The US dollar initially tried to rally against the South African rand on Tuesday but continues to dance around the 50-day EMA. The 50-day EMA is sloping lower and heading towards the 200-day EMA, perhaps setting up a potential “death cross.” That being said, I do think that we have a lot of noise ahead of us, which makes quite a bit of sense considering that emerging markets are going to have to worry about a lot of inflationary headwinds.

However, the US dollar is struggling against the South African rand in particular, and this is more likely than not due to South Africa’s massive commodity exports. The South African economy is highly levered to things that you dig out of the ground, and as we have seen commodity markets go ballistic over the last couple of weeks, it certainly makes sense that the currency will be doing fairly well as traders are buying in that local currency.

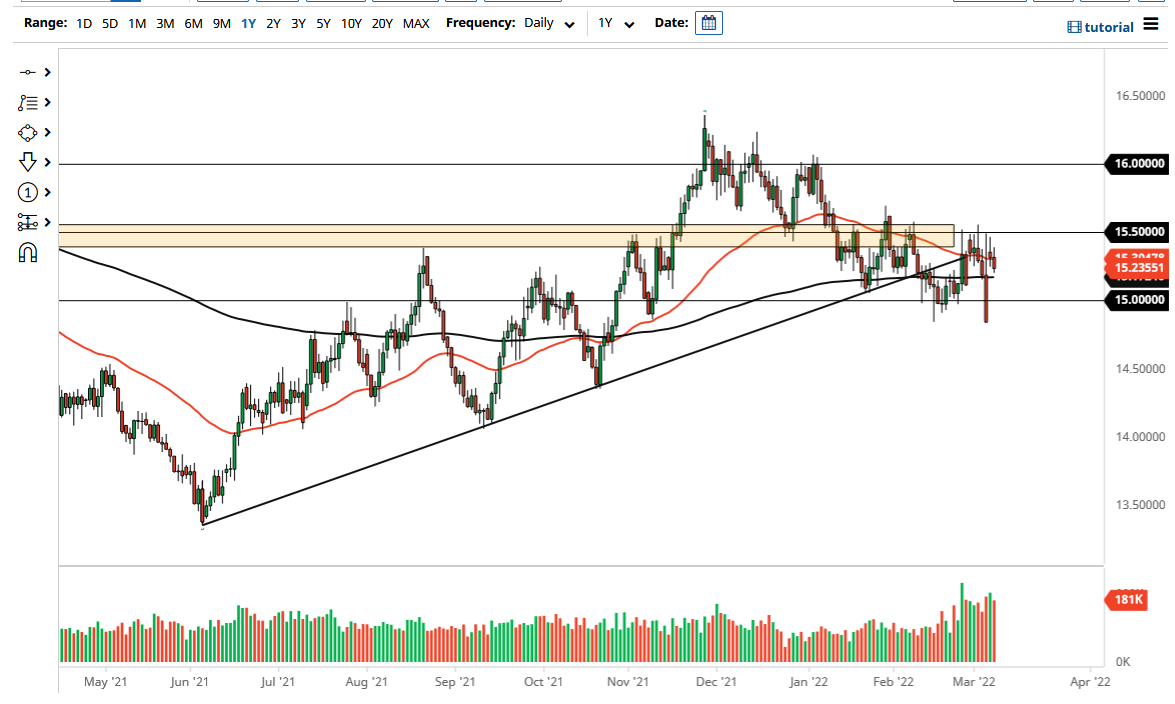

The 15 rand area is the bottom of the overall consolidation that we are in currently, with the 15.50 rand level being the resistance. If and when we can break out of this area, then it is likely that we will see a bigger move, but right now it looks like we are going to be very choppy. This is not a huge surprise, considering that the various issues around the world are pushing and pulling markets in different directions. Quite frankly, volatility is something that is going to continue to be a major issue, and in these emerging market currencies, it is especially pronounced. Because of this, you need to keep your position size reasonable, as the markets will jump around quite drastically.

If we do break to the upside, then it is likely that we will go looking towards the 16 rand level. The market breaking down below the 14.90 rand level will open up the possibility of a move down towards the 14.50 rand level, which has historically been of some importance. For what it is worth, we have recently broken below a trendline, which suggests that we are more likely than not to go lower if momentum picks up. That being said, if we get some type of major “risk-off move”, then we could see the market explode to the upside.