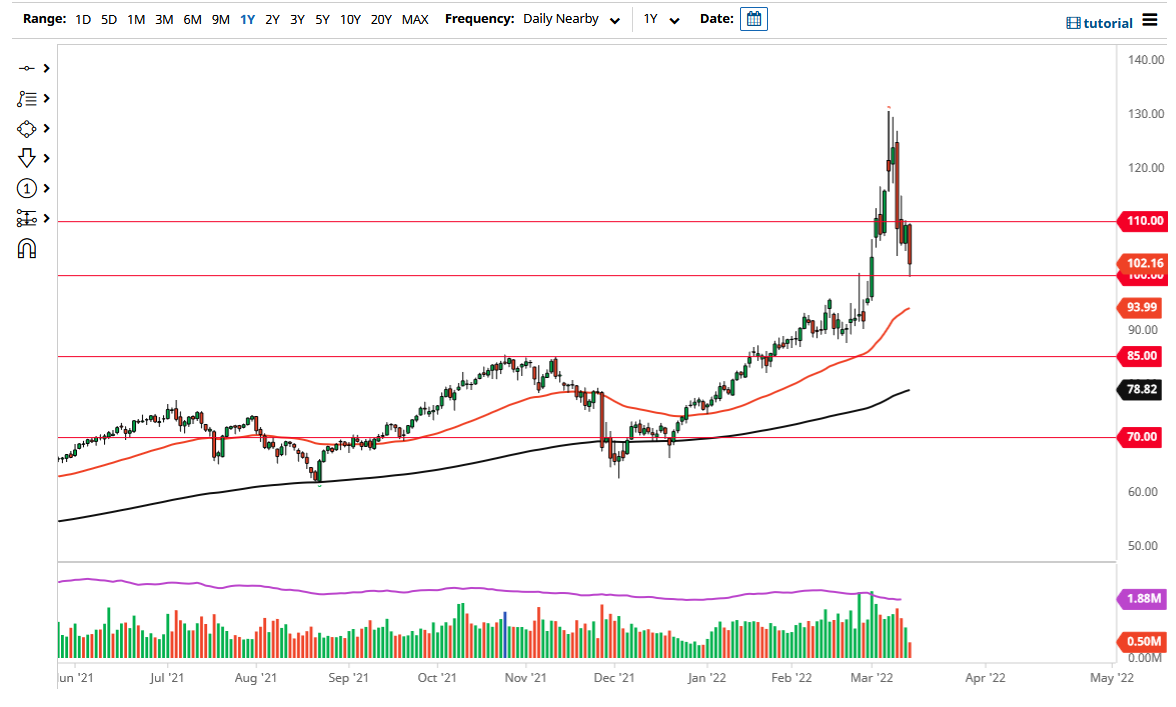

The futures contract for the West Texas Intermediate Crude Oil market melted down early in the session on Monday, as talk of a potential cease-fire in Ukraine started to make the rounds again. That being said, the market has found the $100 level, which is a large, round, psychologically significant figure that would attract a lot of attention. This is an area where we have seen buyers jumping in to pick up a little bit of value, so the question now is whether or not the buyers will continue to jump in and support the market?

The $100 level being broken below would be a very negative sign, as the market almost certainly will go looking towards the 50-day EMA. It is rising, so in theory, it should be a bit of a dynamic support line, but we will have to wait and see what happens if we get down there as to whether or not it will play out to be true. Keep in mind that there are a lot of concerns about the oil supply, but we had gotten so far ahead of ourselves that we desperately needed a pullback. We have dropped $30 a barrel in just the last week or so, so one would certainly think that sooner or later buyers will come in to pick up a bit of “cheap oil.”

I believe the next couple of days will probably determine where we go for the next several weeks, so a bounce from here would have me bullish and getting long yet again. It would not take much of an imagination to draw a trend line that sits just below where we are, basically looking at the 50 day EMA. This of course is something that is worth paying attention to because it is so important, so I believe that it is only a matter of time before the buyers come in, and therefore, I am looking for buying opportunities.

I will probably base my trading on either an hourly or a four-hour chart, trying to get the best entry price possible. Whether or not we test the highs again is a completely different question, but I do think there is a really good chance that we will get yet another bounce eventually. At this point, it just needs to be “cheap enough.”