday as the US dollar continues to act as a wrecking ball against almost everything else. The US dollar continues to attract a lot of inflows due to higher interest rates, and of course, the fact that it represents safety. You should also keep in mind that the Australian dollar is highly sensitive to commodities, which are starting to look a little bit soft. If that is going to be the case, that sets up a perfect scenario in which this market should continue to fall.

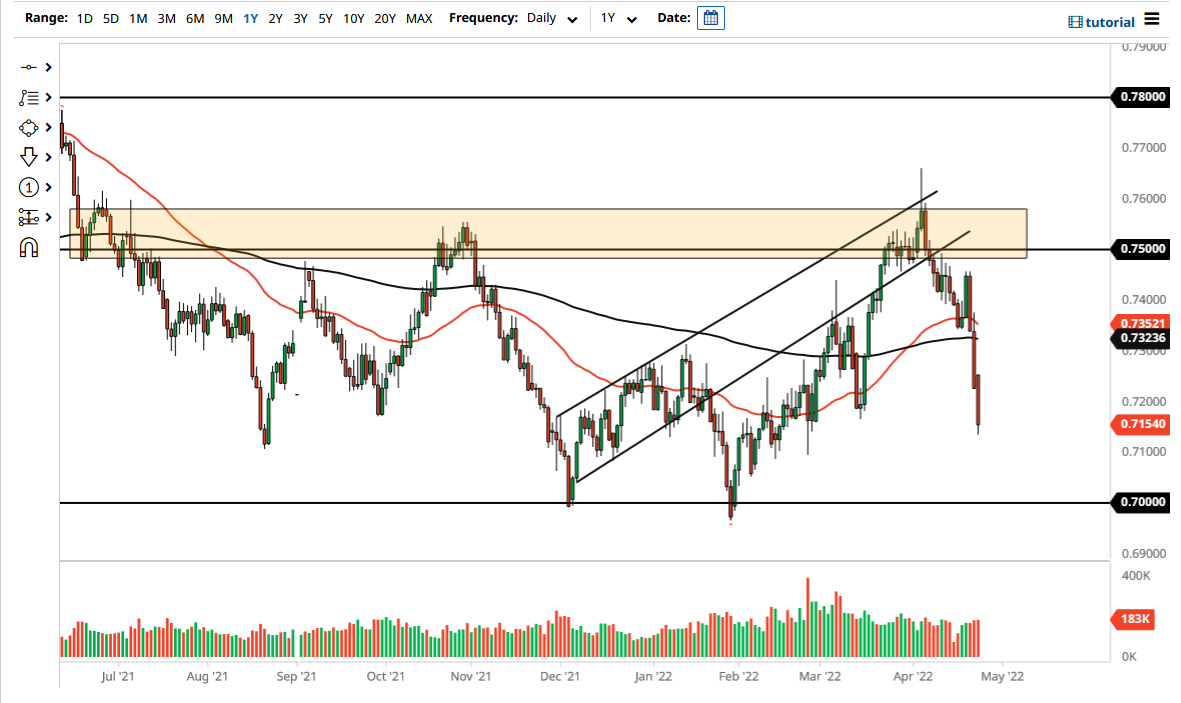

That being said, we are a little oversold at this point, so it does make sense that we could get a little bit of a bounce. A bounce at this point in time should continue to offer a selling opportunity at the first signs of exhaustion. The 0.73 level above should be resistance, right along with the 200-day EMA which is at the 0.7323 level. Above there, then you have the 50-day EMA breaking lower, perhaps getting ready to kick off the so-called “death cross.”

Keep in mind that the US dollar is going to continue to see a lot of inflow due to investors looking for some type of safety, especially as the interest rates rising in the United States kicks off a bit of a feedback loop as it would almost certainly cause major debt issues in other parts of the world. As long as the US dollar continues to strengthen, I just do not see a scenario in which the Australian dollar continues to go higher. However, there are some inflation numbers coming out of Australia that could have a bit of an effect on the market. That being said, I will be looking for “cheap dollars”, and every time we get an opportunity to get involved, I will be more than willing to short this pair. We had previously been trading between the 0.70 level and the 0.75 level, and it looks that at the very least we are going to see a return to that consolidation, but if we were to break down below the 0.70 level, things could get quite ugly rather rapidly. I believe that you would see the US dollar strengthen against almost everything at that point.