The difference between success and failure in Forex trading is very likely to depend mostly upon which currency pairs you choose to trade each week and in which direction, and not on the exact trading methods you might use to determine trade entries and exits.

When starting the trading week, it is a good idea to look at the big picture of what is developing in the market as a whole and how such developments and affected by macro fundamentals and market sentiment.

The world is in the grip of a major geopolitical crisis which is producing very strong trends in the commodities and Forex markets, so it is an interesting time to be trading the market.

Big Picture 6th March 2022

I wrote in my previous piece last week that the best trade for the week was likely to be long of the USD/JPY currency pair following a daily (New York) close above 116.13. This never set up so there was no trade last week.

The news today is dominated by the Russian invasion of Ukraine which is now in its eleventh day. The invasion, fighting, and resultant political and economic crisis has had two very clear and strong impacts on financial markets: certain commodities, notably crude oil, European natural gas, and wheat, have dramatically increased in value, while the euro has dropped quite heavily relative to almost all major currencies.

Clearly, the Ukrainian defense has been far more effective than the Russian leadership or anyone else anticipated, and that Russian losses may already be approaching 10,000 dead troops – nearly two thirds the Soviet Union’s total losses in the 10-year war in Afghanistan in the 1980s.

NATO, the European Union, and associated allies have responded by making it clear they will not become involved militarily or send aircraft, reducing the chance of a full-scale wider European war breaking out, but they are sending quite sophisticated weaponry plus a stream of volunteer soldiers, which seems to be slowing the Russian advance.

On the economic front, strong sanctions have been placed on Russia and the Russian economy, with more and more companies pulling out of Russia or shutting down operations and sales there, while several Russian banks have been cut off from SWIFT. Russian assets abroad are also being seized and frozen. This is going to cause a great deal of economic pain in a country where a lot of people are already barely getting by paycheck to paycheck. However, Russian oil exports seem likely to evade western sanctions, although reportedly western buyers are largely avoiding purchasing Russian oil anyway.

We see major disruption to Russian and Ukrainian exports. These countries supply a large amount of food staples such as wheat and corn, plus other agricultural products such as fertilizer. This class of agricultural commodities has seen very dramatic price rises over the past few days, and it is hard to see how the prices can come down any time soon if the conflict is not brought to a speedy end.

Last week saw the global number of confirmed new coronavirus cases fall again for the sixth consecutive week. Approximately 63.2% of the global population has now received at least one vaccination.

The strongest growths in new confirmed coronavirus cases overall right now are happening in Brunei, China, South Korea, Liechtenstein, Malaysia, New Zealand, Singapore, Thailand, Tonga, and Vietnam.

Fundamental Analysis & Market Sentiment

The dominant market paradigm of the last few years has been one of risk on vs risk off, with stocks, commodities, and riskier currencies rising in one case, and the US dollar, Japanese yen, and Swiss franc broadly rising in the other case. This has been upended in the current environment, where we see stocks ranging, commodities soaring, and the euro plummeting while the US dollar and Japanese yen are showing some relative strength. The paradigm has become unclear, and everything is dominated by the shocks emanating from the Russian invasion of Ukraine. The coming week in the markets is very likely to be dominated by developments in this area, and a continuing high level of volatility. Beyond this, there are a few economic data releases due this week, in order of importance:

US CPI (inflation) data

European Central Bank Main Refinancing Rate and Monetary Policy Statement

Canadian Employment Change and Unemployment Rate

US Preliminary UoM Consumer Sentiment

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows the U.S. Dollar Index printed a near-pin candlestick which was also a near-doji last week, as the price continued its consolidation between the support level at 12174 and the resistance level at 12293. The price is obviously consolidating but there is still a long-term bullish trend in force, with the price higher than where it was 6 months ago, and just barely higher than it was 3 months ago which means the bullish trend is close to ending. We also see the former resistance level at 12257 become new support, which is a weakly bullish sign. If this and the support level at 12174 continue to hold, the long-term bullish trend will be likely to accelerate.

Overall, it seems clear we still have a bullish picture in the USD over the long and medium terms, but in the Forex market the greenback seems to not be the main driver of prices right now. It may be a better time to trade currency crosses not involving the USD, or commodities.

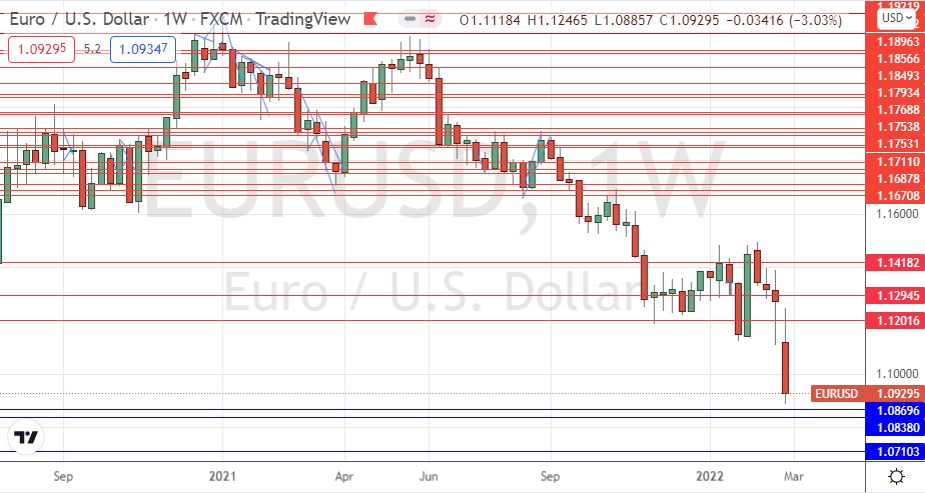

EUR/USD

The Russian invasion of Ukraine has produced a major shock in Europe. The Euro has already been in a long-term bearish trend but the threat of a war breaking out involving NATO in Europe, though slim, has clearly impacted the Euro. The economic fallout from the sanctioning of Russia has also had a major impact. Euro weakness is the standout feature of the Forex market today.

