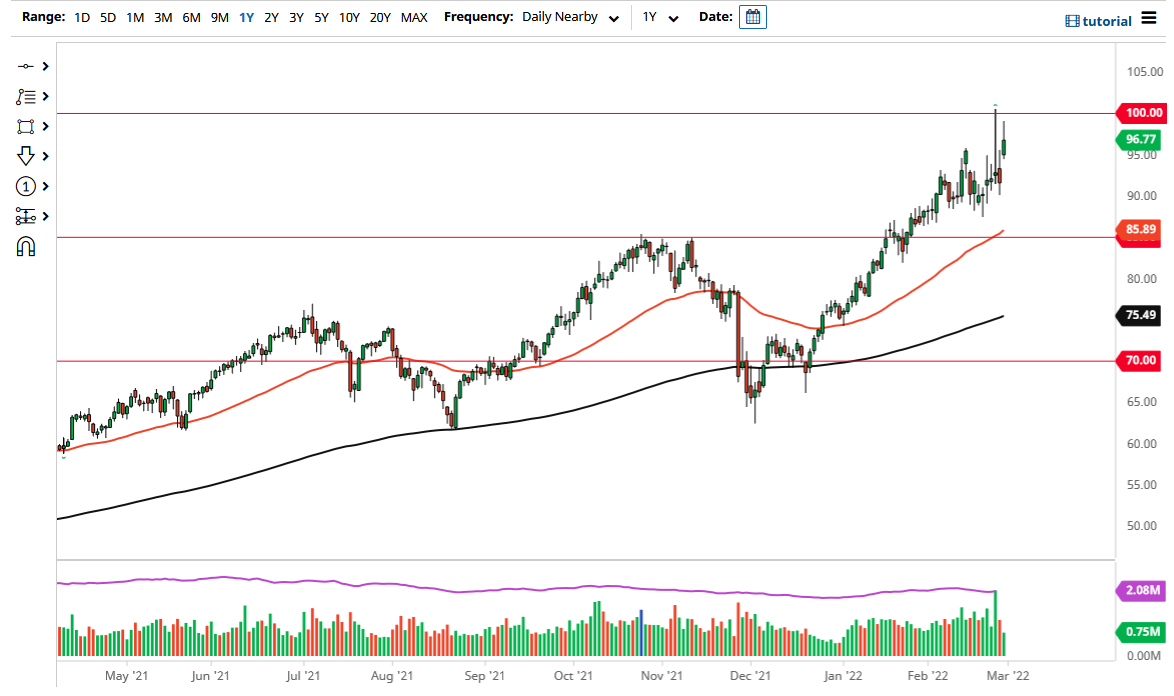

The gap has yet to be filled from the open, so we may get a pullback in order to pull that technical move off but given enough time it is likely that any pullback at this juncture will attract a certain amount of buying pressure. Value hunting will probably be the best way to handle this market because it is bullish for multiple reasons. Not only do we have the war in the Ukraine/Russia sphere, but we also have the reopening of multiple economies around the world, and that of course will demand quite a bit of energy.

Furthermore, you need to keep in mind that we had done almost no real exploration during the pandemic, and of course drilling was minuscule. Because of this, the market is still trying to catch up and rebalance. The $100 level was probably a little bit of psychological resistance, but at this point in time, I think it is likely that we will break above there, and perhaps even go higher. The gap will offer a bit of support, and after that, I would look to the $90 level to offer support as well, and is we have already seen it bring in buyers.

Oil is slightly influenced by the value of the US dollar, but at this point, I think you could probably ignore the US dollar unless it spikes wildly. The markets will continue to look towards OPEC and whether or not it can increase production, something that may desperately be needed at the moment. The members of OPEC still have not shown a willingness to increase output, so it is likely that we will continue to see plenty of upward pressure. It is not until we break down below the $85 level that I would have to reassess the market. Between here and there, I think that any pullback is an opportunity to pick up a little bit of value and joined what might be a longer-term move higher.