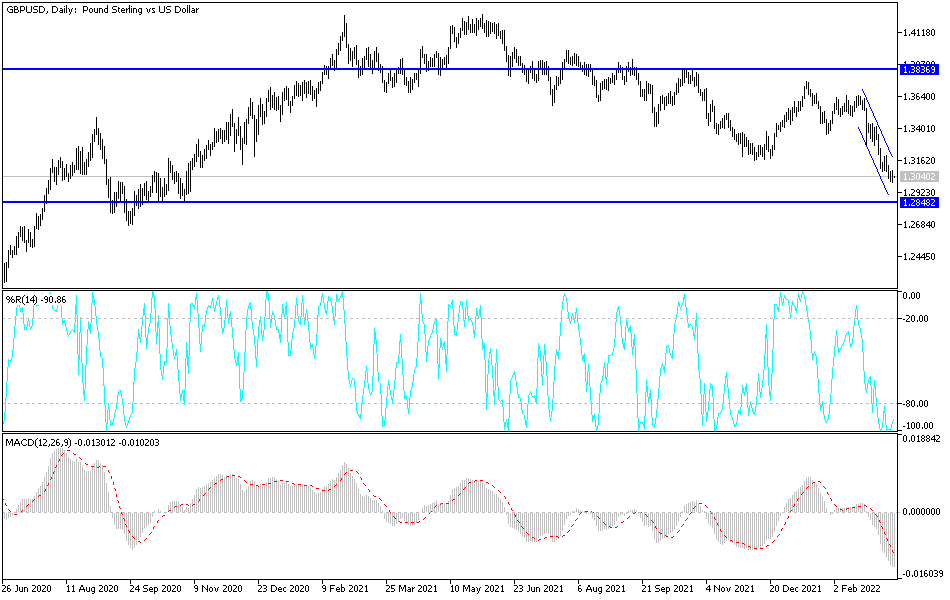

The face of the crucial bears for the GBP/USD currency pair with the psychological support 1.3000 continues, as the collapse below it supports the downside trend and warns of a stronger bearish move. The GBP/USD pair is stabilizing around the 1.3075 level at the time of writing the analysis. Overall, it appears that the British pound is on the verge of breaking below the psychologically important $1.30 level, pushing the midpoint of a long-term trading range near 1.28, according to a new analysis.

Overall, the GBP/USD exchange rate fell significantly during the Ukraine war, and further losses are likely as long as the fighting continues and lower global and UK economic growth rates. Commenting on the performance, Jeremy Stretch at CIBC Capital Markets says. “Although GBP/USD has not traded below 1.30 yet, we again passed through the level in November, the possibility of a collapse in UK real disposable income, affecting the spending point. Estimated towards GBP/USD heading towards mid-2018- 2020 trading range, (1.1412-1.4377), at 1.2894”.

However, sterling will find some temporary relief if a ceasefire is agreed to in hostilities in Ukraine. In this regard, Ukrainian Presidential Adviser Mikhail Podolak said on Monday that negotiations between Russia and Ukraine have ended but are scheduled to resume. "A technician has been suspended from negotiations until tomorrow," he added. For additional work in sub-working groups and clarification of individual definitions. Negotiations are continuing.”

In a video address released on Tuesday, President Zelensky said that "peace is approaching for Ukraine". However, the title did not provide any new details about why this happened. If peace remains out of reach, an extension of the downtrend of the GBPUSD and most other currencies is possible.

In general, the GBP/USD exchange rate started in 2022 trading at 1.3529, but is now at 1.3030 at the time of writing this report. The highest level for the year was at 1.3749, reached on January 13th.

Continuing to talk Ukraine and Russia supports the risks, but the "red lines" drawn by the two sides appear very difficult to integrate into a compromise. For example, Russia wants Ukraine to cede Crimea while also ceding Luhansk and Donetsk. For its part, Ukraine has said that it will not give up an inch of territory. A diplomatic solution that brings a quick end to the war seems unlikely at this point. As such, we believe the commodity/terms of trade shocks to global markets are likely to persist as broader sanctions and tensions could take a long time to unwind.

As long as fears and peace remain elusive, the Pound is likely to suffer, and the Dollar will find a steady supply.

From a technical point of view, JP Morgan says 1.30 support will likely provide some round number support but 1.2850 is already the next area for strong technical support. JPMorgan also says, “Resistance is at 1.3120/25 with 1.3190/00 above.”

This week will also see the Federal Reserve and the Bank of England update monetary policy, with both set to raise interest rates by 25 basis points. This appears to be a neutral development from a relative policy perspective, so markets will instead be looking at guidance for future rate hikes. There are 178 basis points of rises expected from the Fed in 2022, while the figure from the Bank of England stands at 134.

A central bank that can push expectations higher than the other is likely to see benefit from its currency.

According to the technical analysis of the pair: The general trend of the GBP/USD pair is still bearish. The breach of the psychological support 1.3000 will support a stronger control of the bears on the trend, and consequently more collapse, and the 1.2850 support may be the next target. Monetary policy decisions of both the Bank of England and the US Central Bank are important to determine the fate of the currency pair. According to the performance on the daily chart, there will be no real chance for a trend change without the currency pair moving towards the 1.3335 resistance.