The West Texas Intermediate Crude Oil market has been all over the place during the trading session on Thursday, as traders continue to try to price in a bit of a premium for Russian aggression, and of course, the fact that most shipping companies will have nothing to do with transporting Russian oil, effectively taking 10% of the world’s inventory off-line.

Going forward, the market almost certainly will find plenty of buyers, but I think we are getting close to a significant pullback. Quite frankly, there are only so many people out there willing to buy this market going into this type of volatility, and although longer term we will probably go much higher, you need to see a certain amount of profit-taking and of value hunting after that to continue the overall uptrend.

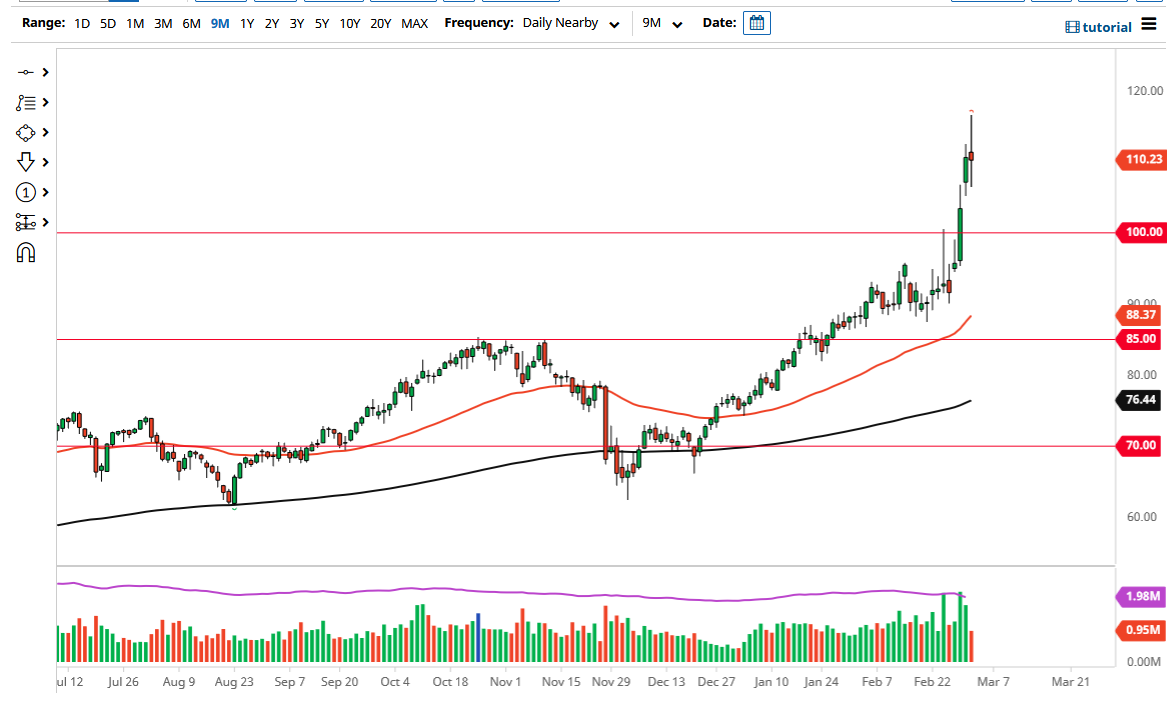

On the downside, I see the $100 level as a potential support level, as it is a large, round, psychologically significant figure and an area that has been important in the past. We have seen a major breakout there, and I think it may have to be retested before we go much higher. However, this does not take into account that we could see a headline crosses the wires that send the market parabolic again, especially if it involves Russia.

We are obviously in an uptrend and a very strong one at that. However, when markets become parabolic like this it is very difficult to keep up this kind of momentum, so the market almost certainly will have to pull back in order to attract more trading capital from big accounts. Even if you told me that we were most certainly going to fall in price tomorrow, I would not sell this market because it is so sensitive to the occasional headline.

As far as changing the overall trend is concerned, I think we would have to break significantly below the $100 level because it would show a complete change in momentum. Unless Russia pulls out of Ukraine suddenly, I just do not see that happening. With all things being equal, this is a market that if you are patient enough you should find value that you can take advantage of. This is by far the preferable way to trade the market, as it has been so obviously one way.