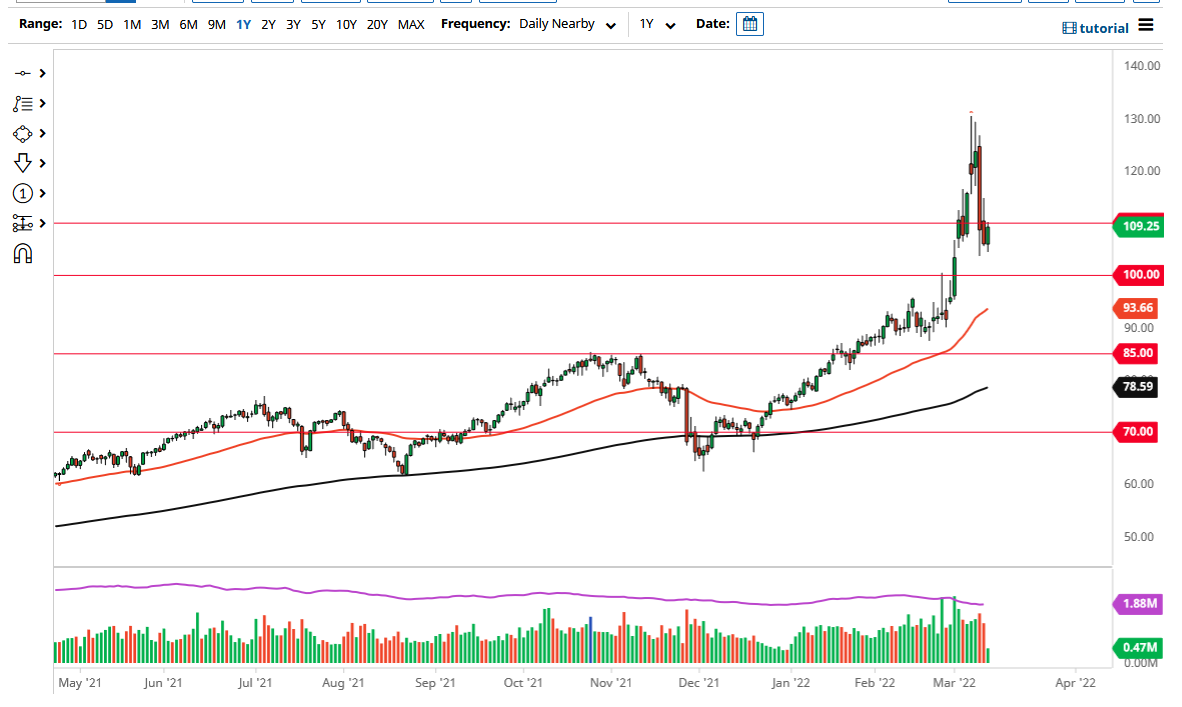

The WTI Crude Oil market rallied a bit on Friday as we reach towards the crucial $110 level. This is an area that has been somewhat noisy as of late, so it is not a huge surprise to see that the market would be attracted to it. Whether or not we can break above there is a completely different question of course, but at this point, I think we are trying to simply stabilize after what had been a brutal selloff.

Keep in mind that there will be a huge demand for crude oil going forward if the market perceives that we are in fact trying to reopen the world economy, but at the same time we have to ask questions about whether or not OPEC is going to step in and flood the market with oil now that it has become a bit of a supply chain issue. If they do, that obviously would be very negative for oil and could drive down prices rather quickly. At that point, I anticipate that the $100 level will be targeted. The $100 level is an area that a lot of people will pay close attention to, as it is a large, round, psychologically significant figure, and an area that had been resistant previously.

Looking at this chart, the candlestick from the Wednesday session was absolutely brutal, and typically a candlestick like that does have a little bit of a follow-through move. That does not necessarily mean that we have to change the overall trend, just that we still have risks to the downside. Unfortunately, we could see a complete reversal based upon a random headline coming out of Russia or Ukraine, so you have to be somewhat cautious to begin with. The oil markets will continue to be front and center when it comes to that type of geopolitical risk, so in general, you need to keep your position size relatively small, as the volatility could pick up quite drastically.

After saying all of that, it should be noted that the market being somewhat calm during the Friday session was a good sign, because it shows that at least we are starting to stabilize a bit, which is the first step to turning around and going higher over the longer term.