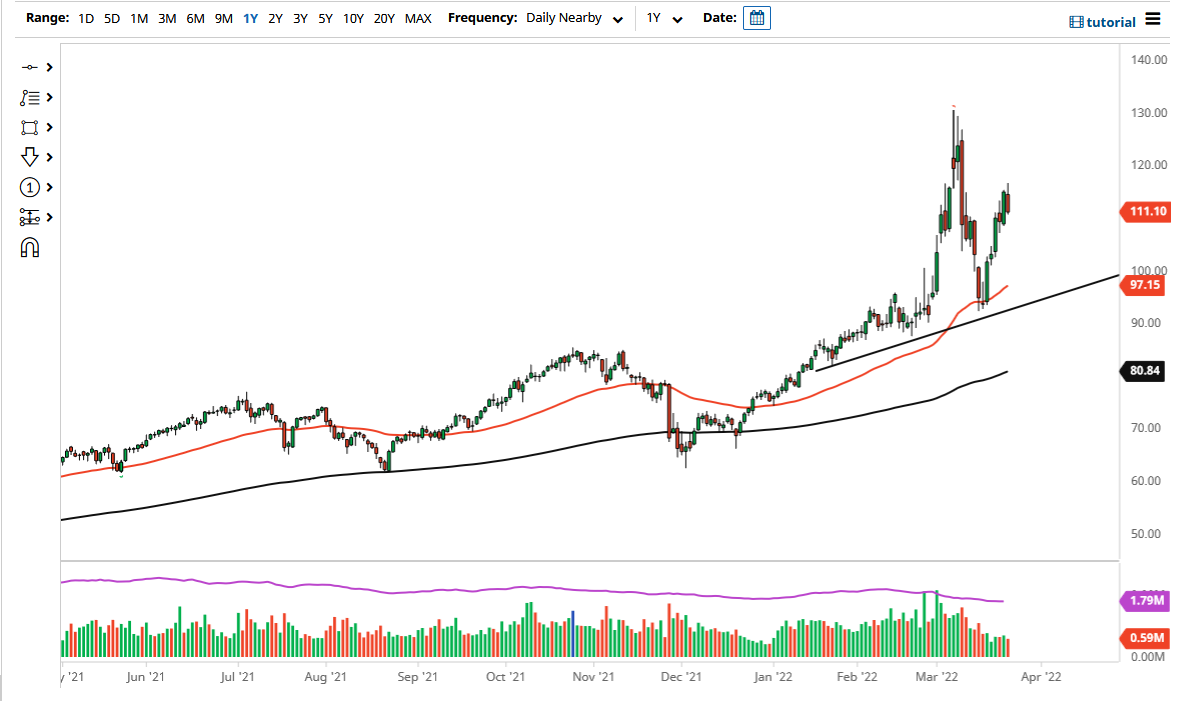

The West Texas Intermediate Crude Oil market has rallied rather significantly over the last couple of weeks, but on Thursday gave back gains to form a less than impressive candlestick. By doing so, it makes it much more likely that we are going to get a bit of a value proposition over the next couple of days, as the market has gotten a bit overextended yet again.

Market participants will continue to see this as a market that will eventually go higher, but it is running out of the necessary momentum to simply go straight up in the air. The markets have been rather overdone multiple times now, and therefore exhaustion will kick in. Exhaustion makes quite a bit of sense because quite frankly you cannot go straight up in the air without profit-taking.

If we do pull back from here, then it is likely that there are multiple support levels just waiting to be seen. The $110 level would be the first area that I think the buyers will flock to, but after that, we could have the $105 level, maybe even the $100 level. Keep in mind that the 50 Day EMA was recently dynamic support, so it does make a certain amount of sense that would be where you would define the overall trend. As long as we are above there, one would speculate that participants continue to see this as a market that will eventually pick up.

There has been a structural problem in the oil market for a while, as there has not been much in the way of capital expenditure, meaning that we have not been finding the oil markets gathering more supply while the pandemic had shut everything down, and now we have the entire world opening up at the same time. The market should offer plenty of buying opportunities on supportive candlesticks, so make sure that you keep your eyes open. That being said, this is a longer-term uptrend and therefore you have plenty of time to get involved. Rushing into this market with big positions would be a reckless way to approach it, as the corrections from parabolic moves can be quite drastic, as we had seen just a couple of weeks ago. Ultimately, I think we could very well go looking towards the highs again.