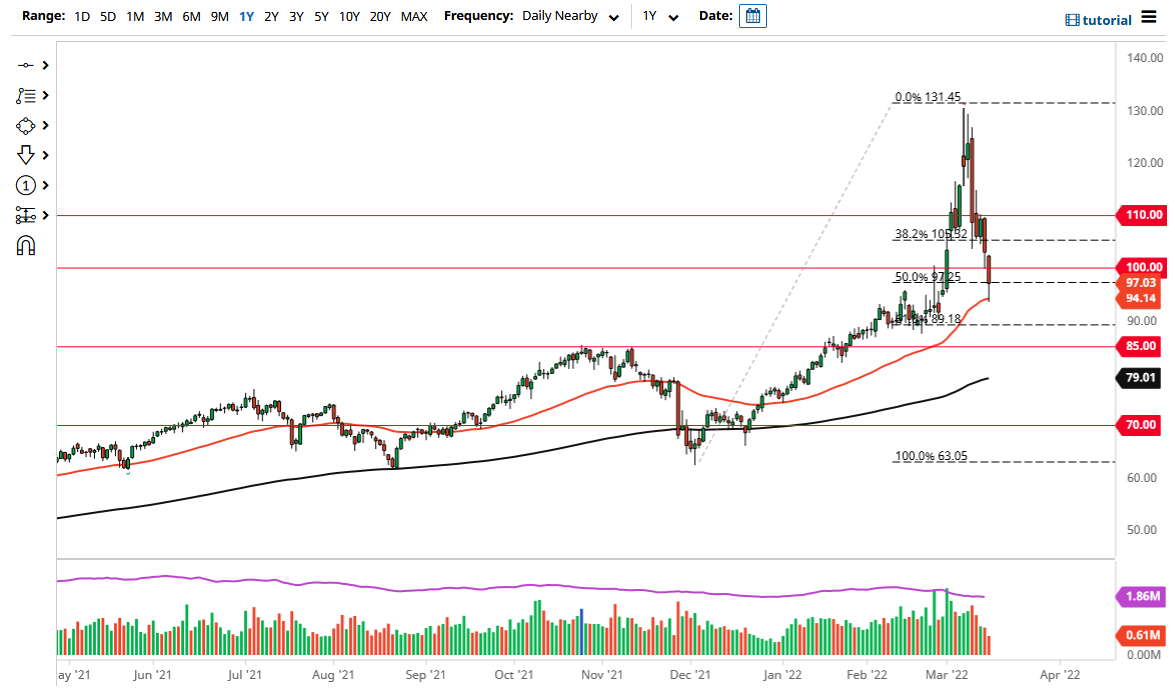

The West Texas Intermediate Crude Oil market gapped lower at the open in Asia and then fell well below the $100 level. It is worth noting that we have found a bit of support underneath, near the 50-day EMA. This is a highly technical market, so it should not be a huge surprise to think that perhaps value hunters were waiting near the technical indicator.

We have dropped almost $40 a barrel over the last six or seven trading sessions, so clearly, we have gone from outrageously overbought to now being outrageously oversold. Unfortunately, I think this type of volatility is going to be here for a while, as the nonsense going on in Ukraine certainly will not help the situation. Furthermore, there are a lot of questions as to whether or not the Americans are going to start buying from the Venezuelans, and so on.

Perhaps the most important aspect will be whether or not we enter a recession globally. If that is going to be the case, oil most certainly will have to come down in price. In fact, a lot of people will point to the fact that when oil gets expensive, that in and of itself can cause a recession. In other words, oil accelerated far too fast to hang on to the gains. This is not to say that we cannot go higher from here, and in fact, I think we probably will. However, we need to do so at a much more sustainable pace than we were on previously.

If we do break down below the 50-day EMA, then it is possible we could go looking towards the $90 level next, which was an area of support recently. On the upside, if we can clear the $100 level again to the upside, then it could bring on more of an uptrend. I think that is probably going to happen given enough time, but we will have to see how much damage has to be done to the market before people are willing to come in and pick it up based on value. At this juncture, I do not necessarily think that oil is going to be easy to trade due to the fact that the OVX, the Oil Volatility Index, is still well above norms, meaning that volatility is still an issue.