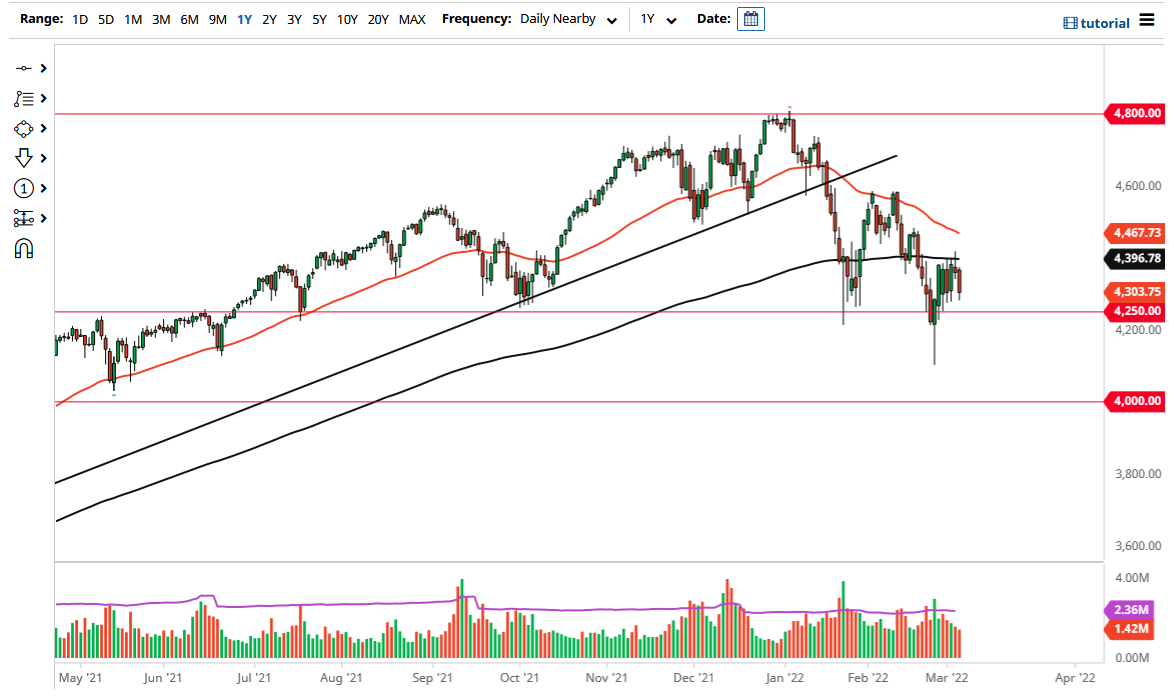

The S&P 500 pulled back a bit on Friday as we continue to see plenty of weakness. The 200-day EMA has been resistance as we had seen on Thursday, after forming a significant shooting star. Underneath, we have the 4250 level, which has offered a certain amount of support. I do believe that given the longer-term attitude of the markets, it is probably going to continue to be a situation where we are fading rallies that show signs of exhaustion.

The market will continue to be very noisy, to say the least, because we have so many different things pushing the markets around based upon fear and greed. The geopolitical issues continue to take front and center of the stage, and I think we will see a lot of attention paid to Ukraine, and tensions between the West and Russia. That being said, the market is likely to see concerns about the Federal Reserve tightening monetary policy at the same time, so it does make sense that we would see stocks suffer as tightening the monetary policy typically will take the risk out of the marketplace.

The 4250 level being broken would open up a bit of a “trapdoor” for the market and it would send this market much lower. At that point, I would anticipate a move initially to the 4200 level, and then eventually the 4100 level. On the upside, we would have to close above the Thursday shooting star in order to have a reasonable expectation of any type of bigger move. The earnings season has proven to be a whole host of warnings from companies about the slowing economic situation ahead. At this point, it is obvious that the United States is going to see decelerating growth, so it makes sense that we would see the stock market reflect that. Ultimately, it is probably only a matter of time before we would see even further downward pressure.

If the war in Ukraine stops, then it is possible that we may get a short-term rally, but that will end up being another opportunity to start selling. Given enough time, I do think that we could test the 4000 handle.