Gold futures continued their recent losses and closed at their lowest level in 3 weeks, as the price of gold fell to the support level of $ 1890 an ounce. We always advise to buy gold from every descending level, however the price of gold returned to rise towards the level of $ 1928 an ounce at the time of writing the analysis. Market losses came as the commodity's safe-haven appeal waned after global stocks rose amid signs of progress in peace talks between Russia and Ukraine.

Gold prices fell despite the weak dollar. The dollar index, which drifted to 98.04, regained some of the gains it later lost, but is still significantly lower at 98.50, down about 0.6% from the previous close. In the same direction, silver futures fell at $24.736 an ounce, while copper futures for May settled at $4.7310 a pound.

On the US economic news front, a report from the Conference Board showed an unexpected improvement in US consumer confidence in March. The report showed that the US Conference Board's consumer confidence index rose to 107.2 in March from a revised 105.7 in February. Economists had expected the index to fall to 107.0 in March from originally 110.5 from the previous month.

The unexpected rise in the headline index came as the current situation index jumped to 153.0 in March from 143.0 in February.

On the other hand, after settling in positive territory during yesterday's session, the US stock market closed flat on Tuesday with technology stocks turning into another strong performance. All major US stock indices ended the trading with strong gains. Where the Dow Jones index closed up 338.30 points, or 0.97 percent, at 35,294.19, The Standard & Poor's 500 Index closed 56.08 points, or 1.23 percent, at 4,631.60, and the Nasdaq settled at 14,619.64, with a gain of 264.73 points, or 1.84%.

Overall, reports of encouraging progress in ceasefire talks between Russia and Ukraine in Turkey helped lift investor sentiment. According to a Reuters report, the Russian Deputy Defense Minister said that Russia has decided to significantly cut off its military activity focused on Kyiv and Chernihiv. Ukrainian negotiators proposed adopting a neutral situation in exchange for security guarantees. Investors also digested the latest batch of economic data. Where a report from the Department of Labor showed that the number of vacancies in the United States was 11.266 million in February of 2022, little changed from 11.283 million in January.

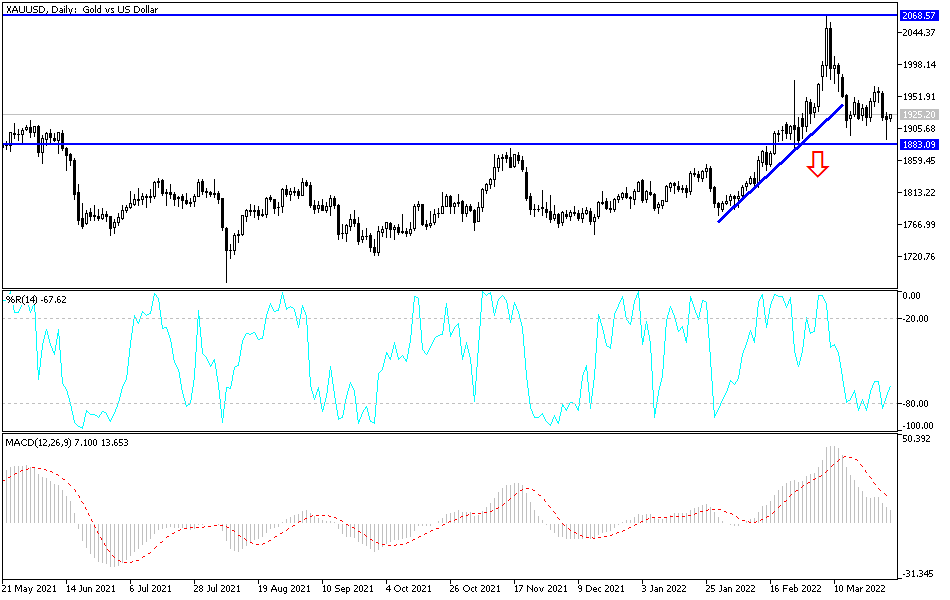

According to the technical analysis of gold: So far, we still prefer to buy gold from every bearish level as long as global geopolitical tensions exist. The most appropriate levels for buying gold are 1880 and 1858 dollars, respectively. As I mentioned before, stability above the $1900 resistance will remain a catalyst for the bulls to dominate and increase technical long positions. The closest targets for bulls are currently 1942, 1960 and 1975 dollars, respectively. The last level is important to move towards the psychological top of 2000 dollars.

The price of gold will be affected today by the price of the dollar and the extent to which investors take risks or not, as well as the reaction from the announcement of US economic data ADP to the change in non-agricultural employment and the growth rate of the US economy.