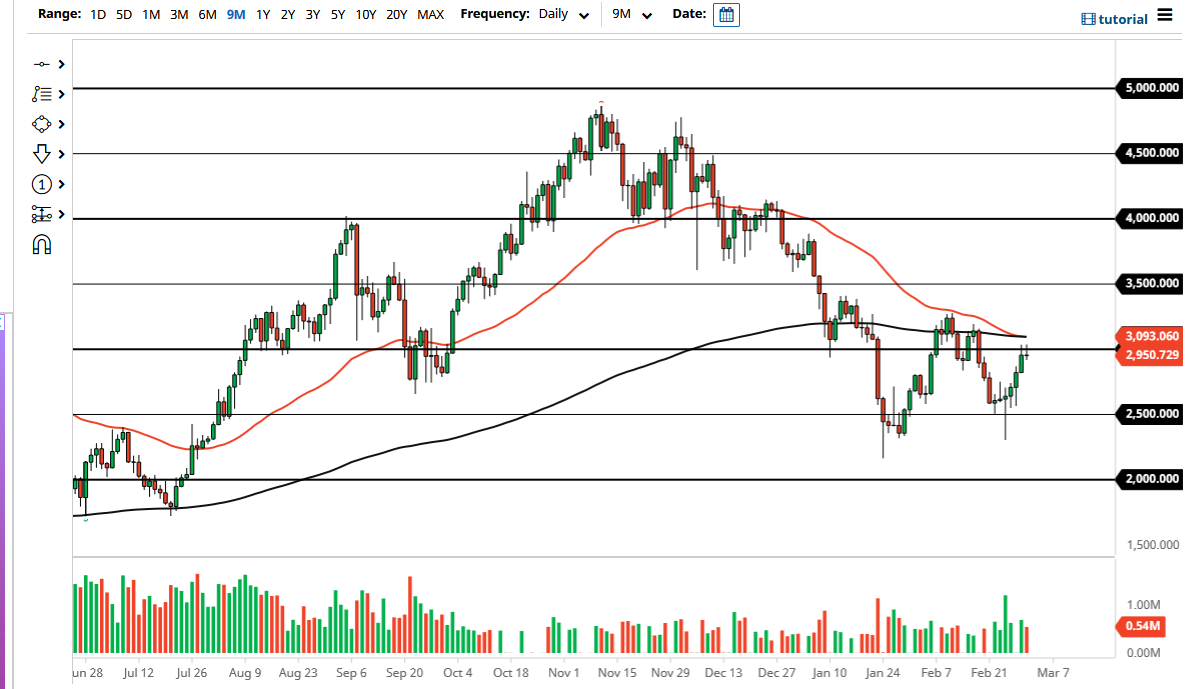

Ethereum initially tried to rally on Wednesday to pierce the $3000 level. However, the $3000 level continues to cause issues, as we have now formed a bit of a shooting star. This is a very negative candlestick in general, so it is worth paying attention to that. Furthermore, the 50-day EMA and the 200-day EMA are both sitting just above. Those both will cause a certain amount of tension as well, and it is likely that we will get a little bit of a pullback.

If we do break down below the bottom of the candlestick on Wednesday, this pullback will likely pick up a little bit of momentum. I currently look at the $2500 level as a potential support level that extends down to the $2250 level. This is a market that is trying to figure out where it wants to go longer term, and as a result, it is going to continue to be very lackluster in general. The 50-day EMA has just broken down below the 200-day EMA, suggesting that the markets are going to continue to see downward pressure as it is the well-known “death cross” indicator.

Either way, Ethereum is something that I like longer-term but that does not necessarily mean that you should jump in with both feet and start buying it. I think that we are in the midst of a larger consolidation that is trying to form some type of bottoming pattern. That being said, Bitcoin looks the same at the moment, which suggests that we are going to simply follow that market. The shape of the candlestick also suggests that we may be running out of strength.

In general, this is a market that is trying to form a large “W pattern”, just as the Bitcoin market is. That being said, the market has not reached as high in the pattern as Bitcoin has, so we need to see that market break out so that we can go higher. In the short term, Ethereum will continue to be at the whim of monetary policy and risk appetite. Risk appetite has been utterly destroyed by the Federal Reserve tightening monetary policy and inflationary concerns. In this economic situation, crypto continues to underperform.