Despite the recent optimism from the negotiation round between Russia and Ukraine, the rebound gains for the GBP/USD currency pair declined, as it did not exceed 1.3182 and settles around 1.3110 at the time of writing the analysis. The weak rebound was due to investor disappointment as the British Pound came under pressure due to a growing question mark over the expectations of the Bank of England (BoE) interest rate policy. Sterling has fallen from the start this week after BoE Governor Andrew Bailey reiterated that commodity pressure on income could serve as a substitute for some of the additional bank rate increases taken by financial markets as set out later in the year.

Governor Bailey acknowledged on Monday that some additional bank rate increases are likely to be necessary, given that the current calibration of the Bank of England's monetary policy continues to add to inflation at a time when commodity prices and a strong job market threaten to trigger the extended period in which price growth remains well above the Bank of England's 2% target.

The governor also clearly and forcefully indicated that market expectations of a bank rate hike from 0.75% to 2% by the end of the year are likely to be on the excessive side of feasibility.

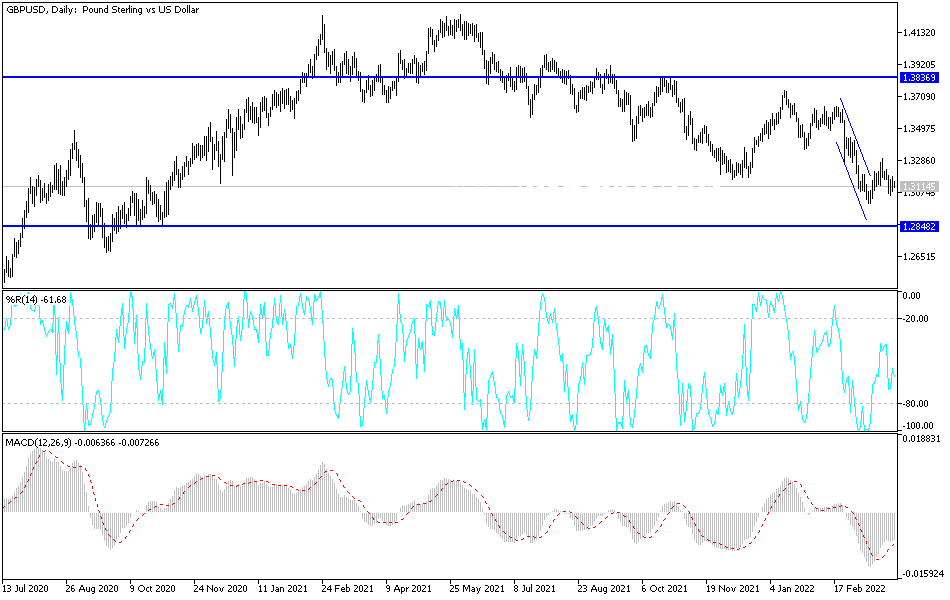

According to the technical analysis of the pair: On the daily chart, the psychological support is still 1.3000 for the price of the GBP/USD currency pair. This is the most important target for a stronger and closer control of the bears, which may increase the technical selling for more movement down. On the other hand, we still see that the breach of the resistance level 1.3335 is important for the bulls to control the trend. The performance of the currency pair will remain subject to developments regarding the Russian war and the expectations of a rate hike, whether from the Bank of England or the US Federal Reserve.