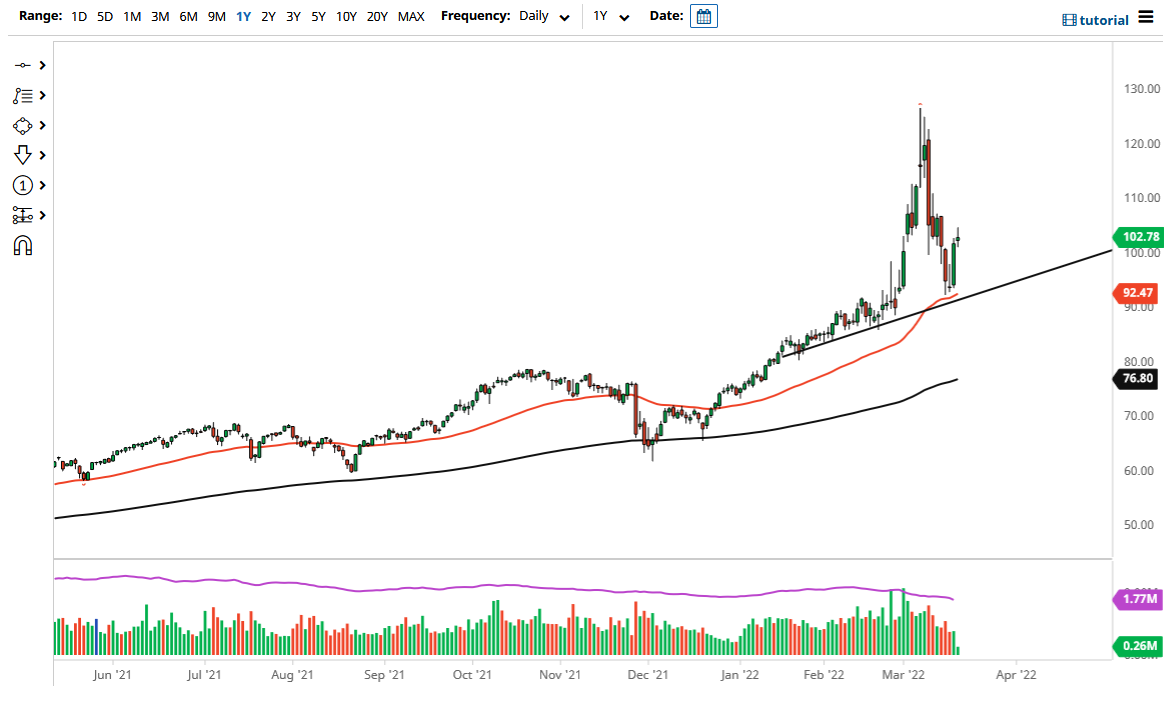

The West Texas Intermediate Crude Oil market rallied a bit on Friday but did stall a bit as we reached the end of the week. That being said, this is a market that looks as if it is trying to stabilize near the 50ay EMA, and of course, the trendline that sits right there with it. Because of this, I think it is only a matter of time before dips will be bought, which means that I have no interest in shorting this market. Yes, I recognize that the daily candlestick for Friday was a bit of a shooting star, but it is not surprising that people were not willing to hold risk into the weekend.

What I anticipate is that the market may pull back a bit from here, but it should offer value. I am more than willing to take advantage of that value on a dip, and as long as we can stay above about $92, I think I feel pretty good about owning crude oil. The alternate scenario is that we will simply rip the top off the candlestick from the Friday session, and just go higher. I do not really have a scenario in which I am a seller, at least not until we are below the $90 level. If that were to happen, then we will probably go looking towards the $80 level.

Crude oil will continue to be volatile because we have a major supply issue in the fact that there has not been enough capital expenditure worldwide. That has caused a lot of issues with the supply chain, even before the pandemic nonsense. Moving forward, there are a lot of concerns about the fact that the economy is slowing down, and that could have a negative effect on crude at the same time. In other words, I think you are going to see more volatility, not less. However, it is obvious that we had recently been overbought so to have a crash from a parabolic move like that is not a huge surprise. I do not read too much into it other than the market got ahead of itself and now is trying to come back to sanity for a while. Keep your position size small in this market.