Accordingly, the British Pound fell against most of the major currencies during last week's trading, with a decline of 1.60% against the Euro and a decrease of 0.86% against the Dollar. In the case of the GBP/USD currency pair, it reached the 1.3027 support level, the lowest for the currency pair since November 2020.

Indeed, when examined over a one-month period, the pound sterling is at risk of being the worst performing major currency, vying for the "wooden spoon" with the Swedish krona. In short, sterling finds itself in an unsupportive global environment characterized by the war in Ukraine, rising inflation and expectations of lower global growth.

Overall, the prospect of a BoE rate hike this week has little support for the GBP bulls. Therefore, for the time being at least, it appears that the overall trajectory of the sterling's performance will be bearish. As the war in Ukraine is unlikely to end soon and external inflationary pressures continue to mount, the war-related trend of pound weakness is likely to continue.

The British pound has traditionally tended to underperform in times of anxious global markets. Indeed, the lowest points in the pound sterling exchange rate to the euro did not come in the wake of the Brexit referendum in 2016, but rather after the financial crash of 2008 and the outbreak of coronavirus fears early in the year 2020.

If the global stock markets are in a prolonged downturn it is difficult to see a strong performance of the British Pound.

Hopes for peace in Ukraine may offer some relief to the markets and ease downside pressures on sterling, but the recent fiasco of talks between the Russian and Ukrainian foreign ministers suggests there is little scope for a breakthrough in the near term. On the other hand, the US dollar remains a preferred haven amid geopolitical tensions and widening expectations of a global economic recession linked to the rising cost of commodities. Moreover, expectations of a rapid series of US interest rate hikes, starting in March, add to the supply of the US dollar.

However, domestically, the news could be worse.

Data released on Friday showed that the UK economy entered the Ukraine crisis on a solid basis with January GDP data beating expectations. According to official figures, GDP rose 0.8% month-on-month in January according to the Office for National Statistics, up from -0.2% in December and ahead of market expectations of 0.2%. The year-over-year growth reading came at 10.0%, better than the 9.3% the market was looking for and stronger than the 6.0% figure released in December.

The Office for National Statistics also reported that all sectors grew in January 2022, with services increasing by 0.8%, production by 0.7% and construction by 1.1%. The stronger-than-expected data supports the view that the BoE will raise interest rates again in March, and possibly again over the coming months. In theory, this is supportive of the GBP, but the market appears to have fully priced in the possibility of higher interest rates. This channel may not be a source of support for the British currency as it was at the beginning of the year.

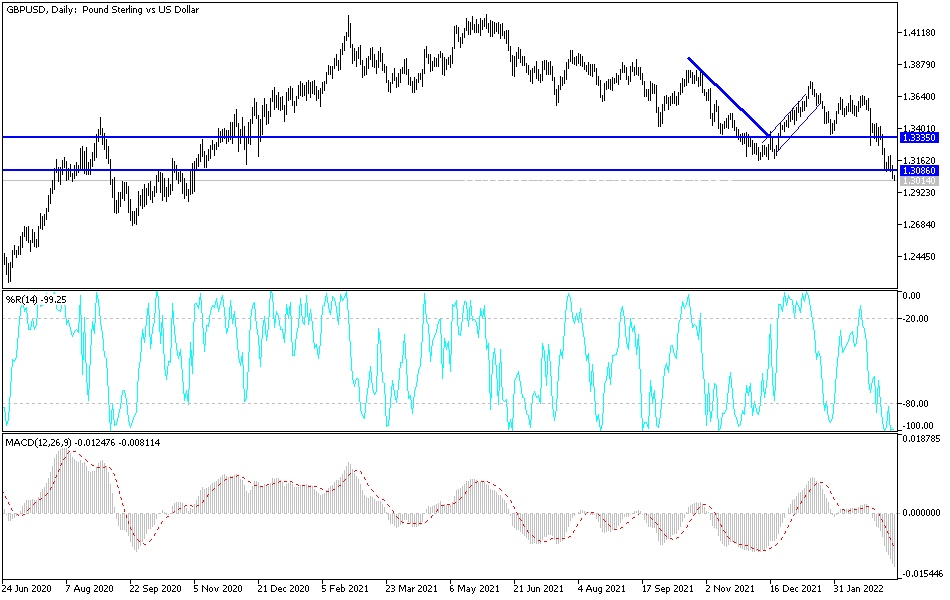

According to the technical analysis of the pair: There is no doubt that the recent losses of the GBP/USD currency pair pushed some technical indicators towards oversold levels as shown by the performance on the daily chart below. Despite that, the continuation of the weakness factors will not stop forex traders to push the currency pair towards stronger bearish levels, the closest to it are currently 1.2910 and 1.2800, respectively. On the other hand, there will be no opportunity to reverse the trend without moving the currency pair towards the 1.3335 resistance, otherwise the general trend of the GBP/USD will remain bearish.