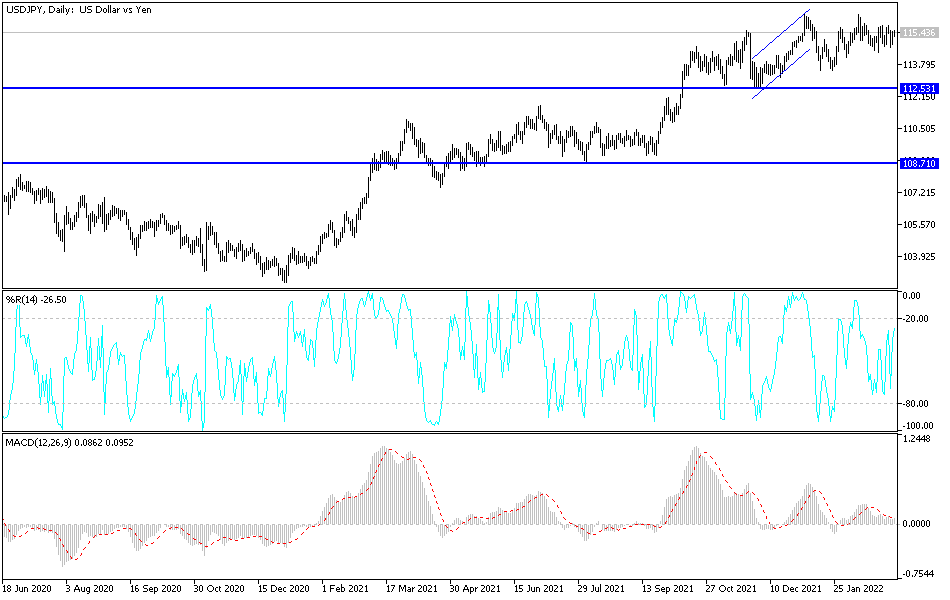

With the beginning of this week's trading, the price of the USD/JPY currency pair attempted to recover, stable around the 115.47 resistance level, after selling operations that moved the pair towards the 114.65 support level at the end of last week's trading. But these gains may collide with the continued aversion of investors to risk in light of the continuation of the Russian-Ukrainian war, which casts doubt on the future recovery of the global economy.

US stocks fell to their lowest levels amid mounting concern about rising energy costs as investors assessed the impact of the rise in commodity prices on inflation and economic growth. The US dollar extended its gains, while Treasury yields fell from session highs.

The S&P 500 fell for a third day, down 1.5 percent with all but two of the 11 major industrial groups declining, with tech giants shares losing ground. The Nasdaq 100 index fell by 2 percent. The price of oil jumped due to the possibility of a ban on Russian supplies, and accordingly the price of Brent crude jumped to $139 a barrel, before trading approached $120. And the price of gas, palladium and copper in Europe recorded its highest levels ever.

Meanwhile, the Biden administration is considering whether to ban imports of Russian oil and energy products, a move that could increase economic pressure as more companies pull out of the country in response to Moscow's invasion of Ukraine. European Union governments have been divided over whether to join US goods from grains to metals, and fears have mounted of chaos in raw material flows due to the invasion and sanctions against Russia.

Inflation expectations in the 10-year US bond market jumped to a record 2.785 percent, while the yield on benchmark Treasuries rose by two basis points to 1.75 percent. The dollar scale rose for a third day, trading at its highest level since 2020.

The global economy was already suffering from high inflation due to the pandemic. The Fed and other major central banks now face the difficult task of tightening monetary policy to contain the cost of living without altering economic growth or roiling risk assets.

Ukrainian and Russian officials will meet for a third round of talks but hopes for progress at the meeting later are low as Russian President Vladimir Putin has said Kyiv must agree to his demands if the fighting is to end. Putin signed a decree allowing the government and companies to pay foreign creditors in rubles, in a bid to stave off defaults while capital controls remain in place. Amid the crisis, more companies are backing off their Russia operations, including streaming giant Netflix and social media service TikTok, which is owned by ByteDance Ltd.

Meanwhile, China has warned the United States against trying to build what it called a Pacific version of NATO, while declaring that security differences over Taiwan and Ukraine are "absolutely incomparable".

According to the technical analysis of the pair: Despite the improvement in the performance of the USD/JPY currency pair today, the improvement faces continued aversion of investors to risk. This is in favor of the Japanese yen more than the dollar. Therefore I still prefer selling the dollar yen of each ascending level, the closest targets for the bulls are currently 115.75 and 116.40, respectively. On the downside, and according to the performance on the daily chart, a break of the 114.15 support will be important for a stronger control of the bears.

The currency pair is not awaiting important and influential data today, and therefore investor sentiment for risk appetite or not will have the strongest influence on the pair's direction.