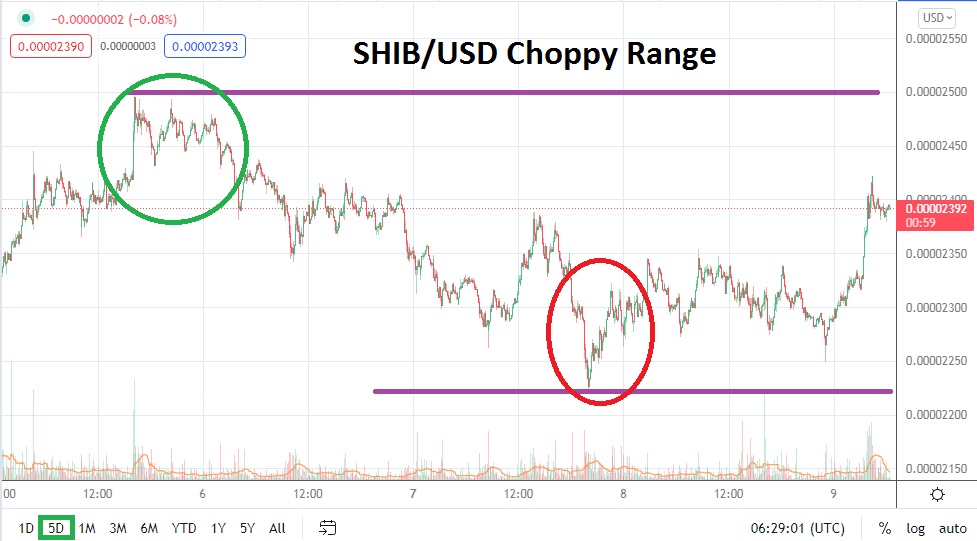

SHIB/USD has turned upwards in early trading this morning after producing fresh lows on the 7th and 8th of March. SHIB/USD still remains within the lower boundaries of its mid-term bearish technical charts, but today’s reversal higher will intrigue speculators who crave the volatility of the fractionally valued Shiba Inu cryptocurrency and its sudden storms from small changes to its price.

The broad cryptocurrency market has been choppy the past week of trading and this should not come as a surprise taking into consideration global news developments and the impact on financial assets. SHIB/USD remains a distinct speculative asset, which often is a barometer of sentiment within the digital asset sphere. While SHIB/USD remains within its lower price range speculative buyers may look at the current ratios of the cryptocurrency and monitor it for potential buying opportunities.

Support levels should be looked at by conservative buyers who want to catch a push higher in SHIB/USD. They might want to wait for slight moves downward, which do not crash past support junctures below which are perceived to be durable. Because SHIB/USD trades within a fractional value framework, traders need to consider the use of entry price orders so their fills meet their expectations. If current short term support near 0.00002380 and 0.00002370 are not penetrated lower, this could be an opportunity to pursue a higher move.

As of this writing, SHIB/USD is trading above the 0.00002420 level. Skeptics may want to point to yesterday’s lows and the day before as warning signs, SHIB/USD can certainly move lower and challenge depths seen in the month of January, but support thus far has proven rather stable.

The lows of 0.00002220 approximately on the 7th of March are realistically not so far away, and given the capability of volatility within SHIB/USD speculators need to remain concerned about sudden momentum changes. Choppy trading has been produced the past week of trading, but a range between 0.00002218 and 0.00002498 has been displayed, which can be described as extremely consolidated when values are looked at without a focus on the fractional amounts of value being considered.

Traders need to carefully consider their use of leverage when trading SHIB/USD. Targeted trading should include all necessary risk taking tactics, including stop loss and take profit orders. While quick hitting trades may be the keystone of SHIB/USD, speculators who can use cautious amounts of leverage and make sure their transactions costs are not unbearable may consider holding onto SHIB/USD for longer trades. Large amounts of momentum in SHIB/USD can create substantial changes to account balances – for good and bad are within the scope of potential fractional trading results.

Shiba Inu Coin Short-Term Outlook

Current Resistance: 0.00002415

Current Support: 0.00002370

High Target: 0.00002475

Low Target: 0.00002281