Gold prices fell below the historic psychological high of $2000, ending the tumultuous trading week. Investors were taking profits early in the hope that the conflict between Ukraine and Russia could improve or at least, not escalate. With the US dollar rising and Treasury yields rising, metallic commodities may take a breather. Gold prices fell to the level of 1959 dollars an ounce, and its gains last week reached a peak of 2070 dollars an ounce. Despite the sell-off, gold prices moved to a tepid weekly increase of 0.25%, leaving its annual gain above 8%.

Silver, the sister commodity to gold, is still above $26. The white metal is stable in the trading week, up 0.9%, adding its rise since the beginning of 2022 to nearly 12%.

Global financial markets were in positive territory on Friday as investors continue to assess the situation in Eastern Europe, expecting geopolitical tensions to subside soon. Meanwhile, investors may be pricing in higher inflation for the months of February and March after the US annual inflation rate rose 7.9% last month. The CPI will almost certainly reach 8.4% this month.

The University of Michigan's US Consumer Confidence Index fell to 59.7, worse than market expectations of 61.4. Consumer expectations slipped back to 54.4, while current economic conditions slipped back to 67.8. One- and five-year inflation expectations were 5.4% and 3%, respectively.

With reference to the factors affecting the gold market. Bonds were mostly in the green at the end of trading last week, with the 10-year yield unchanged at 2.009%. One-year bond yields rose 0.016% to 1.171%, while yields on 30-year notes fell 0.023% to 2.369%.

Gold is usually sensitive to a high interest rate environment because it raises the opportunity cost of holding non-yielding bullion.

The US Dollar Index (DXY), which measures the performance of the US currency against a basket of major currencies, rose 0.25% to 98.75, from an opening at 98.36. The index is poised for a tepid weekly gain of 0.1%, extending the 2022 jump to nearly 3%. The value of a stronger bet is generally bearish for dollar-priced commodities because it makes them more expensive to purchase for foreign investors.

In other metals markets, April copper futures settled at $4.659 a pound. Platinum futures fell to $1088.30 an ounce. Palladium futures fell to $2,761.00 an ounce.

Generally gold plays its ancient role as a safe haven in times of wars and crises, and people all over the world accumulate in it. The Russian invasion of Ukraine has sent the prices of everything from oil and gas to wheat and minerals soaring, raising fears of inflation, and threatening global economic growth. This leads retail investors everywhere from Vienna and Singapore to New York to safe gold, which rose to $2,070.44 an ounce, close to the record set during the pandemic.

The roughly 10% rise in gold prices since the start of the year has turned into a boon for bullion dealers like Rudolf Brenner, founder of Philoro Edelmetalle GmbH, whose stores in German-speaking Europe now have long lines of buyers — a trend that is likely to continue as the struggle shows no sign of to undo. "When the crisis started in Ukraine, we saw huge orders," said Brenner, whose sales have tripled from their normal level. "People buy everything."

Similar stories appear from gold traders all over the world. At Empire Gold Buyers in New York, CEO Jane Foreman says 30% of his customers who trade in luxury goods like watches and jewelry want bullion instead of cash. Gregor Gregersen, founder of Silver Bullion Pte Ltd. In Singapore, gold and silver sales rose 235% in the first week after the Russian invasion, and demand has increased since then.

“Investors are considering a worst-case scenario of the war in Ukraine and find it wise to buy physical safe haven assets in a safe jurisdiction like Singapore,” said Grigersen.

The increased demand comes after an already strong year for the purchase of minerals, especially in Western countries. Demand for bullion and coins reached 1,124 tons in 2021, according to the World Gold Council, the highest in nearly a decade. This helped support prices at a time when institutional investors weren't holding back much. Generally there are still more gold buyers than sellers now, according to Ash Kundra, who runs J Blundell & Sons in London's historic Hatton Garden jeweler district. He attributes this to the most fearful environment among retail investors. For his part, he said, “I buy about 60% of what I was in 2020.” "Now, I'm selling more."

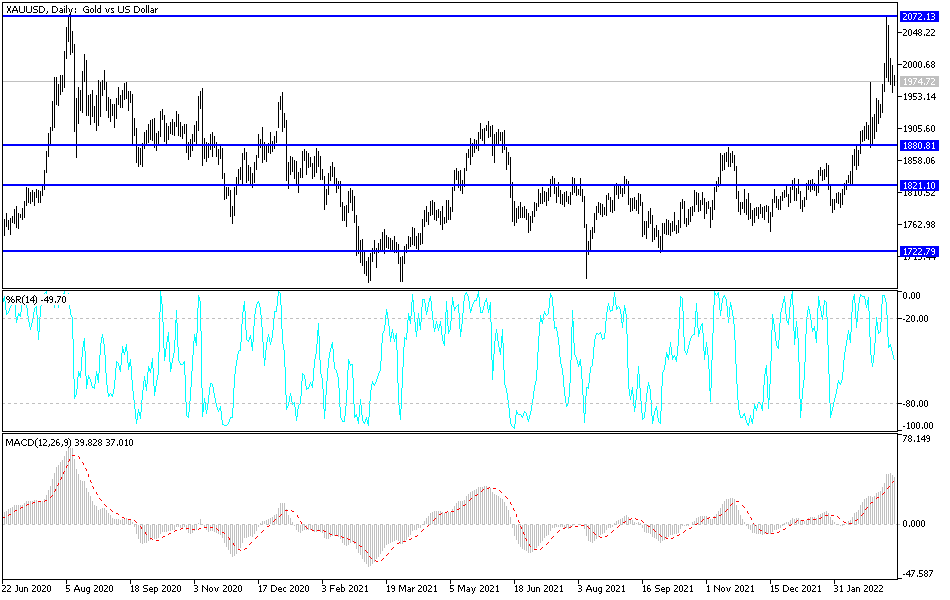

According to the technical analysis of gold: Despite the recent selling operations, the path of gold did not go out of the way. According to the performance on the daily chart it will not happen unless the price of gold moves towards the support level of 1920 dollars. I still prefer to buy gold from every descending level if the Russian war and its consequences last. On the other hand, approaching the historical psychological top of $2000 is important for gold's upward trend.