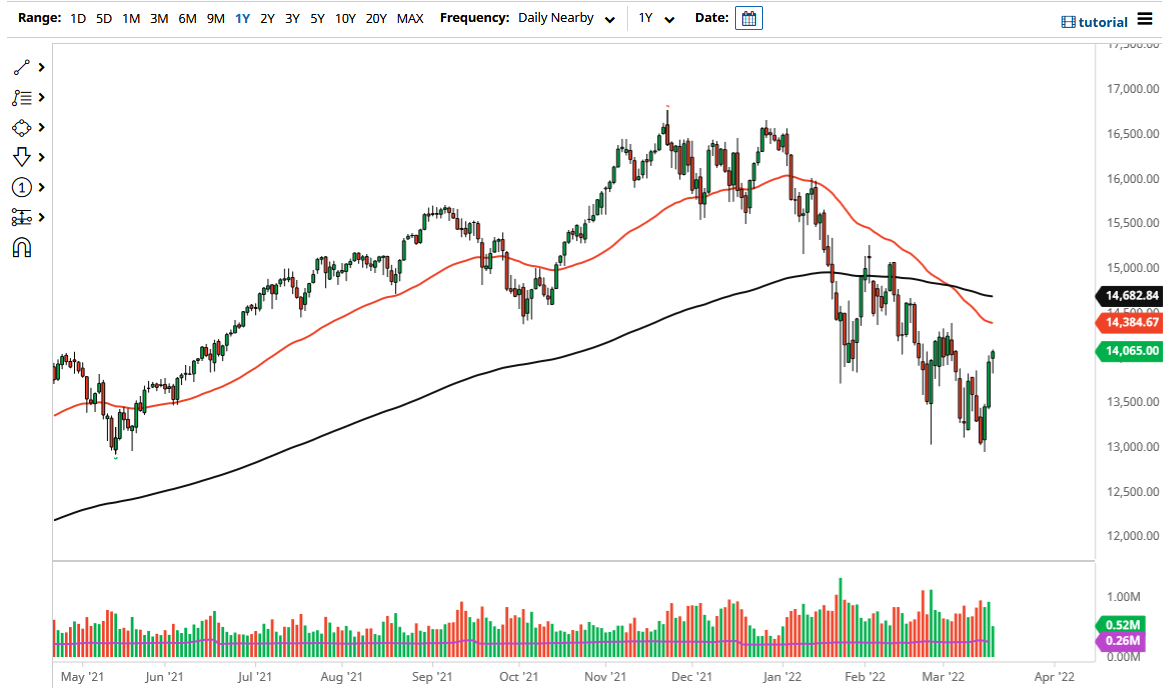

The NASDAQ 100 initially pulled back during the trading session on Thursday but then turned around to rally and a break above the 14,000 level. The candlestick does look rather bullish, but if we were to break down below the bottom of the candlestick, it would turn this candlestick into a “hanging man.” That is a very bearish sign, so it will be interesting to see how this plays out.

If we do break down below the bottom of the candlestick, then it very well could lead the NASDAQ 100 to lower levels such as the 13,500 level, and then possibly the 13,000 level, an area that has been important more than once. If that area gets broken, we could send this market much lower, as it would be a continuation of the overall downtrend. In that scenario, it would obviously be very “risk-off”, so I do believe that not only with the NASDAQ 100 drop down, but it is also probably likely that we would see everything else dropping.

It is very likely that it is only a matter of time before we see a bigger move, due to the fact that there are so many negative issues around the world. It is difficult to imagine that the market will suddenly take off with so much in the way of concern out there. Even if we do rally from here, I would consider it a “bear market rally”, because growth is not going to be found. The 50 Day EMA sits at the 14,382 level and is dropping.

This is going to be a very volatile market, so you will obviously have to be cautious with your risk management. Even if we do get a nasty bear market rally, I think it is only a matter of time before exhaustion sets back and so that is going to be the trade. The economic indicators simply do not line up for stronger stocks, although we are probably still trying to recover from an oversold condition. That is simply a short-term market move that could turn around and drop quite drastically. At the drop, it is very likely that it could be vicious and “out of the blue.” As far as buying is concerned, I need to see more in the way of convincing to get involved. While this has been a strong three days, the reality is that it is but a blip on the radar.