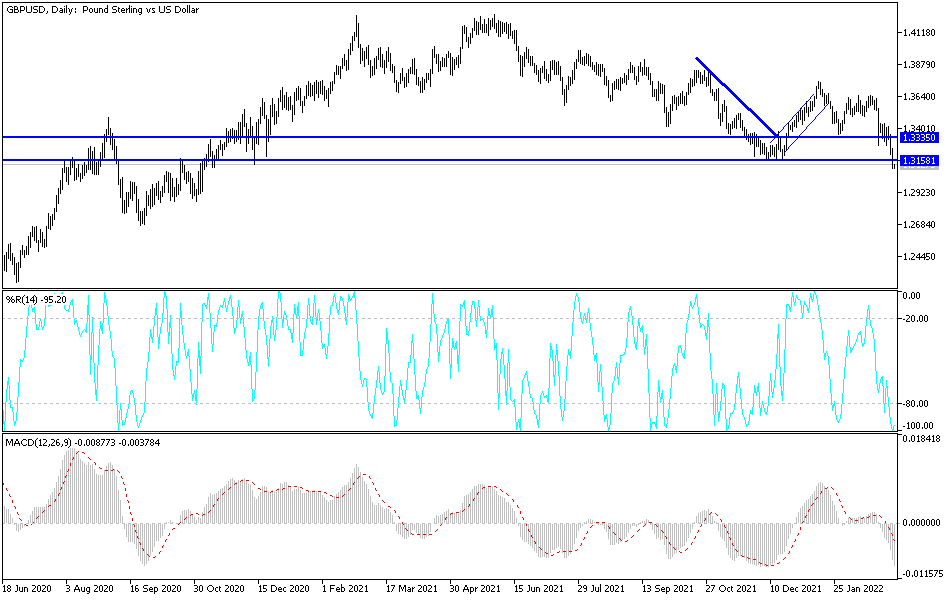

The GBP/USD exchange rate fell sharply last week and may be subject to more losses that are likely to make it breach a major Fibonacci retracement and test the main weekly moving average around 1.3120.

It tested the support 1.3102 and is stable around it at the time of writing the analysis, waiting for more losses if the European crisis continues. Sterling was little changed in terms of overall trade weighted metrics last week after its sharp rise against the euro as other major European currencies bore the brunt of the market response to Russia's ongoing and increasingly destructive attempt to impose itself on Ukraine.

The pound sterling exchange rate fell by more than one percent in the second consecutive weekly decline after it appeared to be dragged down by the collapse of the single European currency. Both are likely to remain vulnerable to more losses in the coming days. The US dollar is likely to rise further this week. It won't take long for the US dollar index to test 100 points for the first time since the early months of the pandemic.

The proximity to the conflict has proven to be a heavy burden on European currencies, which are also highly exposed to significant increases in oil and gas prices caused by concerns about possible loss of supplies from Russia. But with the Ukrainian government expecting to escalate its artillery and air assault on the capital at the earliest, the risk is that energy prices will continue on their upward trajectory and European currencies remain under pressure against the dollar.

The Kremlin's reading of a phone call Sunday between President Vladimir Putin and his Turkish counterpart confirmed that Moscow continues to insist on a complete surrender from the Ukrainian government before it is ready to stop its recently increased bombing of major population centers. This in turn means the danger of a protracted conflict and all that it will entail in the absence of a decisive turn of the tide on the Ukrainian side, or a rethinking of Moscow and the retreat of its invading army; Neither of them can be excluded.

The Kremlin does not yet want to accept and admit failure. But this time it's close. Ukraine's Defense Minister Alexei Reznikov said in a statement on Sunday that dissatisfaction and moral frustration among the occupying forces are growing...there are more and more cases of unwillingness to fight. While the Kremlin continues to assert that the “special military operation” is “going according to plan and within the agreed timeframe,” repeated attempts and subsequent failures to seize and hold strategically important sites such as Hostomil and its airport near Kyiv – which were among the first to be captured In the initial invasion on February 24 - he tells a very different story that still points to an invading force that faltered.

According to the technical analysis of the pair: As I mentioned before, the continuation of the Russian war supports the state of pessimism in the markets and among investors. The price of the GBP/USD currency pair may be exposed to the pressure of investors’ aversion to risk and psychological support 1.3000, the next optimal target for the bears for more control. So far, the general trend has turned, according to the performance on the daily chart, to the downside, giving the bulls a chance to breathe a sigh of relief as the sterling dollar pair crossed the 1.3340 resistance as a first stage. The pair is not waiting for important and influential data today, and accordingly sentiment will be the strongest driver of the trend.