The drop from Friday to Friday in this currency pair was the largest seen for many months, with the price ending the week at a new 18-month low, well into blue sky.

It is very likely that the price of this currency pair will fall again over the coming week.

USD/RUB

The Russian Ruble lost about half its value against the US Dollar and almost every other currency last week. However, it is practically impossible to trade the Ruble as it barely convertible now, and there are no Forex brokers offering it anyway.

It is worth noting that a currency that loses half its value in a week is on the verge of collapse.

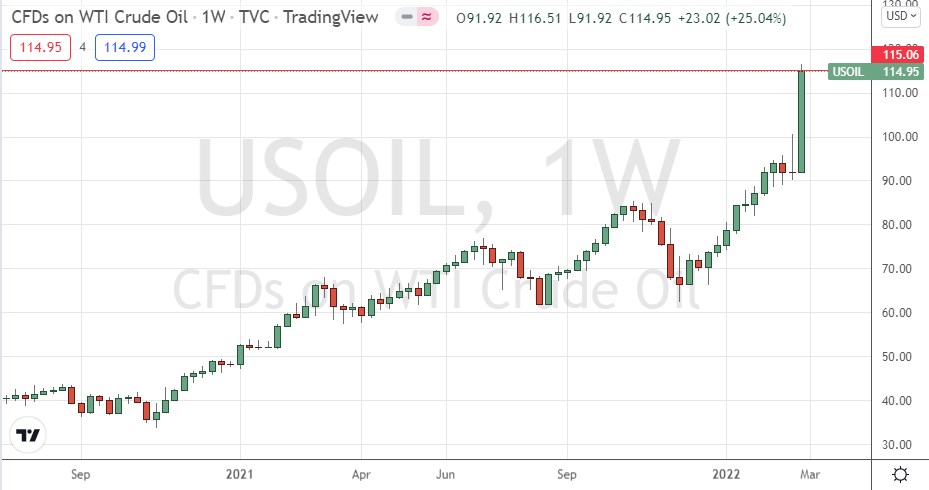

WTI Crude Oil

Last week saw the price of WTI Crude Oil make one of its biggest ever price increases, due to the geopolitical shock of the Russian invasion, plus the fact that Russia is a major exporter of crude oil, and many nations are afraid to buy it in case it gets sanctioned.

The price looks likely to go higher, as it has already reached a new 13-year high on very strong momentum, but it is notable that the weekly close was below the resistance level at $115 which I identified a few days ago.

It may be that Iranian oil is de-sanctioned soon, which could cause the price to drop as it would increase supply.

Wheat

Ukraine and Russia export more than $11 billion of wheat per year, which is a major chunk of the global wheat market.

The past week has seen the price of wheat increase by more than any other major commodity, by approximately 40%.

Investors and speculators have been buying wheat futures, with the Teucrium Wheat Fund a major beneficiary.

Buying wheat is a risky trade as the volatility is so high, and good news for the market could see the price crash dramatically. However, there are already fears that the Ukrainian wheat crop for the next year, which needs to be planted soon, could be very severely reduced, and this is another factor that has pushed the price up so strongly.

If the war continues, it seems likely that the price of wheat will remain high. However, it is worth noting that the price declined sharply from its high on Friday.

Corn

Ukraine exports almost $5 billion of corn per year, which is a significant share of the global wheat market.

The past week has seen the price of corn increase by almost 20%.

Investors and speculators have been buying corn futures, with the Teucrium Wheat Fund a major beneficiary.

Buying corn is a risky trade as the volatility is quite high, but if the war continues, it seems likely that the price of corn will remain high. It is already powering up to reach levels not seen in years.

Palladium

Last week saw the rare metal Palladium rise more strongly that at any time since the coronavirus shock of 2020. The price closed right at the high of its range, very close to the inflection point made last year, which could act as resistance. However, the bullish momentum is very strong, with an increase of almost 20% over the past week, meaning a further price rise is probably likely over the coming days.

Russia is the world’s major exporter of Palladium, and there are growing fears the geopolitical situation will significantly disrupt the supply of Palladium.

Gold

The price of Gold rose strongly last week, but by much less than the other commodities discussed earlier. This is mostly due to risk-off sentiment increasing, although the risk paradigm is becoming less relevant in its typical terms. With both fiat currencies and cryptocurrencies showing their structural weaknesses, Gold is looking quite attractive right now.

Technically, last week’s rise closed right on its high, which is just below the previous week’s low. This strong momentum suggests there will probably be a further rise over the coming days, and it is not impossible that we will even see a test of the all-time high made in 2020 at $2,075.

Bottom Line

I see the best opportunities in the financial markets this week as likely to be short of the EUR/USD currency pair, and long of WTI Crude Oil, Gold, Wheat, and Corn. Volatility in these commodities can be extremely high so trade positions should be sized conservatively. A trailing stop, and not a time-based exit, should be used.