Amid a state of cautious optimism for the easing of fears about the prolongation of the Russian-Ukrainian war, the price of EUR/USD attempted to rebound higher, and achieved yesterday’s gains. It started from the support 1.0890, reached the resistance level 1.1096, and settled around the 1.1065 level at the time of writing the analysis. This is at a time when the euro is waiting for the European Central Bank monetary policy update today.

All safe haven currencies sold off significantly in the last week of February after Russian military forces crossed the border into Ukraine, although European currencies were by far the lowest; led by those in Central and Eastern Europe.

We expect the ECB to halt its hawkish shift, which seems unlikely to give the EUR any lifeline. However, markets will remain on the lookout for any currency related comments. “We believe EUR/USD may remain under pressure until it finds support around the 1.0640 lows for 2020,” says Chris Turner, analyst at ING.

As for the euro, the dollar, and other euro exchange rates, much depends on the European Central Bank's latest inflation forecast and its assessment of what the conflict in Ukraine means for its monetary policy outlook, both of which are due to be revealed on Thursday.

“We expect geopolitics to delay plans for ECB policy normalization, but not derail it," says Ruben Segura Kaiwela, European economist at BofA Global Research. However, firm commitments at this week's ECB meeting are unlikely. The rush to end the Asset Purchase Program (APP) will likely be greater than in December, but slower than it was before the war in Ukraine.”

“But with inflation expectations expected to be very high in 2022, still at the target (maybe a bit higher) in 2023, and a little lower by 2024, it is becoming increasingly difficult for doves to argue that further adjustment is necessary,” the analyst added. To bring inflation back to 2%.

The war has pushed gas prices in the Eurozone higher while driving up global oil prices, prompting investors to reduce bets that the European Central Bank will raise interest rates more than once in 2022. Higher oil and gas prices will put pressure on consumers in the region. The euro and inevitably slowing growth, leading to stagflation, and complicating the European Central Bank's planned shift towards higher interest rates.

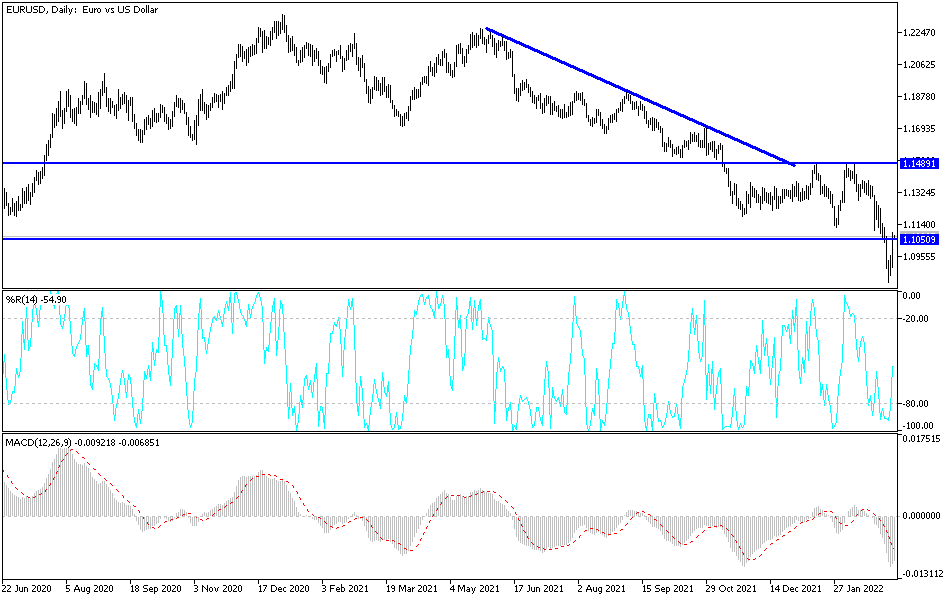

According to the technical analysis of the pair: The recent rebound attempts did not get the EUR/USD price out of its sharp bearish channel recently. According to the performance on the daily chart, there will not be a first reversal of the current general bearish trend without breaching the resistance levels 1.1120 and 1.1330, respectively. So far, the return of stability below the support 1.0980 warns of a strong move for the bears again. In addition to the European Central Bank's announcement of its monetary policy update and the statements of ECB Governor Lagarde, the EUR/USD pair will also be affected by the announcement of the US inflation reading through the Consumer Price Index.