With continued risk aversion, the GBP/USD exchange rate recorded a new low in 2022 as the Russian invasion of Ukraine undermined expectations about the number of interest rate hikes that can be achieved at the Bank of England in 2022. This week, the pound sterling dollar fell towards the support level of 1.3172, its lowest during the year 2022. The pound was lagging behind its peers in the G10 currencies, as investors lowered their expectations for interest increases amid the deterioration of global economic growth expectations due to the Russian invasion of Ukraine and its associated repercussions.

Since expectations of a Bank of England rate hike were particularly high before the invasion, there is more room for disappointment. As of February 22, there were 134 basis points for the Bank of England's 2022 interest rate hike in the OIS markets, a money market that serves as a barometer of investor expectations for future rate hikes. However by the end of February, that forecast had fallen to 126 basis points, and as of March 2, there are only 100 basis points of rise expected for the year.

This represents an important reassessment of what is to come out of the BoE, depriving the Pound of what was a crucial source of support until geopolitics took hold of the markets.

The amount of Fed rate hikes for 2022 has also fallen dramatically. As of February 22, there were 140 rate hikes, but as of March 2, it is down to 117. Despite a quick reassessment of the Fed rate hike, it tends to benefit in times of heightened geopolitical fear as the currency's high liquidity makes it a safe asset.

Therefore, the decline in global stock markets and the resulting demand for cash inevitably tends to benefit the highly liquid dollar. For those who monitor the forex FX markets in the near term, the question remains to what extent the broader price outlook will continue to be adjusted, which is always linked to news from Ukraine.

Any easing of tensions is likely to deprive the dollar of its safe haven status while also revealing a rapid decline in Fed rate hike expectations. Therefore, the GBP/USD exchange rate will be a clear candidate for a rebound in light of any easing of tensions.

One potential source of relief in the near term may be the second round of talks between Russia and Ukraine, with the aim of ending the conflict. In this regard, the Interfax news agency reported, quoting the press secretary of the Belarusian Foreign Ministry, Anatoly Glaz, that Belarus said on Wednesday that the authorities were ready to “do everything possible” to ensure further Russian-Ukrainian negotiations on the settlement of the Ukraine crisis.

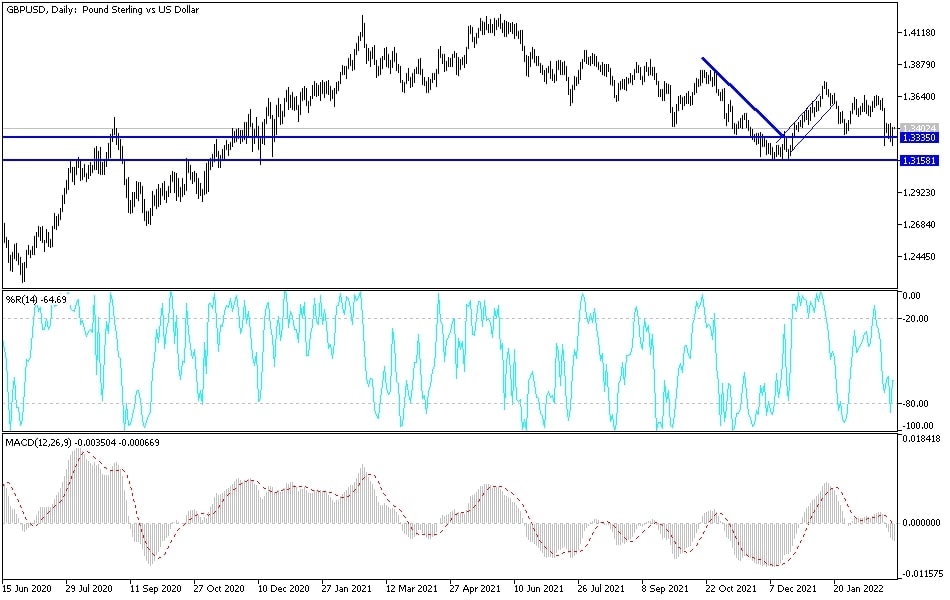

According to the technical analysis of the pair: the recent stability of the price of the GBP/USD currency pair is a good buying base, The buying deals will not occur to push the currency pair higher and out of the last descending channel without returning stability and optimism, and therefore risk appetite. Sterling's gains are valid, but geopolitical tensions remain in favor of buying the dollar as a haven. Currently, the closest targets are 1.3310, 1.3220 and 1.3100, respectively. On the upside and according to the performance on the daily chart, the bulls need to break the resistance levels 1.3485 & 1.3660 to confirm the reversal of the current bearish outlook.

Today, the PMI reading for British services and from the US will be announced the number of weekly jobless claims, non-farm productivity, ISM services index and the next testimony of US Federal Reserve Governor Jerome Powell.