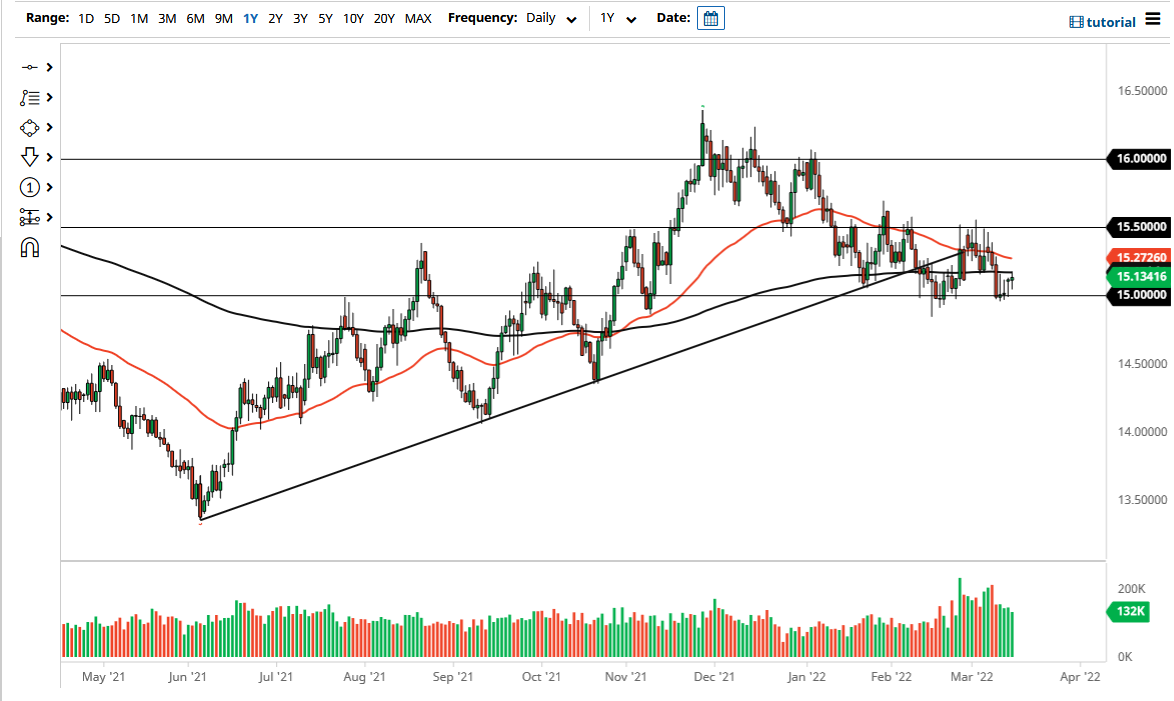

The US dollar went back and forth on Tuesday against the South African rand, as we sit just below the 200-day EMA. This is an indicator that a lot of people pay close attention to and use to define the overall trend.

Looking at this chart, you can see that we have been bouncing around between the 15 rand and the 15.50 rand level for a while now, and I think it is not until we break out of this area that we have the ability to move a significant amount of money into this market. The 15 rand level is an area that a lot of people will pay close attention to due to the fact that it is a large, round, psychologically significant figure, and we are potentially forming a bit of a “double bottom” at the moment.

If the market were to break down below the 15 rand level, then the market is likely to go looking towards the 14.50 rand level. On the upside, if we break above the 200-day EMA, then it is possible that we would go back towards the top of the range at the 15.50 rand level. If we can break above there, then the market is likely to go towards the 16 rand level.

Keep in mind that there are a lot of questions about where global growth is going, and of course, we have the Federal Reserve meeting over the Tuesday and Wednesday sessions that will have a major influence on where we go next. After all, the interest rate hike is already known to be coming, but markets will start to question whether or not the statement is going to be hawkish or dovish after that. The question is whether or not the Ukraine war has given the Federal Reserve enough cover to tone it down a bit. By the end of the day on Wednesday, we should have a little bit more in the way of clarity. The next day or two might be a bit choppy, but once we break out of the range that we are currently sitting in, it could bring out more money into the market to get things moving. Keep in mind that the next day or so could be very volatile, so patience will probably go a long way.