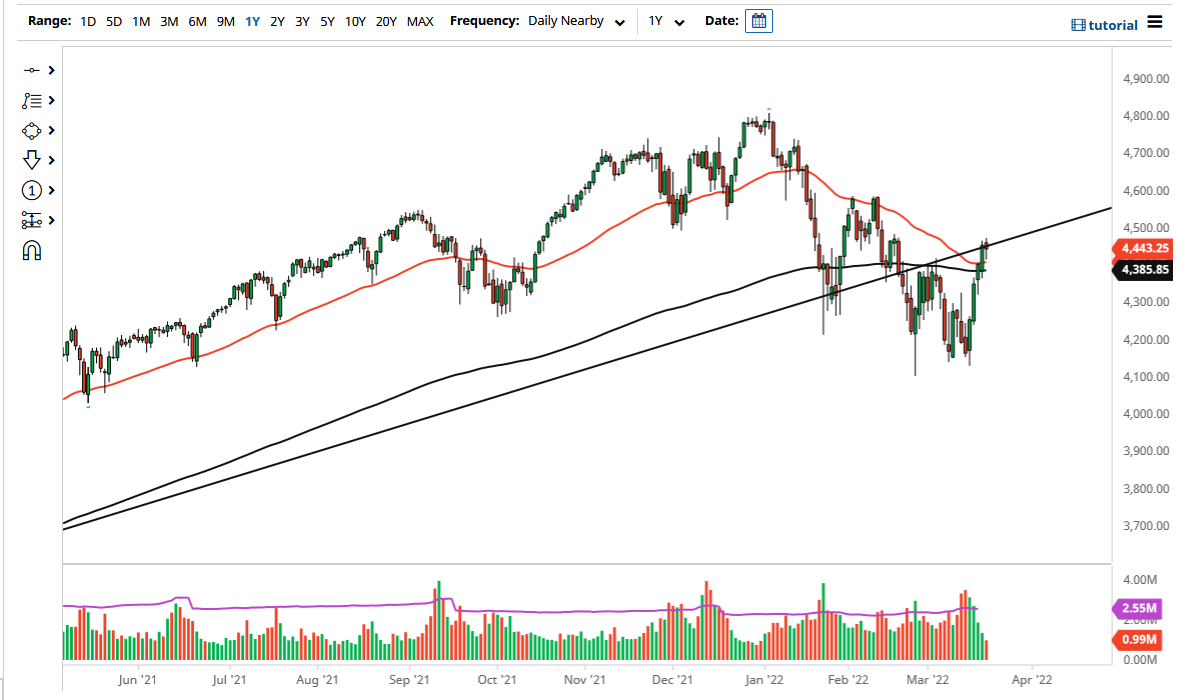

The S&P 500 had a relatively quiet session on Monday, as we continue to hang about the previous uptrend line. By doing so, it looks as if the market is turning around a bit, which does make sense when you take a look at the geopolitical situation. After all, there are a lot of risks out there when it comes to growth and that has not changed.

I would point out that Friday was a quadruple witching day, so a lot of options for volatility would have affected the index itself. Because of this, I think we have a situation where the market gave a little bit of a “false reading” at the end of the week. If we can break down below the 200-day EMA at the 4385 level, then I think systematic trading will start to short this market again. This is a market that not only has to deal with technical difficulties, but also fundamental issues.

Inflation is going to be a major problem for this market, and I do not see that changing anytime soon. Beyond that, the Federal Reserve is looking to tighten interest rates, and it should have an effect on markets also. As interest rates continue to rise, it makes the “risk-free rate of return” higher. This is a standard model that a lot of people on Wall Street pay close attention to. Furthermore, you also have to worry about geopolitical issues when it comes to the Ukraine war, and tensions between the United States and Russia. Supply chains are going to get worse, not better, so it will be interesting to see how that comes into play as well.

Ultimately, there is a lot of noise out there when it comes to the global economy, and that does not typically bode well for risk assets such as stocks. At this point, I think it is probably only a matter of time before we fall back towards the 4300 level, perhaps followed by the 4150 region. A breakdown below 4100 opens up a big flush lower and could make a certain amount of sense as the US economy itself is looking to slow down from a massive amount of growth to almost none sometime later this year.

That being said, if we break above 4500, I will simply have to hold my nose and buy stocks, because arguing with price is a great way to lose money.