Gold continued to decline after bond yields rose ahead of the key Federal Reserve meeting where policy makers are set to raise US interest rates. The profit-taking operations pushed the gold price towards the level of $130 an ounce at the time of writing the analysis. Gold prices fell after rising to the top of $ 2071, which is closest to the historical record peak for the price of gold in the era of the pandemic. The sharp gains of the gold market came as the Russian invasion of Ukraine and accelerating inflation increased the demand for safe haven assets. The war has led to continued inflows of bullion-backed exchange-traded funds, pushing total holdings to a one-year high, according to preliminary data compiled by Bloomberg.

Months of speculation about a new wave of interest rate increases appears to have peaked on Wednesday, as the US central bank is expected to begin tightening to rein in decades-high inflation, exacerbated by rising commodity prices. Markets are now indicating that they expect to raise US interest rates by a quarter point from the Federal Reserve in 2022. The 10-year Treasury yield extended its gains after rising to its highest level since July 2019 on Monday, reducing the allure of non-interest-bearing gold .

The price of palladium rose 0.2 percent after falling 15 percent on Monday, the largest drop since March 2020, as supply concerns eased. Vladimir Potanin, the largest shareholder in MMC Norilsk Nickel BGSC, said the company is maintaining exports despite suspending air links with Europe and the United States by forwarding shipments.

Separately, the European Union is set to agree to ban the sale of luxury goods to Russia over a certain value as well as the purchase of several steel and iron products from the country as part of a fourth round of sanctions over the invasion of Ukraine, according to a project obtained by Bloomberg. Palladium - which is mostly used in catalytic converters in gasoline engines - is exempt from the restrictions.

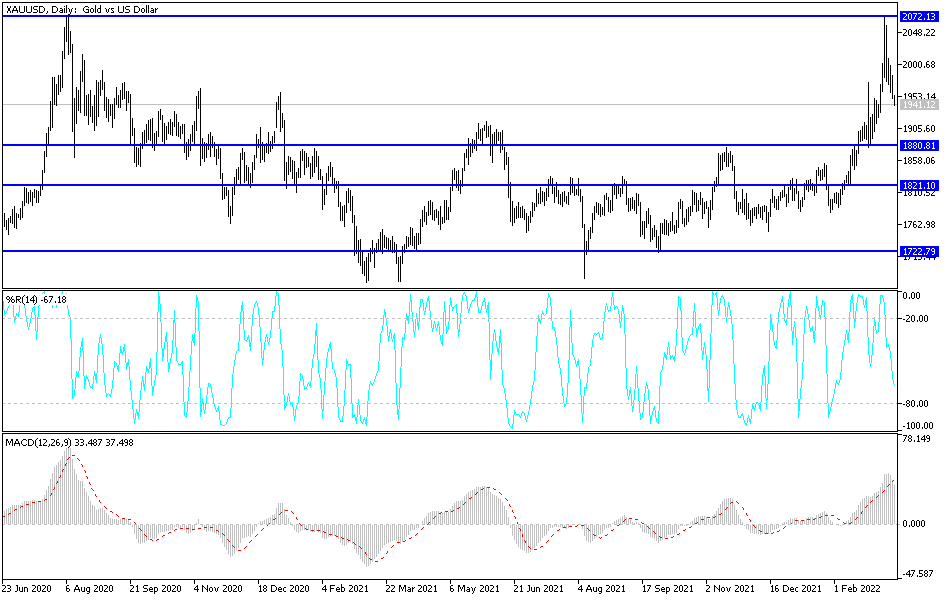

According to the technical analysis of gold: As mentioned before, breaking the $ 1930 support will be important to the gold market bears, only the performance on the daily chart. The price of gold may head towards the next support level of $ 1880 an ounce. After the storm of the US Federal Reserve, attention will return to the Russian war, which was a good reason for the record gains for gold recently. On the other hand, the return of the movement towards the resistance of 1985 dollars an ounce is important for a stronger and continuous control of the bulls.