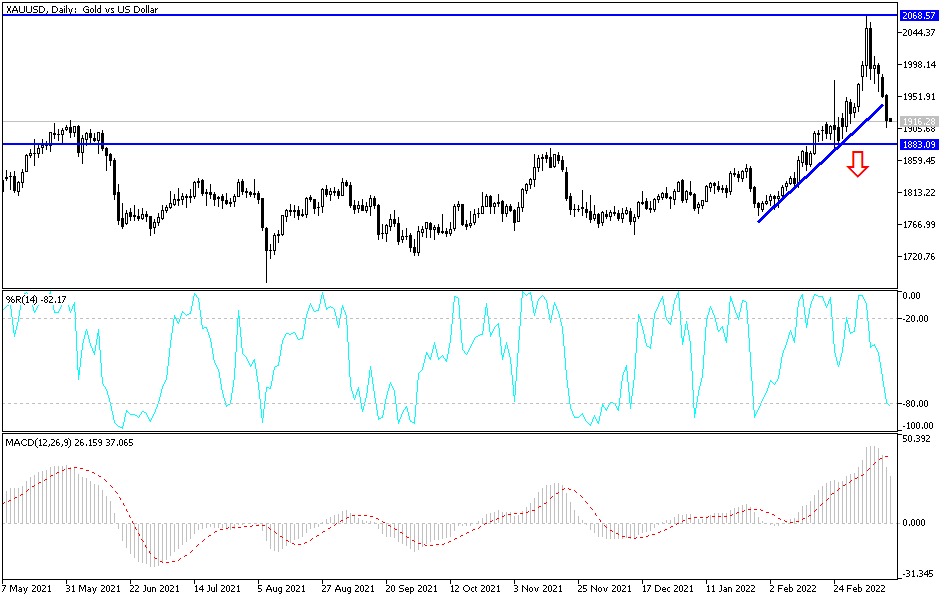

For five trading sessions in a row, gold prices are falling amid profit-taking sales. This is after the yellow metal market gains reached the resistance level of $ 2071 an ounce, very close to the record and historical level, which it recorded in response to the world’s fears of COVID-19. Selling operations pushed the price of gold towards the level of support 1907 dollars an ounce. Price settled around the level of $ 1918 an ounce at the time of writing the analysis. Interestingly, the rise recorded in recent weeks is comparable to that observed at the height of the COVID-19 crisis. In both cases, the rise in gold prices was based on its status as a safe haven and store of value.

Gold prices fell, amid a rise in US Treasury yields ahead of the Federal Reserve's monetary policy announcement on Wednesday. It is widely expected that the Federal Reserve will raise the target range for the US interest rate by a quarter of a percentage point when it announces its interest rate decision.

Positive news improved market sentiment. An aspect that led to the recovery of global stocks while reducing the demand for safe havens such as gold and other precious metals. Indeed, other precious metals, which also hold safe haven status, pulled back from multi-year highs at the start of the week.

Investors also reacted positively to a report from the US Labor Department showing producer prices rose slightly less than expected in February. Where the Department of Labor said that the producer price index for final demand jumped by 0.8 percent in February, after jumping by an upwardly revised 1.2 percent in January.

Economists had expected producer prices to rise 0.9 percent compared to the 1.0 percent jump originally reported for the previous month. Excluding food, energy and commercial services prices, core producer prices rose 0.2 percent in February after a 0.8 percent increase in January. Meanwhile, traders seem to have shrugged off concerns about higher interest rates even as the Federal Reserve prepares to announce its first rate hike since 2018 on Wednesday.

However, officials will have to balance curbing high prices without pushing the US economy into recession. A separate report showed manufacturing activity in New York state weakened significantly in early March as orders fell and delivery times lengthened.

Ukraine and Russia will resume talks on Wednesday as a key adviser to Ukrainian President Volodymyr Zelensky described the negotiations as "difficult and sticky," but acknowledged there was room for compromise. US President Joe Biden is scheduled to travel to Brussels next week to meet NATO allies and participate in a summit of European Union leaders as Russia continues its invasion of Ukraine.

According to gold technical analysis: Gold bulls may lose control of the market if the current selling operations move towards the support level of 1875 dollars. This is an important level to break the strong upward channel formed by the price of gold since the start of the Russian-Ukrainian war. The stronger control of the bulls will not return to the trend without moving towards the resistance 1983 dollars an ounce. Because it is an important level for the psychological summit of 2000 dollars again. Whatever the decision of the US central bank, I still prefer buying gold from every bearish level.