The price of the euro against the dollar entered the new week’s trading near its lowest level in two years and may be subject to more losses. This will be before the monetary policy decision of the European Central Bank next Thursday, which may have a stabilizing effect on the single European currency. The losses of the euro pair against the dollar EUR/USD reached the support level 1.0806, before settling around the 1.0870 level. The euro posted its biggest one-week drop since March 2020 when the coronavirus first shut down the global economy last Friday after an increasingly devastating conflict escalated in Ukraine, which has weighed on currencies across the continent as well as further afield.

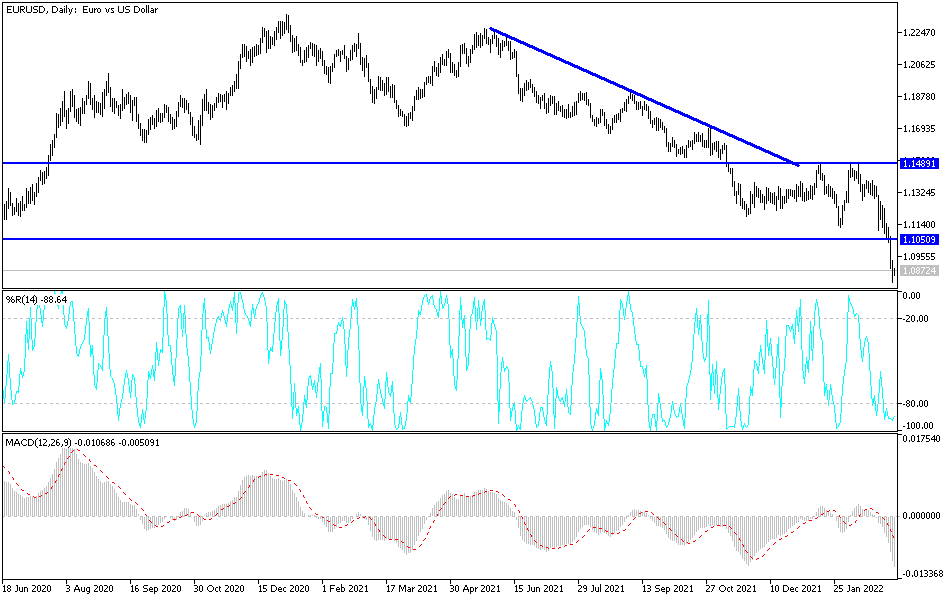

With the Ukrainian government expecting an escalation in artillery and air assault on the capital at the earliest, the risk is that the euro will remain under pressure against the dollar and many other major currencies during the first half of the week. Commenting on the performance, Juan Manuel Herrera, strategist at Scotiabank said, “The euro broke below the 1.10 level and now faces limited signs of support until the psychological ground in the 1.09 and 1.08 areas. However, the currency's movement in oversold levels on the RSI indicates that a move to these levels is unlikely to occur in quick succession.

However, there is some possibility that the economic outlook and monetary policy guidance issued by the European Central Bank on Thursday will have supportive effects for the EUR given the financial and economic side effects of the conflict in Ukraine and the resulting humanitarian crisis which are very inflationary.

Because of the Russian war, crude oil prices rose significantly above $100 a barrel It approached record financial crisis levels on Monday while natural gas prices reached new highs due to market concerns about the potential loss of supplies from Russia, and each of these developments will raise inflation further. Above the new highs already reached in February and only reported last week by the statistics agency Eurostat.

The European Central Bank will balance the risks of higher inflation with weak economic growth. Accordingly, Joseph Caporso, head of international economics at the Commonwealth Bank of Australia, says, “We consider the risk that the European Central Bank reduces the negatives on economic growth, and supports the euro during the day.”

Most recently, Eurostat figures showed that inflation in the Eurozone rose from 5.1% to 5.8% in February, taking it to a new record high above 5.4% in the United Kingdom, while the most important core measure of inflation rose from 2.3% to 2.7% in another. Noting that non-energy price pressures continued to increase early in the new year and even before the invading Russian army crossed the border into Ukraine on February 24.

This is potentially significant given that ECB Governor Lagarde previously said at the February press conference that inflation risks are already beginning to shift higher. It also refrained from repeating an earlier opinion that European interest rates are unlikely to rise this year. This in turn causes financial markets to become more confident in betting on the approaching end of the era of negative interest rates.

According to the technical analysis of the pair: Although the recent losses of the EUR/USD currency pair pushed most of the technical indicators towards oversold levels, the continuation of the weakness factors represented in the Russian war will increase the suffering of the euro in the coming days. This is since expectations are strong that the European Central He will not be in a hurry to raise interest rates. Breaking the next psychological support 1.0800 will support a stronger domination by the bears, and therefore move towards more violent descending levels, and the closest ones after that are 1.0750 and 1.0600, respectively.

On the upside, the attempts of the EUR/USD pair are still vulnerable to selling as long as the Russian-European crisis persists. Today, the euro will react relatively to the announcement of the growth rate of the eurozone economy and the change in employment, and from the United States, the trade balance numbers will be announced.