The dollar will struggle to extend its multi-month rally as the market appears to have achieved a “peak hawk” in its expectations for future Fed rate hikes, some analysts say, but others question the notion that the greenback always drops after the first rally of the cycle. In the case of the GBP/USD currency pair, it tried during last week's trading to break the downside trend with gains to the resistance level of 1.3210 and closed the week's trading stable around the 1.3175 level. This month the Federal Reserve and the Bank of England raised interest rates, and both the dollar and the British pound are proving a slowdown in the G10 currency space.

However, the Pound held ground against the Dollar, indicating that expectations of future interest rate hikes by the Federal Reserve are what matters to the GBP/USD pair at this point. The Federal Reserve is on course to raise US interest rates on six more occasions in 2022 - more than the Bank of England will do - in what amounts to a frantic attempt to normalize policy in the face of rising inflation.

However, this policy trajectory has been sufficiently telegraphed, meaning that the forex FX markets were “priced in” long before the Fed actually hiked with a 25 basis point hike last Wednesday. This was manifested in the build-up of expectations to push the Dollar higher, which remains one of the best performing currencies in the past year. But, “the market is pretty much at a 'peak hawk' for the Fed. Can the Fed raise 7 times this year? Most likely, but the market has already priced it in, says Biban Ray, forex analyst at CIBC Capital.

One of the stages of the US dollar's multi-month appreciation against the British pound and other major currencies was the anticipation of higher interest rates from the Federal Reserve, which in turn would increase bond yields and increase inflows into US monetary assets. For this trend to continue, markets would like to see more price hikes in the future.

Forecasts released by the Federal Reserve point to seven rate hikes this year and roughly four next year with an average expected rate that will end at 2.8%. Overall, the GBP/USD exchange rate recovered above the $1.31 level following the Fed's policy decision in March that saw US interest rates raise and signal that six more hikes are likely to fall in 2022.

Research by RBC Capital over the past 20 years has found that there have been periods when the US dollar has not been sensitive to spreads, but there has never been a period when the dollar has not. Another key element in the slightly higher dollar exchange rate is the ongoing market anxiety associated with Ukraine. The safe haven US dollar is a natural benefactor as investors show their nerves and as long as the war continues, the weakness of the global reserve currency will be met with support.

Therefore, the rise in the GBP/USD exchange rate is likely to be limited under these circumstances. Indeed, it is worth remembering that sterling is one of the undisputed losers of the G10 in the war in Ukraine. Commenting on this, Chris Turner, analyst at ING Bank says, “There is a camp arguing that the US dollar usually sells in the first six months of the Fed's tightening cycle - presumably based on a 'buy the rumor, sell the truth' mentality of a good tightening cycle." What is different this time, in our opinion, is the strong tightening that will be undertaken by the Federal Reserve and the events in Ukraine that have damaged European growth prospects and will affect currencies in the region.”

"In summary, we believe the US dollar will continue to bid on dips against European currencies and the Japanese yen, while commodity-exporting currencies could continue to outperform," the analyst added. Meanwhile, the war fueled soaring commodity prices, and promised to extend the period of severe global inflationary pressures that threaten to slow global economic growth. The dollar is a countercyclical currency which means that it rises when the global economy suffers, so the basic background remains one from which the dollar can benefit.

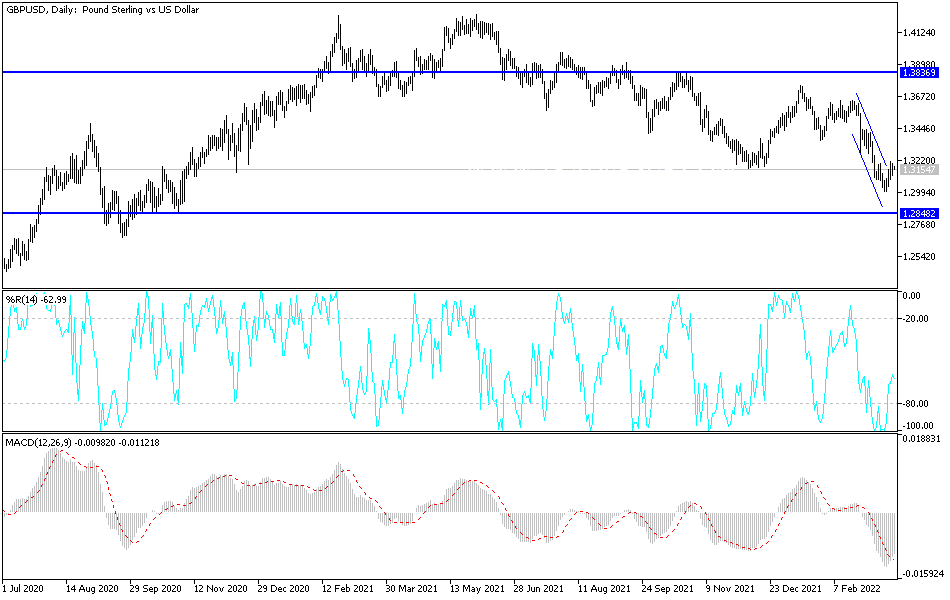

According to the technical analysis of the pair: According to the chart of the daily time frame, the price of the GBP/USD currency pair is still trying to break the general bearish trend, and it may succeed in that in the event of a rebound and breaking the top of the resistance 1.3350. Until that happens, the general trend will remain bearish, and the war will continue. Russia and its consequences for the future of the global economic recovery will support the bears to move towards psychological support 1.3000 again.