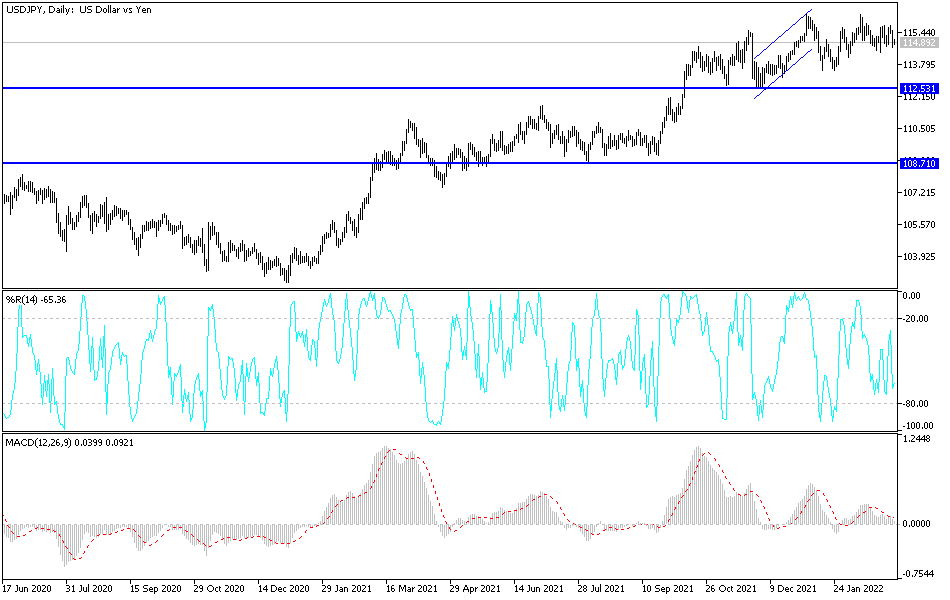

Investors' flight from risk has increased in light of the prolonged and expanding scope of Russia's military operations, adding to market fears. Accordingly, the USD/JPY had a stronger opportunity for a downward correction to reach the 114.64 support level, before recovering today around the 115.00 level. This is after announcing stronger than expected numbers for the US labor market, which supports the expectations of raising US interest rates strongly this year.

In a buoyant sign of the US economy, companies ramped up hiring last month as Omicron faded and more Americans exited to spend in restaurants, stores, and hotels despite rising inflation. According to official figures, employers added a solid 678,000 jobs in February, the largest monthly total since July, the Labor Department said Friday. The country's unemployment rate fell to 3.8%, from 4% in January, continuing the sharp decline in US unemployment to its lowest level since before the outbreak of the epidemic two years ago.

Employment figures were collected on Friday before the Russian invasion of Ukraine, which sent oil prices higher and increased risks and uncertainties for economies in Europe and the rest of the world.

However, February employment data suggests that two years after COVID-19 shut down the country and lost 22 million jobs, the disease has lost its grip on the US economy. More people are taking jobs or looking for work - a trend that, if it continues, will help alleviate the labor shortage that has baffled employers over the past year.

In addition, there are fewer people now working remotely due to illness. The constant influx of people into offices can boost urban employment in the city center. The number of Americans delaying job searches for fear of illness fell sharply from January, when Omicron was raging, to February.

In general, recent economic data also shows that the US economy is maintaining its strength with a decrease in new infections with the Corona virus. Consumer spending has risen, driven by rising wages and savings. Restaurant traffic has regained pre-pandemic levels, hotel reservations are up, and many more Americans are traveling than at Omicron's peak. However, the escalating costs of gasoline, wheat, and metals such as aluminum, which both Ukraine and Russia export, are likely to accelerate inflation in the coming months. Rising prices and war concerns may slow employment and growth later this year, although economists expect the consequences to be more dire in Europe than in the United States.

According to the technical analysis of the pair: Despite the improvement in the performance of the USD/JPY currency pair today, the continued aversion of investors to risk is in favor of the Japanese yen more than the dollar. We prefer to sell the dollar yen from an ascending level. The closest targets for the bulls are currently 115.75 and 116.40, respectively. On the downside, and according to the performance on the daily chart, the break of the 114.15 support will be important for a stronger control of the bears.