Today's recommendation on the lira against the dollar

- Risk 0.50%.

- None of the buy or sell transactions of yesterday were activated

Best entry points buy

- Entering a long position with a pending order from 14.55 levels

- Place your stop-loss point below the 14.36 support levels.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the strong resistance levels at 15.00.

Best selling entry points

- Entering a short position with a pending order from 14.87 levels.

- The best points to place the stop loss are the highest levels of 14.98.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the support levels 14.40

The Turkish lira has stabilized without significant changes against the dollar since yesterday's trading. Investors followed reports showing that the Turkish government targeted the revitalization of the tourism sector in the hope of raising foreign income from the hard currency. This is due to tourism sectors being affected by the Russian war in Ukraine, as the country’s political administration tended to improve its relationship with the Gulf states and Israel during the recent period in the hope of attracting a new class of foreigners. Expectations for Turkish tourism revenues amounted to about $35 billion this year and are approaching pre-pandemic levels, before the outbreak of the war in Ukraine. It is noteworthy that the country's monetary reserve has been severely damaged in recent years considering the efforts of the Central Bank to maintain the value of the lira against the dollar, which has not succeeded much.

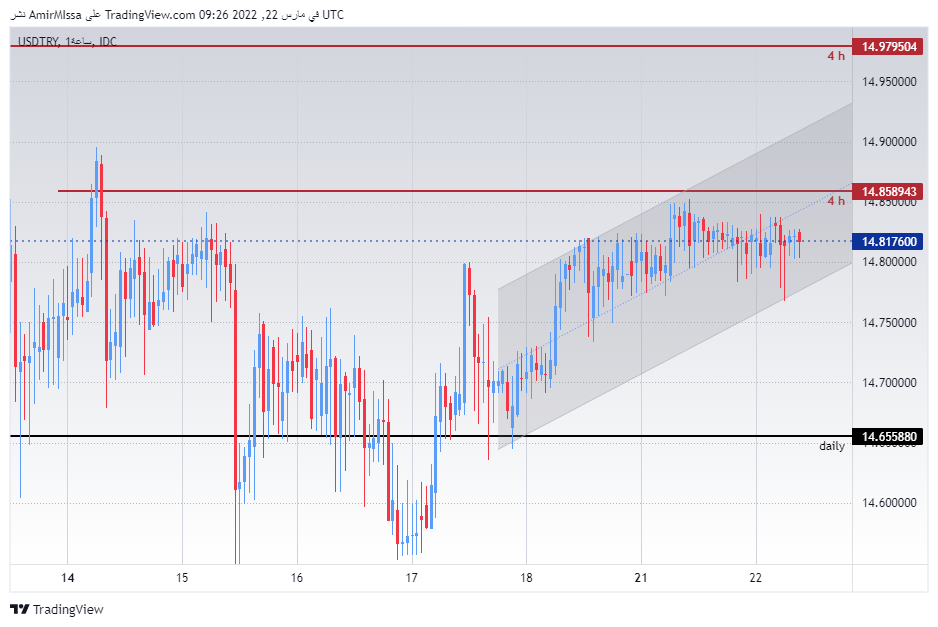

On the technical level, the Turkish lira settled against the dollar without significant changes, as the pair traded within the general upward trend that has been going on for nearly a month. The dollar pair against the lira is still trading above the 50, 100 and 200 moving averages, respectively, on the daily time frame, the four-hour time frame, and the moving average 50 on the 60-minute time frame. The pair is trading within an ascending channel on the 60-minute time frame shown on the chart. The pair is also trading the highest support levels, which are concentrated at 14.65 and 14.51 levels, respectively. On the other hand, the lira is trading below the resistance levels of 14.85 and 15.97, respectively. We expect the pair to continue rising as long as it stabilizes within the channel range. The pair targets 15.26 levels, which represents 61 Fibonacci for the last bearish wave, which started at 20-12-2021 and ended on 23-12-2021. Please adhere to the numbers in the recommendation with the need to maintain capital management.