The US dollar initially fell a bit on Monday to reach down towards the 50-day EMA, only to turn around and show signs of strength again. Bouncing from the 50-day EMA of course is a very bullish sign, as it is a widely followed technical indicator. That being said, we are also facing a bit of resistance just above, so this market will continue to squeeze overall.

I know a lot of you wonder why the Canadian dollar is not performing right along with the oil market, but that correlation does not have to be followed all the time. The oil markets are being driven by absolute panic and the possibility of sanctioning Russian oil. We already have a tight crude oil market, so it would make sense that it takes very little to push traders over the edge.

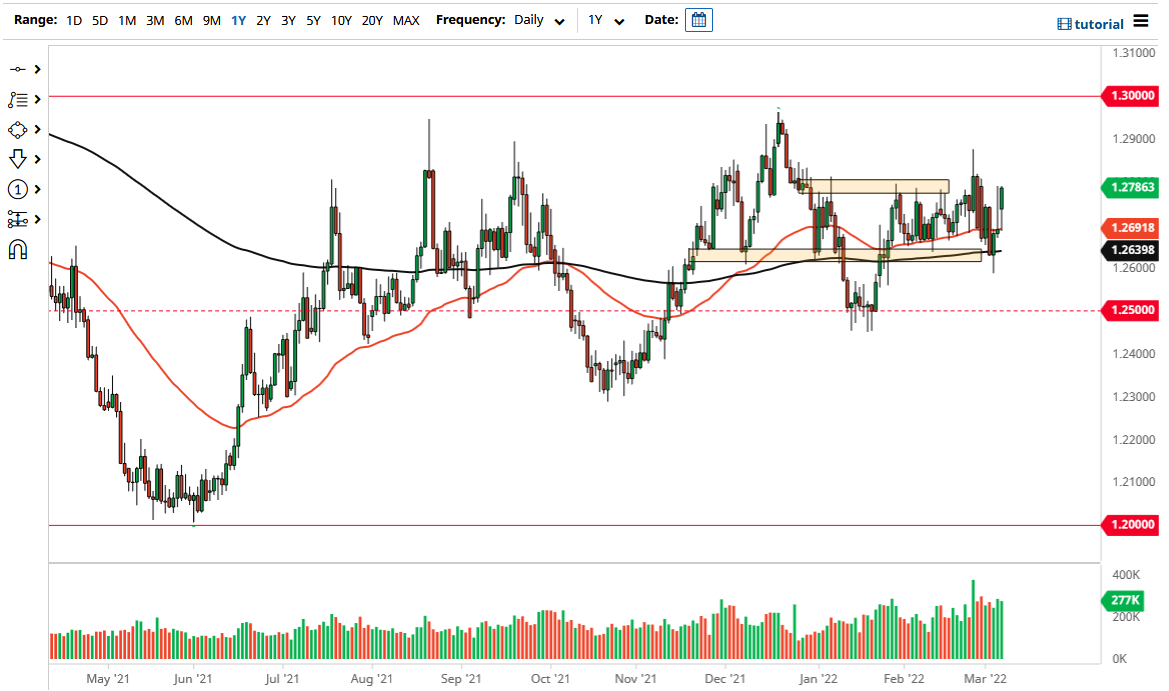

That being said, Canada has a whole plethora of problems that overwhelm the currency. Even though the Canadian central bank recently raised rates, the reality is that most people knew that was going to be the case anyway. The question now is whether or not the US dollar can break above the 1.28 level rather significantly? If it does, then it could open up a move for the US dollar to go looking towards the 1.30 level.

Breaking down below the 200-day EMA and the support barrier sitting right around the 1.2640 level opens up the possibility of a rather significant breakdown. In that scenario, we would see the US dollar probably go looking towards the 1.25 handle rather quickly. The breaking down below the 1.25 handle opens up a rather significant drop. However, in this environment, it is very difficult to imagine a scenario where the US dollar is going to be shunned for another currency in general. Yes, we have seen some commodity currencies do okay, namely the Australian and New Zealand dollars. However, it is worth noting that during the Monday session the market does look as if it is trying to turn around in those markets as well. In general, I think this is a market that given enough time will break out, and when it does, it will go looking towards the 1.30 handle despite what is going on with oil.