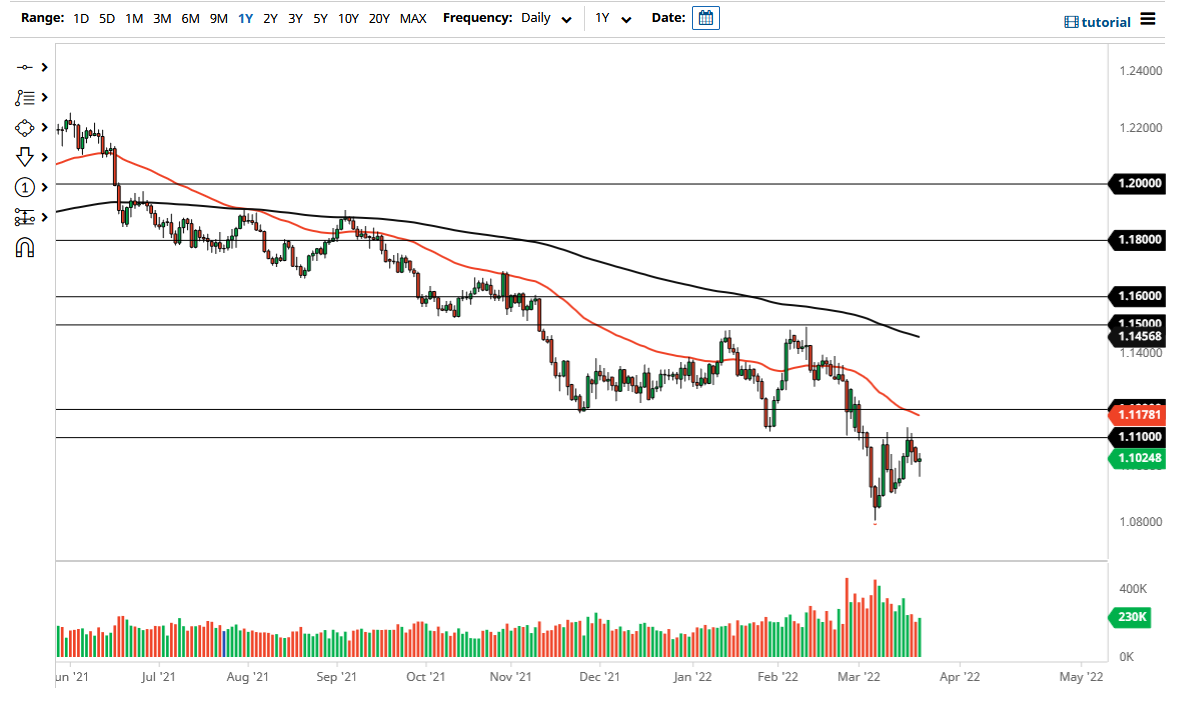

The euro fell a bit on Tuesday, only to find buyers and form a bit of a hammer. The hammer is a very bullish sign, but I think we still have a lot of noise above that is going to continue to cause major issues. While I do think that this has been a nice little recovery, the keyword here is “little.”

If we break down below the bottom of the hammer, then it will open up fresh selling, perhaps allowing the euro to trade down towards the 1.08 level. Raking down below the bottom of a hammer is one of my favorite ways to trade because it shows not only did the buyers push, but then they got overrun again. It shows tenacity to the downside and therefore it is worth paying close attention to. On the upside, we could break out to the top of the candlestick and go looking towards the 1.11 handle.

The 1.11 area extends to the 1.12 handle, and therefore it makes quite a bit of sense that we could see a lot of selling pressure in that general vicinity. Furthermore, the 50-day is just below the 1.12 handle, and then is starting to drift lower. This is a market that I think will eventually find sellers as the interest rate differential between the United States and Europe continues to extend.

The market has been bearish for quite some time, and for good reason. The European Union has all kinds of issues, not just ones involving interest rates. The markets will continue to be very noisy, but if you wait for an opportunity to pick up “cheap dollars”, then it is likely that you will get an opportunity to short yet again. In fact, it is not until we break above the 1.12 handle that I could become somewhat bullish, and at that point, I would expect to see the euro go looking towards the 1.14 handle, and perhaps even the 200-day EMA above there. In general, this is a market that I still like fading on rallies, but we do not have that signal quite yet. Because of this, a lot of patience will be needed in order to trade this market.