For two days in a row, the price of the EUR/USD currency pair is trying to recover higher, stable around the 1.0985 level. This is after recent sharp losses due to the Russian war, to the support level 1.0806. EURUSD is trying to draw a line below previous loss last week. The conflict in Ukraine and the market response to Wednesday's comments and policy guidance from the US Federal Reserve are likely to be a judgment if it can hold permanently above the recent bottom level at 1.08.

The European single currency rose strongly against the other major currencies as commodity prices fell. Stock markets pared losses in early March amid speculative suggestions that diplomatic efforts might be able to end the Russian invasion of Ukraine. The euro rose further on Thursday when the European Central Bank (ECB) brought forward to June the date when its asset purchase program would reduce its monthly purchases of government bonds to €20 billion, before officially acknowledging that European interest rates could rise soon.

It wasn't long before the Bureau of Labor Statistics data indicated that inflation in the US rose to 7.9% in February, boosting the US dollar broadly with the pull of the euro against the dollar to around the 1.09 level for the week.

Similar to BofA Global Research's expectations of 1.08, a short-term bottom for the euro, TD Securities and Credit Suisse suggest an approximate trading range of 1.08 to 1.12 is likely to be in the future. But much still depends on the single European currency on whether oil, gas and overall energy prices will be kept secret over the coming days, while the EUR/USD rate is also likely to be sensitive to new expectations and policy guidance the Federal Reserve will provide on Wednesday.

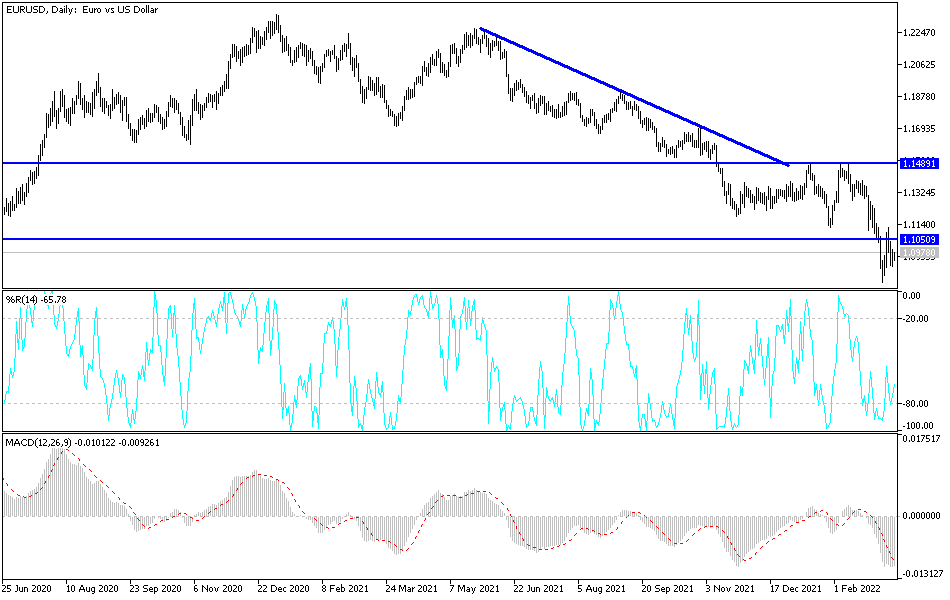

According to the technical analysis of the pair: The price of the currency pair EUR/USD, according to the above listing, will remain stable in narrow ranges until the US Federal Reserve announces its monetary policy decisions tomorrow. Russian-Ukrainian List Investors do not care about the arrival of technical indicators towards oversold levels as far as following up on the effects of the war on the future of the economic recovery of the Eurozone.

On the upside and according to the performance on the daily chart, the breach of the resistance levels 1.1125 and 1.1260 will be important to start breaking the sharp bearish channel for the currency pair. The currency pair will be affected today by the announcement of the ZEW reading of German economic sentiment and then the announcement of the US producer price index numbers.