The NASDAQ 100 initially shot higher during the course of the trading session on Thursday but continued to see plenty of selling pressure as the risk is most certainly souring. The NASDAQ 100 is an index that needs growth and risk appetite strengthening, and at this point, it certainly does not look like we have the proper scenario where growth stocks will perform well.

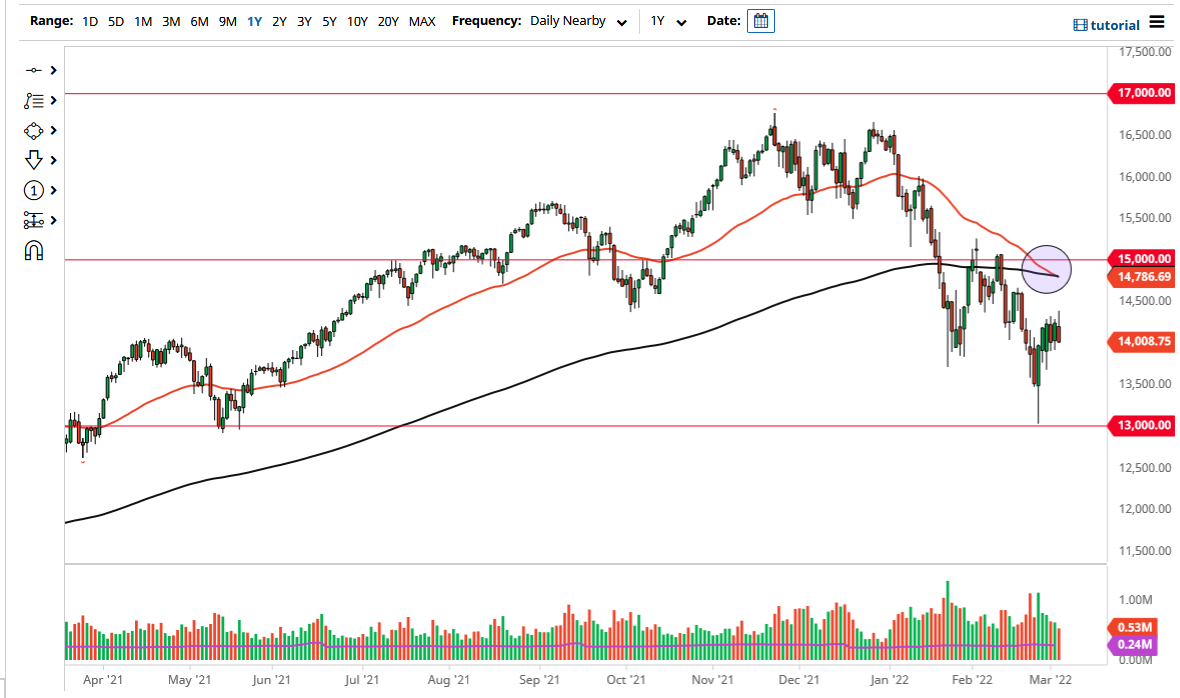

The 50 day EMA is now threatening to cross below the 200 day EMA, forming the so-called “death cross” that a lot of longer-term traders pay close attention to. I do not necessarily know that it means anything other than the fact that it will add even more pessimism to the market.

As you can see, we continue to make “lower highs” and “lower lows”, the very epitome of a downtrend. It is very likely that the NASDAQ 100 will have trouble rallying from here, mainly due to the fact that we are just not in the right environment for people to be willing to look for growth. Growth is something that is probably going to be very difficult to find globally, so I do not necessarily see a scenario where an index like the NASDAQ 100 or other technologically laden markets gain.

Interest rates continue to be pushed higher as the Federal Reserve is clearly going to tighten quite drastically and may even have to do so stronger than anticipated. When that happens, a lot of money flows away from highflyers, such as the companies that make up the bulk of this index volume. That is a perfect scenario for this market to continue struggling, and I think at this point we are likely to go looking towards the 13,500 level if we break down below the minor support level at 13,925 that has shown itself most of the week.

One thing is for sure, the market certainly has shown no real confidence on moves higher, and now it appears that we may be getting ready to enter an accelerated move to the downside. Quite frankly, I do not think it would take much to have traders panicking yet again. It might be Ukraine, it might be inflation, or it could just simply be the fact that monetary policy is tightening, but there are plenty of reasons to think that this market drops.