The euro initially tried to rally on Tuesday but has given up gains yet again as we continue to see the downtrend strengthen from a longer-term standpoint. Furthermore, we need to be very cautious over the next 24 hours as the Federal Reserve has an interest-rate decision coming, and perhaps more importantly, the press conference and statement.

Most traders believe that the Federal Reserve will raise interest rates by 25 basis points so that in and of itself should not cause too much of a reaction. The question is going to be what the tone of the statement is and perhaps any of the answers to the press conference questions as to where we may be going in the future. There are some traders out there that believe the Federal Reserve now has enough coverage from the Ukraine and Russia war to perhaps become a bit more dovish. If that is the case, that could work against the US dollar but obviously, there are bigger things at play here as well.

Keep in mind that the European Union has a ton of problems that go far beyond the Federal Reserve. The most obvious one of course is the war in Ukraine, but there are also concerns about growth and confidence. It appears that the European Union is on the precipice of something rather ugly, as we have seen so much in the way of negativity when it comes to economic reports. Earlier in the session, the German ZEW came in at -39, with an expected reading of +5! There is absolutely nothing good about that type of reading, and it does suggest that perhaps the European Union is going to continue to struggle. In this environment, I just do not see the US dollar giving up the overall trend. This does not mean that we cannot rally from here, I just think that rallies will be sold into.

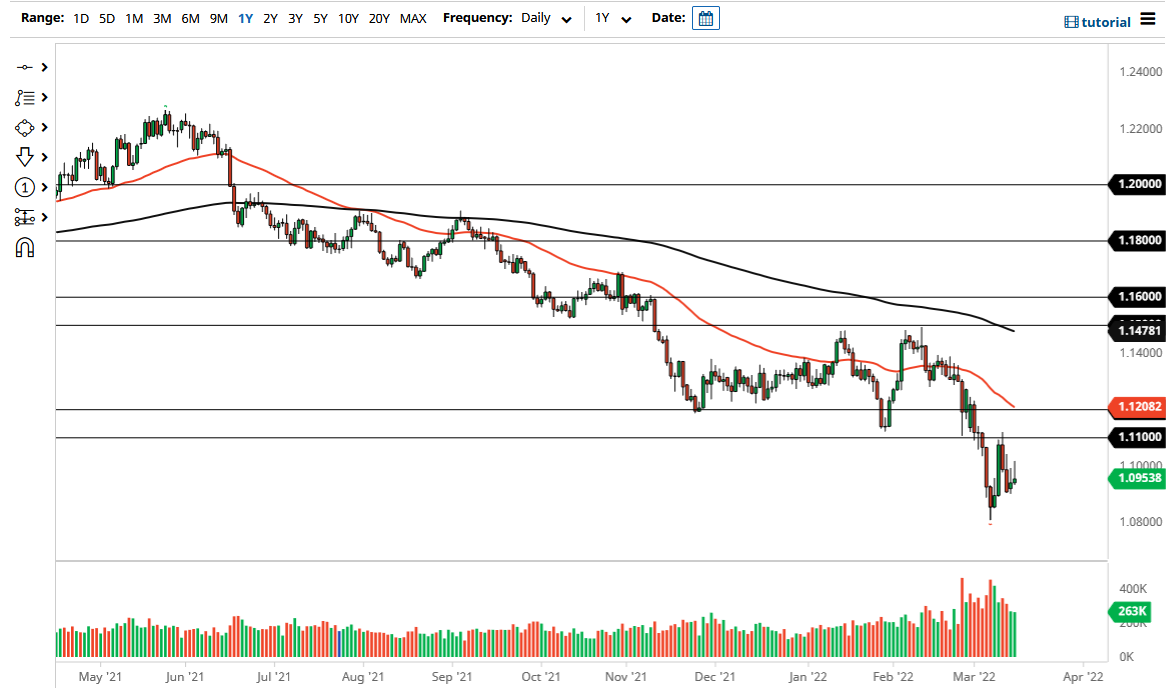

If we did rally, the 1.11 level is a significant barrier that is going to be difficult to overcome. There is an area of resistance that starts at that level and extends all the way to the 1.12 handle. This is also where the 50-day EMA is starting to slice through, so I think it all lines up to be a “sell on the rallies” type of situation.