The Ethereum market has pulled back just a bit during the trading session on Thursday to show signs of hesitation. Ethereum is going to struggle in this environment as there is a major “risk-off” type of attitude around the world. The market will more than likely continue to see noise more than anything else, but the real question is whether or not the $25 level is going to hold as support. So far, it has attempted to, but we have not been able to take off to the upside.

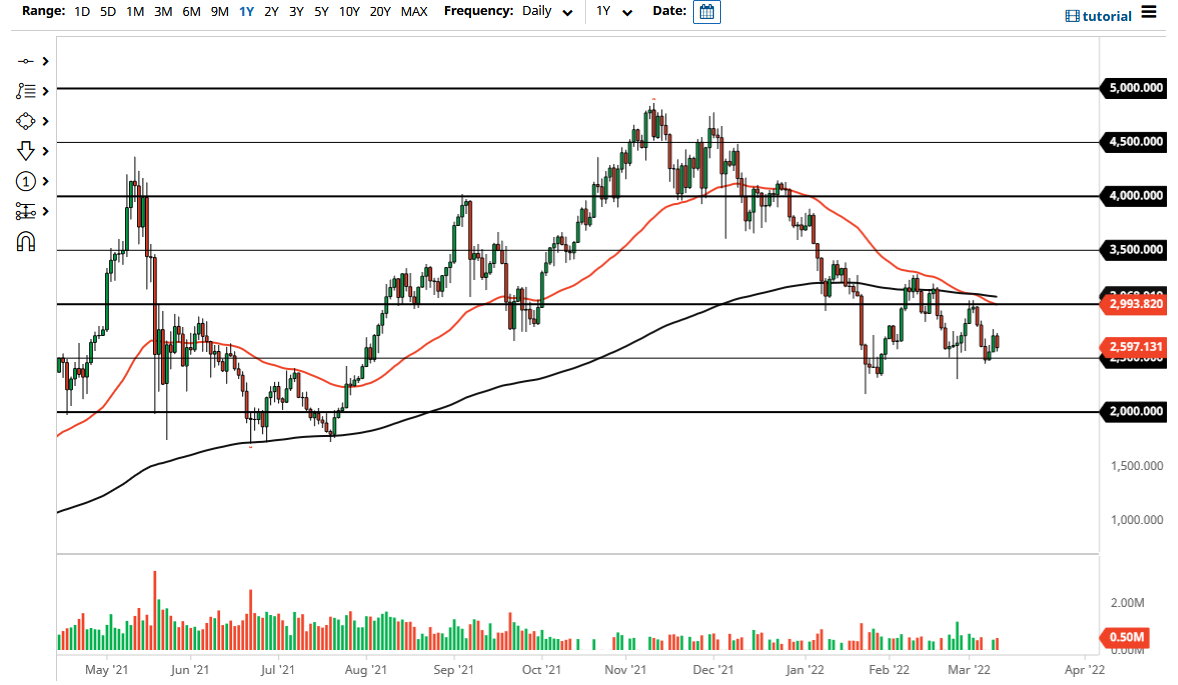

The 50 Day EMA has crossed below the 200 Day EMA, forming the so-called “death cross.” This is normally a very negative sign from the longer-term standpoint, so therefore I think we will see more selling pressure every time it rallies. In fact, when you look at the chart, it does not take much in the way of imagination to suggest that we are in the midst of the descending triangle, which of course is a very bearish signal.

Having said that, we have not broken down yet, and I think it would kick off if we went below the $2400 level. You can see that there is a very likely trend line just above, so I think at this point in time if you see Ethereum start to rally, you are looking for signs of exhaustion on shorter-term charts in order to start selling again. However, if we were to see this market break above the $3000 level on a daily close, that could send things in a completely different direction, making Ethereum much more bullish.

Ethereum is widely traded by institutional investors now, so you need to be aware of the fact that it is considered to be a high-risk asset. As long as that is going to be the case, the market is going to continue to be very jittery when it comes to monetary tightening, and of course a general “risk-off” attitude. As long as we have plenty of that fear out there, it is difficult to imagine crypto doing very well. Granted, Bitcoin and Ethereum will be the first two places money goes to, so this market has more of a chance than many of the other altcoins out there. Nonetheless, as long as the US dollar continues to attract inflows, it is going to be difficult for Ethereum to really get moving to the upside.