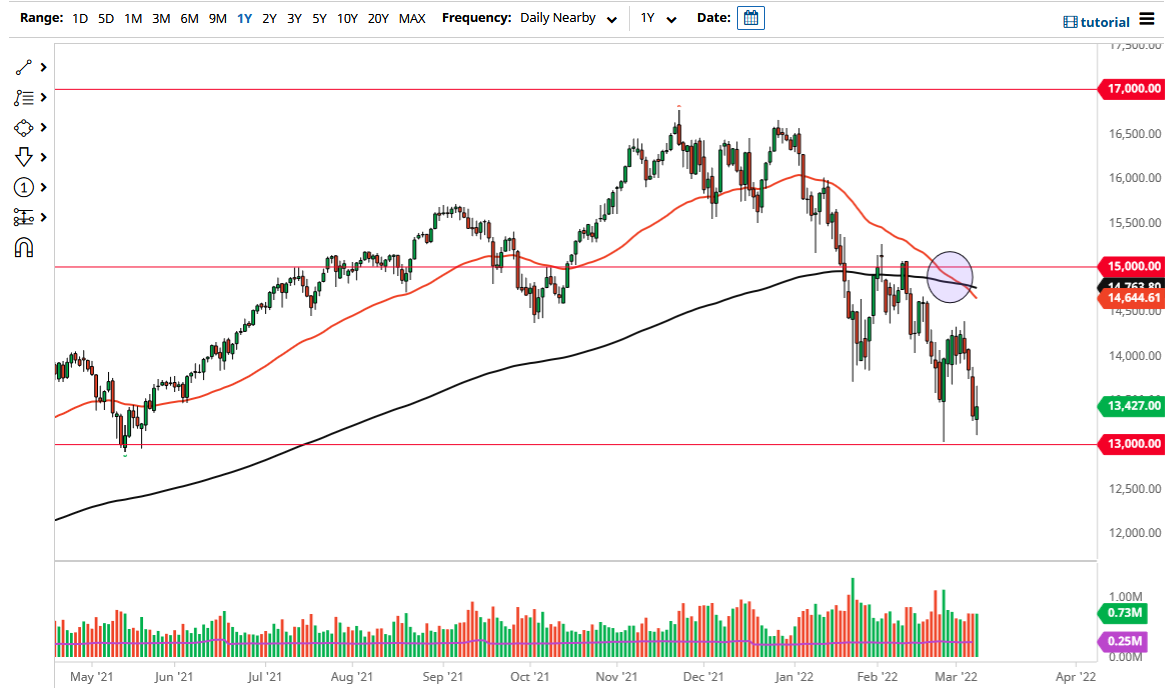

The NASDAQ 100 went back and forth on Tuesday to reach down towards the crucial 13,000 level. This is an area that has been supportive recently, so it would make sense that we would bounce from here. That being said, the markets are obviously very noisy at the moment, and I do think is probably only a matter of time before a rally has to happen. This rally would be what I would consider a “bear market rally”, as we have simply dropped too quickly.

Nothing has fundamentally changed in this market, so I do believe that it is probably only a matter of time before we see the NASDAQ 100 break down below the 13,000 level, but we will not get there in a straight line. We recently have formed the “death cross”, which is an indicator that longer-term traders will pay attention to. I believe that the NASDAQ 100 will continue to struggle as tightening monetary policy comes, but we are not that far away from a Federal Reserve meeting where they are not only expected to see the need to tighten, but then they will release a statement that a lot of market participants will be paying close attention to.

If they remain hawkish, that could send the NASDAQ 100 plunging. We have CPI numbers coming out of the next couple of days, and a whole host of other potential headlines that will more likely than not work against the value of high-flying technology stocks. At this point, I believe that short-term rallies will be sold into, and I also believe that the 13,500 level, as well as the 14,000 level above there, should offer a significant amount of resistance. I will be looking for long wicks to the upside of candles to take advantage of.

On the other hand, if we simply slice through the 13,000 level, I think the NASDAQ 100 will go looking towards the 12,500 level rather quickly. Stock markets around the world continue to fall apart and I believe at this point everybody is waiting around for the Federal Reserve to save them. With inflation rolling the way it is, there is a really good chance the Federal Reserve will not do this. Furthermore, they have just made Federal Reserve governors stop trading. In other words, they will not be lining their pockets.