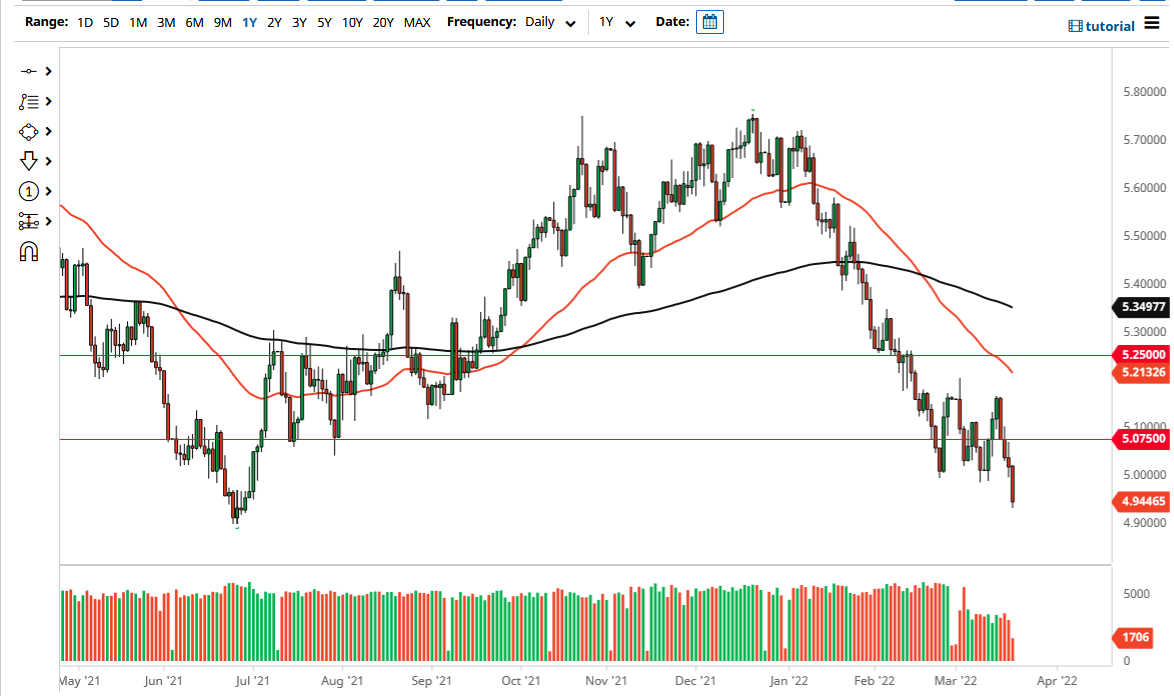

The US dollar fell again on Monday against the Brazilian real, breaking down below the 5.00 BRL level. This is an area that has a certain amount of psychological importance to it, and it is worth noting that we have seen multiple attempts to break down through here, meaning that this is a breakdown that is worth paying attention to.

While the US dollar has done fairly well against multiple other currencies, Brazil is an exporter of commodities which has a lot of influence on the real itself. Because of this, I think we will continue to see commodity currencies, in general, do quite well, and that includes this one. Keep in mind that Brazil is more or less a commodity exporter of soft commodities, but they have seen massive spikes in value right along with energy and metals.

If we do rally from here, I think that the area right around the 5.0750 BRL will cause quite a bit of resistance, so I think it is likely that we will see sellers jump back in and push this pair lower. While the US dollar may be relatively strong against other currencies, as long as the commodity markets continue to behave the way they are, some of these EM commodity currencies are going to be very attractive. This is especially true considering that a low-yield environment continues to see traders trying to get some type of return in the bond market anywhere they can. While the US is starting to offer more in the way of yield, the reality is that countries like Brazil and Mexico continue to outperform in that sense.

It is not until we break above the 5.1250 level that I would truly be impressed by some type of move higher unless, of course, we get a major headline that has people running away from anything close to being risky and into the US dollar or perhaps even the US Treasuries markets. Ultimately, this is a market that I think will continue to go lower but we are probably going to see short-term rallies. I look at those rallies as an opportunity to sell on signs of exhaustion. Furthermore, the candlestick size for Monday does suggest that there is a little bit of momentum here.