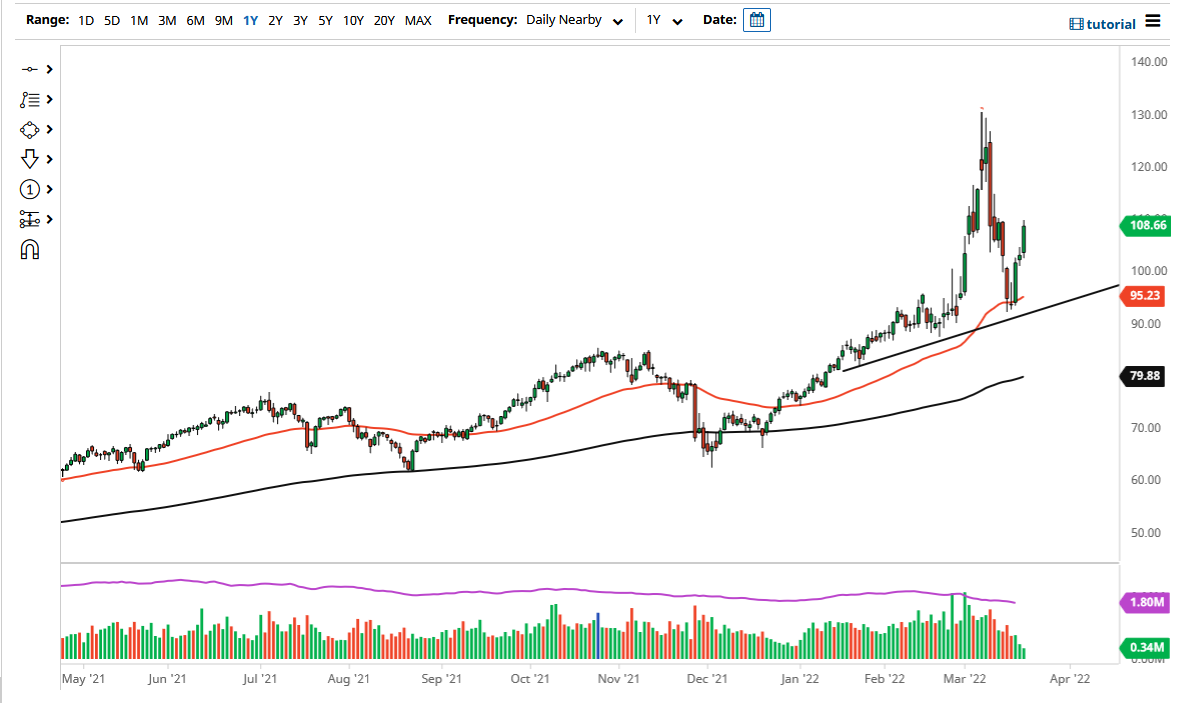

The West Texas Intermediate Crude Oil market rallied right away at the open on Monday to go looking towards the $109 level. This is an area that previously had been resistance so it will be interesting to see whether or not this area can hold. I would anticipate that a little bit of a pullback is likely, but there is so much in the way of a barrier that I think you need to build up enough momentum to finally smash through it. That being said, the market has been extraordinarily bullish and bearish over the last couple of weeks, and the volatility seems to be picking up yet again.

On a pullback from here, is very likely that we could see the $100 level offer support, right along with the 50-day EMA and the uptrend line that sits just below it. A pullback to that area should see plenty of demand because structurally we do not have enough supply from a global standpoint at this point. The size of the candlestick for the trading session on Monday is rather impressive, but it is obvious that there is a little bit of noise above that is going to be difficult to overcome.

However, if we were to break above the $110 level, then it opens up a move towards the highs again which is closer to the $130 level. I would love to see this market move higher on a more sustainable path instead of the massive spike that we had seen recently. Momentum is also something you need to pay attention to, not just the directionality. Yes, I am a buyer only and I do think that dips offer plenty of value, but there is no point whatsoever in trying to short this market at this juncture.

Pay attention to US Dollar Index, because it can also have an influence on this market, but right now it seems like we are paying closer attention to the fact that very little in the way of the typical negative correlation, as there is so much in the way of noisy and panicky trading across various assets. At this point, I think this is a market that has further to go, but that does not necessarily mean that is going to be easy to hang onto. Keep your position size reasonable, and only add once the trade works out in your favor.