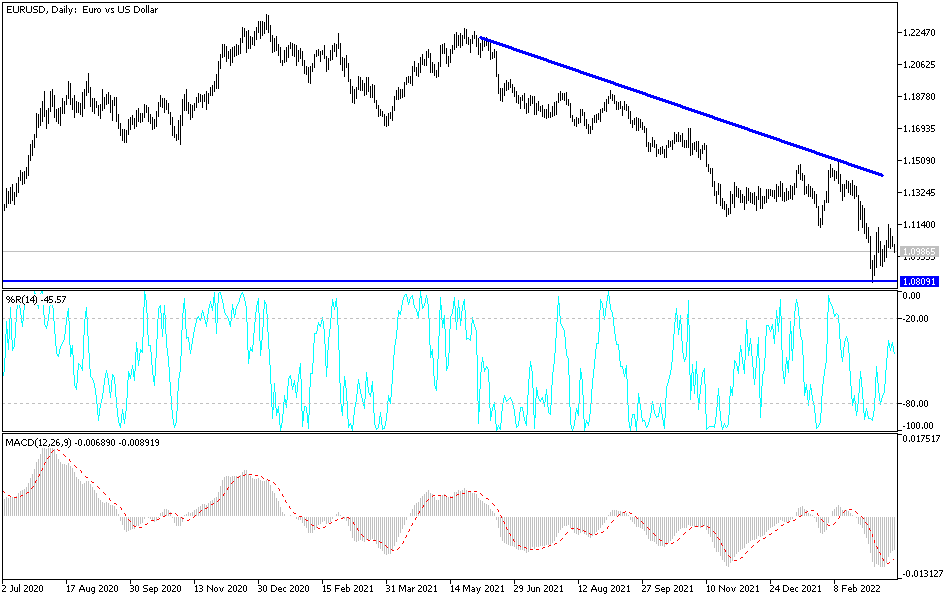

The EUR/USD exchange rate recovered more than last week from two-year lows, but with multiple layers of resistance looming on the charts, the euro may struggle to extend its recovery beyond 1.1150 over the coming days. The gains of the EUR/USD pair reached the resistance level of 1.1137, but with the continuation of the Russian war and the failure of the last rounds of negotiations, it was natural to renew selling operations for the currency pair. Accordingly, the price of the euro dollar settled down around the support level 1.0980 at the time of writing the analysis. The performance confirms what we always recommend selling EUR/USD from every bullish level.

The single European currency, the euro, rose sharply against several major currencies in the past week as global markets rallied amid investor optimism about peace talks between Russia and Ukraine, as well as the resulting declines in oil and gas prices.

Lower energy costs and improved risk appetite in global markets helped the euro briefly rise above $1.11 last week but did not give it enough momentum to overcome the layer of Fibonacci resistance levels that took the charts from 1.1150 and above. These last levels may act as a hindrance to any further attempts to recover by the euro in the coming days when the single European currency is once again sensitive to the path of oil and gas prices.

Overall, Europe's heavy dependence on imported energy means that continental currencies including the euro will be among the most vulnerable this week to any renewed strength in oil and gas prices. They are highly responsive to developments in and around Ukraine. The euro's short-term outlook is also likely to depend on the market's interpretation of Tuesday's speech from European Central Bank President Christine Lagarde at the Bank for International Settlements' Innovation Summit, and reading of Thursday's IHS Markit PMI surveys.

According to the technical analysis of the pair: The stronger path of the EUR/USD currency pair is still to the downside and a drop in energy prices from the recent peak could push the Euro above 1.1200 this week if it happens. Much about the outlook for the euro also hinges on whether the market rediscovers its appetite for the dollar after last week's dips, which continued even after what was widely seen as the "hawkish" policy statement from the US Federal Reserve. On the daily chart, the EUR/USD broke the support level 1.0925, which will support the move towards the next psychological support 1.0800.

I still prefer to sell EURUSD from every bullish level. The pair is awaiting the reaction from the statements of ECB Governor Lagarde only today.